A cartel is an organization of independent businesses or entities that collaborate to control prices, limit production, or restrict competition in a particular market, often resulting in higher costs for consumers. This anti-competitive practice undermines free market principles and can lead to legal consequences for those involved. Explore this article to understand how cartels operate and how they might impact Your industry or daily life.

Table of Comparison

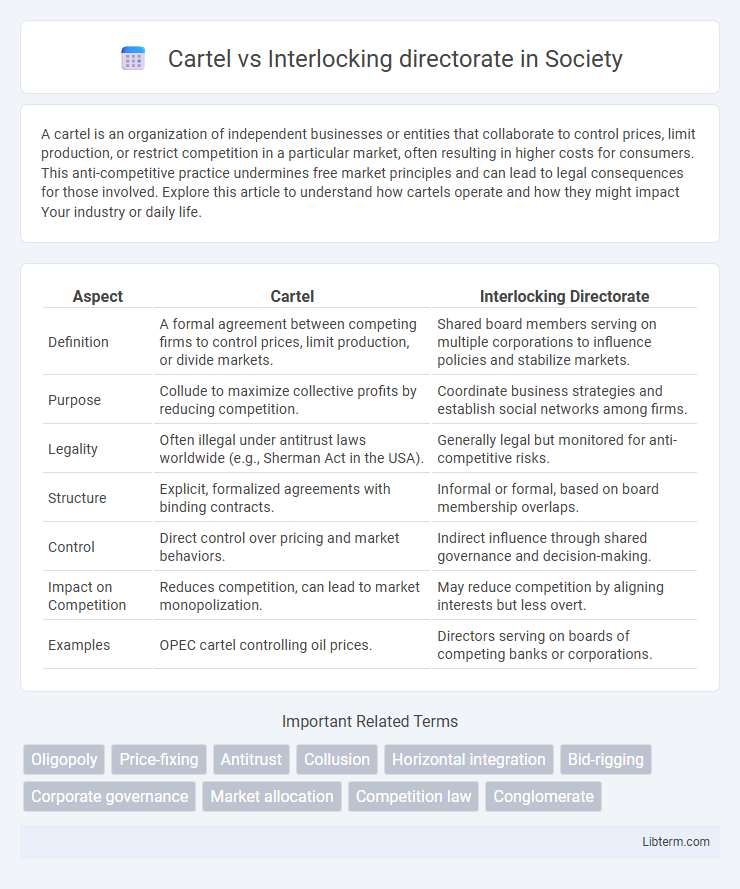

| Aspect | Cartel | Interlocking Directorate |

|---|---|---|

| Definition | A formal agreement between competing firms to control prices, limit production, or divide markets. | Shared board members serving on multiple corporations to influence policies and stabilize markets. |

| Purpose | Collude to maximize collective profits by reducing competition. | Coordinate business strategies and establish social networks among firms. |

| Legality | Often illegal under antitrust laws worldwide (e.g., Sherman Act in the USA). | Generally legal but monitored for anti-competitive risks. |

| Structure | Explicit, formalized agreements with binding contracts. | Informal or formal, based on board membership overlaps. |

| Control | Direct control over pricing and market behaviors. | Indirect influence through shared governance and decision-making. |

| Impact on Competition | Reduces competition, can lead to market monopolization. | May reduce competition by aligning interests but less overt. |

| Examples | OPEC cartel controlling oil prices. | Directors serving on boards of competing banks or corporations. |

Introduction to Cartel and Interlocking Directorate

Cartels are formal agreements between competing firms to control prices, limit production, or divide markets, enhancing collective market power and reducing competition. Interlocking directorates occur when a person serves on the board of directors of two or more competing companies, potentially facilitating coordination and shared strategic decisions without explicit collusion. Both mechanisms impact market dynamics by influencing firm behavior, but cartels operate through explicit agreements while interlocking directorates work via shared governance structures.

Defining Cartels: Key Characteristics

Cartels are formal agreements among competing firms to fix prices, limit production, or divide markets, aiming to reduce competition and increase collective profits. They typically involve explicit coordination, enforceable contracts, and penalties for members who deviate from agreed terms, distinguishing them from more informal arrangements like interlocking directorates. Unlike interlocking directorates, which involve shared board members to align interests subtly, cartels engage in overt collusion often subject to legal prohibition.

Understanding Interlocking Directorates

Interlocking directorates occur when a person serves on the board of directors of two or more companies simultaneously, creating a network of shared governance that can influence corporate decision-making and market competition. This practice can lead to reduced competition and coordinated strategies, similar to the effects of cartels, but operates through governance structures rather than explicit agreements. Understanding interlocking directorates is crucial for regulators monitoring anti-competitive behaviors and corporate control within industries.

Legal Framework: Cartel vs Interlocking Directorate

The legal framework governing cartels strictly prohibits agreements between competitors to fix prices, limit production, or allocate markets, as these practices violate antitrust laws such as the Sherman Act in the United States and the Competition Act in the European Union. In contrast, interlocking directorates are subject to regulation under laws like Section 8 of the Clayton Act, which restricts individuals from serving on the boards of competing corporations to prevent anti-competitive coordination and conflicts of interest. Enforcement agencies focus on detecting cartels through criminal penalties and fines, while interlocking directorates are often addressed through civil suits and remedial measures to ensure market competition is not compromised.

Economic Impact of Cartels

Cartels significantly distort market competition by coordinating prices or output, leading to higher consumer prices and reduced economic efficiency. The economic impact includes diminished innovation incentives and allocative inefficiencies, as resources are misallocated due to the lack of competitive pressure. Interlocking directorates, while potentially fostering anticompetitive practices through shared corporate control, generally have less direct impact on market prices than explicit cartel agreements.

Economic Impact of Interlocking Directorships

Interlocking directorships influence market competition by enabling coordinated strategies among firms, often reducing rivalry and facilitating tacit collusion. This concentration of board members across multiple companies can lead to diminished innovation and higher prices, impacting overall economic efficiency. Empirical studies highlight how such network structures consolidate market power, undermining antitrust regulations and decreasing consumer welfare.

Anti-competitive Behavior: Comparing Mechanisms

Cartels engage in anti-competitive behavior by explicitly colluding to fix prices, limit production, or divide markets, which directly restricts competition and harms consumers. Interlocking directorates, on the other hand, create indirect anti-competitive effects by coordinating corporate strategies through shared board members, facilitating tacit collusion without overt agreements. Regulatory scrutiny often targets cartels for their explicit coordination, while interlocking directorates present challenges due to their subtle influence on market competition and potential conflicts of interest.

Famous Cases: Cartels and Interlocking Directorates

The infamous De Beers diamond cartel dominated global markets by controlling supply and prices, exemplifying cartel influence on trade. In contrast, interlocking directorates were highlighted in the 1930s U.S. investigations, where overlapping board memberships among major corporations like General Electric and U.S. Steel revealed coordinated market control. Both frameworks demonstrate how collusion, either through explicit agreements or intertwined governance, can stifle competition and affect market dynamics significantly.

Regulatory Responses and Enforcement

Regulatory responses to cartels typically involve stringent antitrust laws and aggressive enforcement actions by authorities such as the Federal Trade Commission (FTC) and the Department of Justice (DOJ), aiming to dismantle price-fixing, market allocation, and bid-rigging conspiracies. Interlocking directorates, where the same individuals serve on the boards of competing companies, face regulatory scrutiny primarily under the Clayton Act, with enforcement focusing on preventing anticompetitive coordination and potential conflicts of interest through investigations and remedies like divestitures. Both frameworks emphasize the importance of transparency, compliance monitoring, and penalties including fines or structural remedies to maintain fair competition and prevent market abuse.

Future Outlook: Trends and Challenges

Future trends in cartel formation face increasing regulatory scrutiny driven by advanced data analytics and international cooperation, making detection more effective and penalties more severe. Interlocking directorates are expected to encounter stricter governance frameworks and transparency requirements to mitigate conflicts of interest and market manipulation. Emerging challenges include balancing innovation incentives and antitrust enforcement amid evolving corporate networks and digital economies.

Cartel Infographic

libterm.com

libterm.com