Monopoly is a classic board game that challenges players to acquire properties, manage resources, and strategically bankrupt opponents to dominate the market. Mastering key tactics like property trading, house building, and managing cash flow can significantly increase your chances of winning. Discover essential Monopoly strategies and tips to enhance your gameplay in the rest of this article.

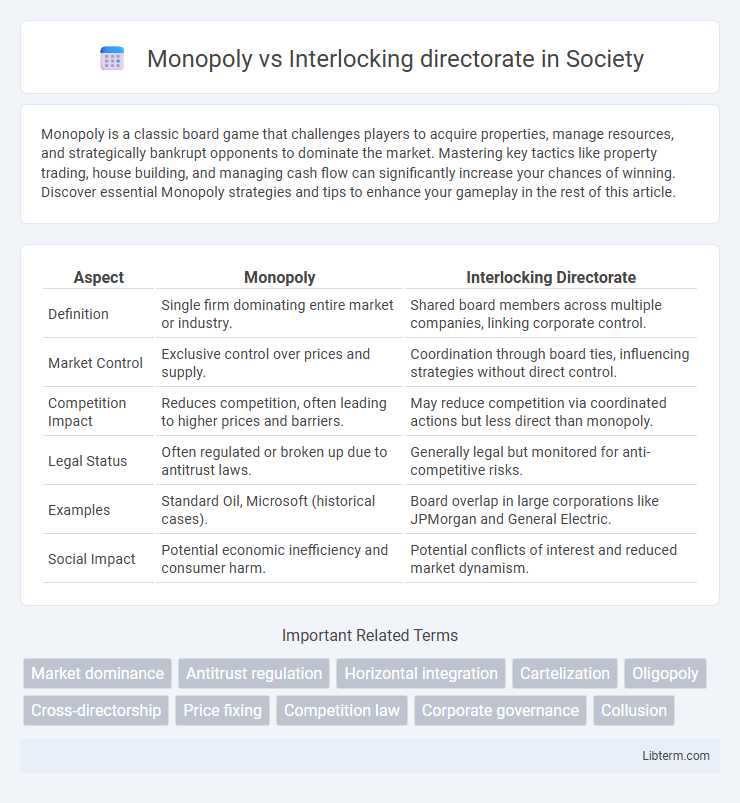

Table of Comparison

| Aspect | Monopoly | Interlocking Directorate |

|---|---|---|

| Definition | Single firm dominating entire market or industry. | Shared board members across multiple companies, linking corporate control. |

| Market Control | Exclusive control over prices and supply. | Coordination through board ties, influencing strategies without direct control. |

| Competition Impact | Reduces competition, often leading to higher prices and barriers. | May reduce competition via coordinated actions but less direct than monopoly. |

| Legal Status | Often regulated or broken up due to antitrust laws. | Generally legal but monitored for anti-competitive risks. |

| Examples | Standard Oil, Microsoft (historical cases). | Board overlap in large corporations like JPMorgan and General Electric. |

| Social Impact | Potential economic inefficiency and consumer harm. | Potential conflicts of interest and reduced market dynamism. |

Understanding Monopoly: Definition and Characteristics

Monopoly is a market structure characterized by a single firm that dominates the entire market, controlling supply and pricing without competition. Key characteristics include high barriers to entry, unique product offerings without close substitutes, and significant price-setting power. This contrasts with interlocking directorates, where multiple firms remain separate entities but share board members, potentially influencing market competition indirectly rather than through outright market control.

What is an Interlocking Directorate?

An interlocking directorate occurs when a member of a company's board of directors simultaneously serves on the board of another company, creating a network of overlapping leadership. This arrangement can influence corporate decision-making and coordination, potentially impacting market competition and promoting collusion. Unlike monopolies, which consolidate market control through ownership, interlocking directorates exert influence through shared governance without direct acquisition of firms.

Historical Background of Monopolies and Interlocking Directorates

Monopolies historically emerged during the Industrial Revolution as companies like Standard Oil and U.S. Steel gained dominant market control, leveraging economies of scale and aggressive business tactics to stifle competition. Interlocking directorates, prevalent in the late 19th and early 20th centuries, involved the same individuals serving on multiple corporate boards, enabling coordinated decision-making and consolidation across industries. Both phenomena influenced U.S. antitrust legislation, notably the Sherman Antitrust Act of 1890, aimed at curbing anti-competitive practices and preserving market competition.

Legal Framework: Antitrust Laws and Corporate Governance

Monopoly regulation and interlocking directorates both fall under the scrutiny of antitrust laws designed to prevent anti-competitive practices and promote market fairness. The Sherman Act and Clayton Act specifically address monopolistic behaviors and prohibit interlocking directorates among competing firms to avoid collusion and preserve corporate governance integrity. Corporate governance frameworks enforce transparency and accountability, ensuring that board structures do not facilitate monopolistic power or compromise competitive market conditions.

Economic Impact of Monopolies

Monopolies significantly distort market competition by enabling single firms to set prices above marginal cost, reducing consumer surplus and overall economic welfare. Interlocking directorates can exacerbate this effect by facilitating collusion and reducing competitive pressures among firms, leading to higher prices and less innovation. The economic impact of monopolies, intensified by interlocking directorates, results in decreased market efficiency and slowed economic growth.

Influence of Interlocking Directorates on Market Competition

Interlocking directorates significantly influence market competition by facilitating coordinated strategies among firms through shared board members, which can reduce competitive pressures and promote tacit collusion. These overlapping directorships often lead to synchronized pricing, market allocation, and reduced innovation, enabling firms to consolidate market power without explicit agreements. Such structures undermine antitrust objectives by creating an environment where monopolistic dominance emerges subtly through networked corporate governance.

Key Differences: Monopoly vs Interlocking Directorate

Monopoly occurs when a single company dominates a market, limiting competition and controlling prices, whereas interlocking directorate involves individuals serving on multiple company boards, potentially influencing decisions across various firms. Monopolies primarily impact market concentration and consumer choice, while interlocking directorates affect corporate governance, coordination, and potential conflicts of interest. Key differences lie in their influence scope: monopoly focuses on market power, and interlocking directorates center on governance and strategic control across organizations.

Case Studies: Real-World Examples

The Microsoft antitrust case exemplifies the dangers of monopolistic practices, where the company was found guilty of using its dominant OS market position to stifle competition. In contrast, the GE and Westinghouse interlocking directorate in the early 20th century raised concerns over collusion, as shared board members coordinated strategies that limited market rivalry. These case studies highlight how monopolies concentrate market power, while interlocking directorates can subtly influence competitive dynamics through overlapping corporate governance.

Regulatory Responses and Policy Recommendations

Regulatory responses to monopolies often involve antitrust laws and rigorous market competition enforcement aimed at preventing single-firm dominance and promoting consumer welfare. In contrast, interlocking directorates are typically addressed through disclosure requirements, conflict-of-interest rules, and limitations on board overlap to prevent anti-competitive coordination between firms. Policy recommendations emphasize enhancing transparency, strengthening enforcement mechanisms, and updating corporate governance standards to mitigate risks associated with both monopolistic practices and interlocking directorates within interconnected corporate networks.

Future Outlook: Ensuring Fair Competition

Future outlook for addressing Monopoly and Interlocking Directorates involves strengthening regulatory frameworks to enhance market transparency and prevent anti-competitive practices. Increasing use of advanced data analytics and AI-driven monitoring tools enables early detection of monopolistic behavior and conflicts arising from interlocking directorates. Enhanced global cooperation among antitrust authorities promises more effective enforcement, ensuring fair competition and fostering innovation across industries.

Monopoly Infographic

libterm.com

libterm.com