A custodial wallet securely stores your cryptocurrency by entrusting a third party with the private keys, simplifying access but requiring trust in the service provider's security measures. This type of wallet is ideal for users who prioritize ease of use and quick recovery options without managing private keys themselves. Explore the rest of the article to understand the benefits, risks, and best practices for using custodial wallets.

Table of Comparison

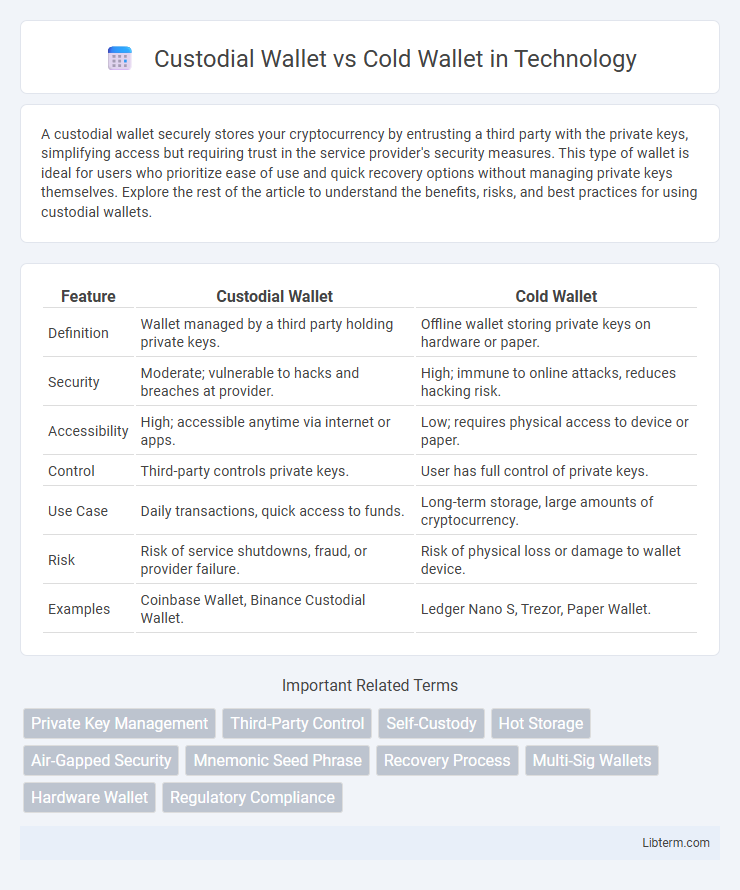

| Feature | Custodial Wallet | Cold Wallet |

|---|---|---|

| Definition | Wallet managed by a third party holding private keys. | Offline wallet storing private keys on hardware or paper. |

| Security | Moderate; vulnerable to hacks and breaches at provider. | High; immune to online attacks, reduces hacking risk. |

| Accessibility | High; accessible anytime via internet or apps. | Low; requires physical access to device or paper. |

| Control | Third-party controls private keys. | User has full control of private keys. |

| Use Case | Daily transactions, quick access to funds. | Long-term storage, large amounts of cryptocurrency. |

| Risk | Risk of service shutdowns, fraud, or provider failure. | Risk of physical loss or damage to wallet device. |

| Examples | Coinbase Wallet, Binance Custodial Wallet. | Ledger Nano S, Trezor, Paper Wallet. |

Understanding Custodial Wallets

Custodial wallets store private keys on behalf of users, offering ease of access and simplified management but requiring trust in a third-party service provider for security. These wallets are commonly used by exchanges and online platforms, enabling quick transactions but increasing vulnerability to hacks or mismanagement. Understanding the trade-off between convenience and control is essential when choosing a custodial wallet over a cold wallet, which keeps keys offline for enhanced security.

What is a Cold Wallet?

A cold wallet is a type of cryptocurrency storage that keeps private keys offline, significantly reducing exposure to hacking and online threats. Unlike custodial wallets where a third party manages the private keys, cold wallets give users full control over their assets by storing keys on hardware devices or paper. This method is preferred for long-term security and safeguarding large cryptocurrency holdings from cyber attacks.

Key Differences: Custodial vs Cold Wallet

Custodial wallets store private keys on behalf of users, relying on a third party for security and access control, while cold wallets keep private keys offline, enhancing protection against online threats and hacking. Custodial wallets offer convenience and faster access but carry risks of centralized breaches, whereas cold wallets prioritize security through physical isolation, making them ideal for long-term storage. The key difference lies in control: custodial users trust a provider with their assets, whereas cold wallet users maintain full ownership and responsibility for their private keys.

Security Features of Custodial Wallets

Custodial wallets offer enhanced security features such as multi-factor authentication, biometric access controls, and regular security audits by the service provider to protect users' assets. These wallets rely on trusted third parties to securely store private keys, ensuring professional management of encryption and backup protocols. While custodial wallets simplify access and recovery, users must evaluate the provider's security infrastructure and reputation to mitigate risks associated with centralized control.

Security Features of Cold Wallets

Cold wallets provide superior security features by storing private keys offline, eliminating exposure to online hacking threats and phishing attacks common in custodial wallets. These wallets use hardware-based encryption and require physical access for transaction approvals, significantly reducing the risk of unauthorized access. Cold wallets also support multi-signature authentication, adding an extra layer of security that enhances protection against theft and loss.

User Control and Accessibility

Custodial wallets manage private keys on behalf of users, offering convenience but limiting user control and increasing reliance on third-party security. Cold wallets store private keys offline, enhancing security and user control by keeping assets inaccessible to online threats but requiring manual access for transactions. Users prioritizing full control and maximum security often prefer cold wallets, while those valuing ease of access and simplified management may opt for custodial solutions.

Backup and Recovery Options

Custodial wallets offer backup and recovery through the service provider, simplifying the process but requiring trust in the custodian to securely manage private keys. Cold wallets, such as hardware or paper wallets, provide users with full control over backup and recovery, often involving physical storage of seed phrases or private keys in secure offline locations. While cold wallets enhance security by isolating assets from online threats, losing the backup means permanent loss of access, highlighting the importance of careful offline key management.

Suitable Use Cases for Each Wallet

Custodial wallets are ideal for users seeking convenience and quick access to funds, making them suitable for frequent traders and beginners who prefer platform-managed security. Cold wallets offer enhanced security by keeping private keys offline, making them the best choice for long-term holders and institutions storing large amounts of cryptocurrency. Selecting between custodial and cold wallets depends on balancing ease of use with the level of security required for specific crypto asset management.

Pros and Cons Comparison

Custodial wallets offer convenience and ease of use by managing private keys on behalf of users, reducing the risk of losing access but increasing vulnerability to hacks and centralized control. Cold wallets store private keys offline, providing enhanced security against cyber attacks and unauthorized access, though they may be less user-friendly and risk physical damage or loss. Choosing between custodial and cold wallets depends on balancing security needs with accessibility and control preferences.

Choosing the Right Wallet for Your Needs

Choosing the right wallet depends on your priority between security and convenience; custodial wallets offer user-friendly interfaces and recovery options by entrusting third parties with private keys, whereas cold wallets store keys offline, providing enhanced protection from hacks and online threats. For long-term investors prioritizing maximum security, hardware cold wallets like Ledger or Trezor are ideal, while casual users or frequent traders might prefer custodial wallets such as Coinbase or Binance for ease of access and management. Assess your transaction frequency, security preferences, and control over private keys to determine the optimal wallet type that aligns with your cryptocurrency management needs.

Custodial Wallet Infographic

libterm.com

libterm.com