A paper wallet is a physical document containing your cryptocurrency private keys and public addresses, providing an offline method to store digital assets securely. This technique reduces exposure to hacking risks by keeping your keys offline but requires careful handling to avoid physical damage or loss. Discover essential tips on creating and safeguarding your paper wallet to protect your assets effectively.

Table of Comparison

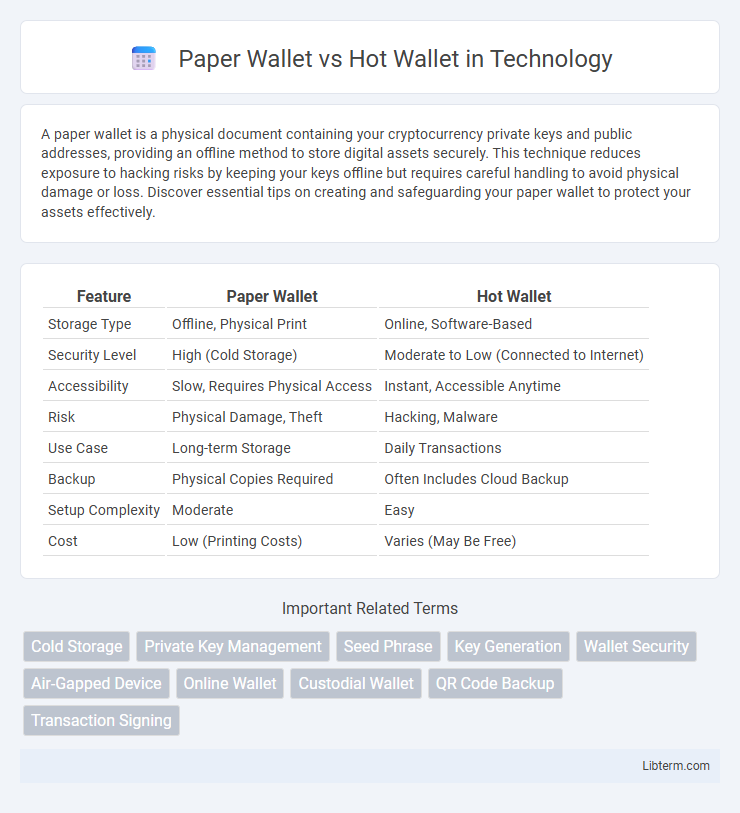

| Feature | Paper Wallet | Hot Wallet |

|---|---|---|

| Storage Type | Offline, Physical Print | Online, Software-Based |

| Security Level | High (Cold Storage) | Moderate to Low (Connected to Internet) |

| Accessibility | Slow, Requires Physical Access | Instant, Accessible Anytime |

| Risk | Physical Damage, Theft | Hacking, Malware |

| Use Case | Long-term Storage | Daily Transactions |

| Backup | Physical Copies Required | Often Includes Cloud Backup |

| Setup Complexity | Moderate | Easy |

| Cost | Low (Printing Costs) | Varies (May Be Free) |

Introduction to Crypto Wallets

Crypto wallets serve as essential tools for storing and managing digital assets, categorized mainly into paper wallets and hot wallets. Paper wallets offer cold storage by physically printing private keys offline, enhancing security against hacking but posing risks of loss or damage. Hot wallets, connected to the internet, provide convenience and quick access for transactions but are more vulnerable to cyber threats.

What is a Paper Wallet?

A paper wallet is a physical document that contains a cryptocurrency user's private keys and public addresses, enabling secure offline storage of digital assets. It is generated through specialized software that produces a printable QR code or alphanumeric keys, ensuring protection from online hacking or malware threats. Paper wallets are ideal for long-term storage but require careful handling to avoid damage or loss, as they are not as convenient for frequent transactions compared to hot wallets.

What is a Hot Wallet?

A hot wallet is a type of cryptocurrency wallet connected to the internet, enabling quick access for transactions and real-time trading. It supports various formats such as mobile apps, desktop software, and web browsers, making it ideal for frequent use and small to medium-sized holdings. Hot wallets prioritize convenience and speed but come with higher exposure to hacking risks compared to offline storage options like paper wallets.

Security Comparison: Paper Wallet vs Hot Wallet

Paper wallets offer enhanced security by storing private keys offline, making them immune to hacking, malware, and phishing attacks, whereas hot wallets are connected to the internet and more vulnerable to cyber threats. However, paper wallets are susceptible to physical damage, loss, or theft, requiring careful handling and secure storage. Hot wallets provide convenience for frequent transactions but demand robust security measures such as two-factor authentication and encryption to mitigate risks.

Accessibility and Usability

Paper wallets offer enhanced security by storing private keys offline, but their accessibility is limited since users must physically manage the paper and lack quick transaction capabilities. Hot wallets provide superior usability with instant access to funds via internet-connected devices, supporting frequent transactions and real-time portfolio management. However, this convenience comes with increased risk of hacking and malware exposure compared to offline storage options.

Risks and Vulnerabilities

Paper wallets face significant risks of physical damage, loss, and theft due to their tangible nature, making them vulnerable to environmental hazards and misplacement. Hot wallets operate online, exposing users to cyber threats such as hacking, phishing, and malware attacks, increasing the risk of digital asset theft. Security depends on user practices, with cold storage (paper wallets) offering offline protection but lower accessibility, while hot wallets provide convenience but higher exposure to vulnerabilities.

Backup and Recovery Options

Paper wallets offer a physical backup by printing private keys on paper, ensuring offline security from digital threats, but risk loss or damage without duplicates. Hot wallets provide easy recovery through seed phrases or cloud backups, facilitating quick access but remain vulnerable to hacking or software failures. Both wallet types require careful management of backup methods to balance security and recovery convenience effectively.

Suitable Use Cases

Paper wallets are ideal for long-term cryptocurrency storage due to their offline nature, eliminating risks of hacking and digital theft. Hot wallets provide quick and easy access for frequent trading or transactions, making them suitable for active users who prioritize convenience. Each wallet type supports different user needs: paper wallets emphasize security and cold storage, while hot wallets focus on accessibility and usability.

Pros and Cons Overview

Paper wallets offer enhanced security by storing cryptocurrency offline, eliminating risks of hacking or malware, but they are vulnerable to physical damage or loss and require careful handling during creation. Hot wallets provide convenient and quick access for daily transactions, with user-friendly interfaces and integration with exchanges, yet they face higher risks of cyber attacks and theft due to constant internet connectivity. Choosing between paper and hot wallets depends on balancing security preferences with the need for accessibility and transaction frequency.

Which Wallet Should You Choose?

Choosing between a paper wallet and a hot wallet depends on your security needs and usage frequency. Paper wallets offer enhanced security by keeping private keys offline, making them ideal for long-term storage with minimal transaction activity. Hot wallets provide convenience and quick access for frequent transactions but carry higher risks due to constant internet connectivity.

Paper Wallet Infographic

libterm.com

libterm.com