Equity crowdfunding allows investors to gain partial ownership in startups or early-stage companies by contributing funds in exchange for equity shares. This innovative financing method democratizes investment opportunities, enabling you to support businesses you believe in while potentially earning returns. Explore the rest of the article to discover how equity crowdfunding can empower your investment strategy.

Table of Comparison

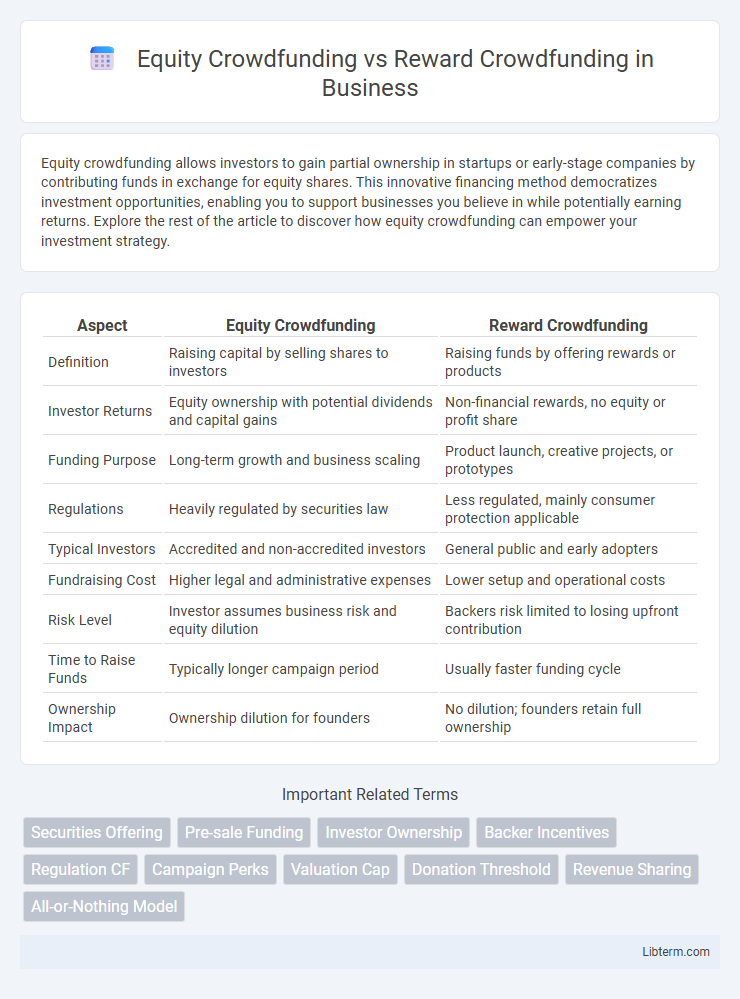

| Aspect | Equity Crowdfunding | Reward Crowdfunding |

|---|---|---|

| Definition | Raising capital by selling shares to investors | Raising funds by offering rewards or products |

| Investor Returns | Equity ownership with potential dividends and capital gains | Non-financial rewards, no equity or profit share |

| Funding Purpose | Long-term growth and business scaling | Product launch, creative projects, or prototypes |

| Regulations | Heavily regulated by securities law | Less regulated, mainly consumer protection applicable |

| Typical Investors | Accredited and non-accredited investors | General public and early adopters |

| Fundraising Cost | Higher legal and administrative expenses | Lower setup and operational costs |

| Risk Level | Investor assumes business risk and equity dilution | Backers risk limited to losing upfront contribution |

| Time to Raise Funds | Typically longer campaign period | Usually faster funding cycle |

| Ownership Impact | Ownership dilution for founders | No dilution; founders retain full ownership |

Introduction to Equity and Reward Crowdfunding

Equity crowdfunding allows investors to obtain shares of a company in exchange for their capital, providing both funding and ownership stakes. Reward crowdfunding offers backers non-monetary incentives, such as products or services, without equity involvement. Both methods enable startups and entrepreneurs to raise funds from a large pool of supporters through online platforms.

Key Differences Between Equity and Reward Crowdfunding

Equity crowdfunding involves investors receiving shares or ownership stakes in a company in exchange for their financial contributions, creating potential for future dividends or capital gains. Reward crowdfunding offers backers non-monetary incentives such as products, services, or experiences rather than equity, making it more suitable for creative projects or product launches. The primary distinction lies in equity crowdfunding's focus on investment returns and regulatory compliance, while reward crowdfunding emphasizes consumer engagement and pre-selling without securities regulations.

How Equity Crowdfunding Works

Equity crowdfunding involves raising capital by selling shares of a business to a large number of investors, who become partial owners and share in future profits and losses. Investors receive equity stakes proportional to their investment, enabling startups and small businesses to access funds without traditional loans or venture capital. Platforms like SeedInvest and Crowdcube facilitate equity crowdfunding by connecting companies with accredited and non-accredited investors under regulatory frameworks such as the JOBS Act in the United States.

How Reward Crowdfunding Works

Reward crowdfunding operates by soliciting small financial contributions from a large number of backers, who receive non-monetary rewards or products in return, often related to the project itself. Platforms like Kickstarter and Indiegogo facilitate this model by allowing creators to set funding goals and offer tiered incentives that correspond to pledge levels. This method enables entrepreneurs and creators to raise capital without giving up equity, making it ideal for product launches, creative endeavors, and social causes.

Investor Motivations and Expectations

Equity crowdfunding attracts investors seeking ownership stakes and potential long-term financial returns from startup equity appreciation or dividends, driven by profit-oriented motivations and active participation in company growth. Reward crowdfunding appeals to backers motivated by receiving non-financial perks, early access to products, or supporting creative projects without expecting monetary gains. Understanding these investor expectations helps distinguish between financially driven commitments in equity crowdfunding and experience or product-based incentives in reward crowdfunding.

Risks and Benefits for Founders

Equity crowdfunding offers founders access to capital by selling shares, enabling long-term investor engagement but potentially diluting ownership and complicating decision-making. Reward crowdfunding provides upfront funding without equity loss, fostering community support and product validation, yet carries risks of under-delivery and reputational damage if promises are unmet. Founders must weigh ownership dilution and compliance complexities in equity crowdfunding against fulfillment challenges and limited funding scope in reward crowdfunding.

Legal and Regulatory Considerations

Equity crowdfunding involves the offering of company shares to investors, requiring compliance with securities regulations such as the SEC's Regulation Crowdfunding in the U.S., which mandates disclosure, investor limits, and registration exemptions. Reward crowdfunding, commonly used on platforms like Kickstarter, operates under fewer regulatory constraints since backers receive non-financial rewards instead of equity, though it must still adhere to consumer protection laws and platform-specific rules. Legal risks in equity crowdfunding include potential securities law violations and investor protection issues, while reward crowdfunding emphasizes fulfillment obligations and fraud prevention.

Suitable Projects for Each Crowdfunding Model

Equity crowdfunding is ideal for startups and early-stage companies seeking capital in exchange for ownership shares, particularly in technology, healthcare, and scalable business models with long-term growth potential. Reward crowdfunding suits creative projects, product launches, and community initiatives that offer backers tangible rewards or experiences rather than financial returns. Selecting the crowdfunding model depends on the nature of the project, funding goals, and willingness to share equity or provide non-monetary incentives.

Success Stories and Notable Case Studies

Equity crowdfunding success stories include companies like BrewDog, which raised millions by offering shares to thousands of investors, showcasing substantial growth and market impact. Reward crowdfunding platforms like Kickstarter have famously supported projects such as the Pebble smartwatch, which raised over $20 million, demonstrating strong consumer interest and product innovation. These case studies highlight the distinct advantages of equity crowdfunding in raising capital through ownership stakes versus the consumer engagement and product validation rewards-based campaigns drive.

Choosing the Right Crowdfunding Approach

Equity crowdfunding involves investors receiving shares or equity in a company in exchange for their funds, making it suitable for startups seeking long-term capital and investor commitment. Reward crowdfunding offers backers non-financial rewards or early access to products, ideal for creative projects or product launches with a focus on community engagement and product pre-sales. Choosing the right crowdfunding approach depends on business goals, the need for funding type, target audience, and the level of control a founder wishes to maintain over their company.

Equity Crowdfunding Infographic

libterm.com

libterm.com