The monetary base consists of the total currency in circulation plus the reserves held by banks at the central bank, serving as the foundation for a country's money supply. It directly influences inflation, interest rates, and overall economic stability, making it a crucial concept in monetary policy. Discover how understanding the monetary base can empower your financial decisions by exploring the rest of this article.

Table of Comparison

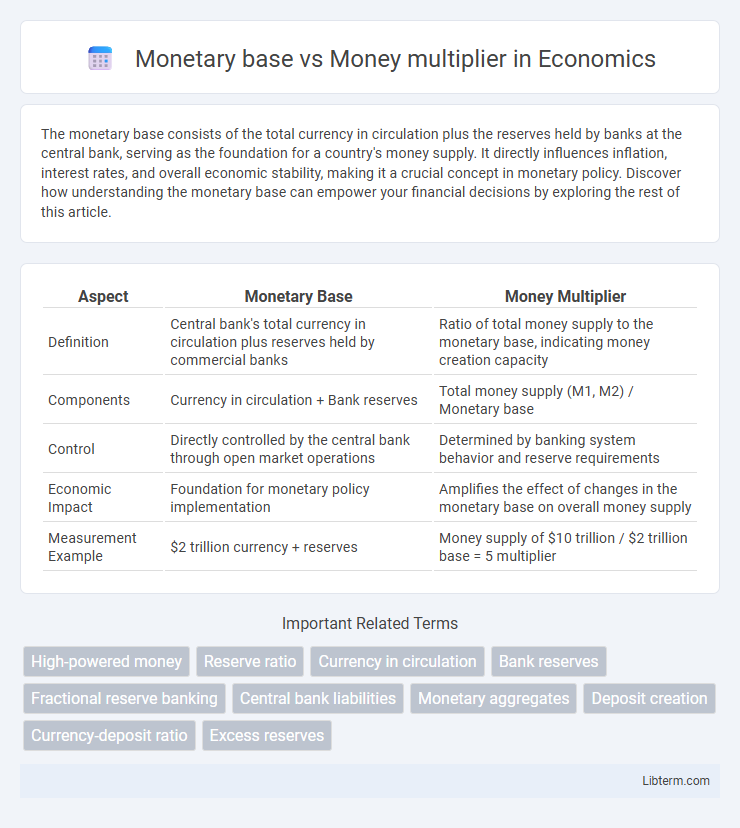

| Aspect | Monetary Base | Money Multiplier |

|---|---|---|

| Definition | Central bank's total currency in circulation plus reserves held by commercial banks | Ratio of total money supply to the monetary base, indicating money creation capacity |

| Components | Currency in circulation + Bank reserves | Total money supply (M1, M2) / Monetary base |

| Control | Directly controlled by the central bank through open market operations | Determined by banking system behavior and reserve requirements |

| Economic Impact | Foundation for monetary policy implementation | Amplifies the effect of changes in the monetary base on overall money supply |

| Measurement Example | $2 trillion currency + reserves | Money supply of $10 trillion / $2 trillion base = 5 multiplier |

Introduction to Monetary Base and Money Multiplier

The monetary base, also known as high-powered money, comprises currency in circulation and reserves held by commercial banks at the central bank. The money multiplier measures the maximum amount of broad money that can be created from a unit of the monetary base through the banking system's lending activities. Understanding the interaction between the monetary base and the money multiplier is crucial for analyzing monetary policy effectiveness and money supply growth.

Definition of Monetary Base

The monetary base, also known as the high-powered money, includes currency in circulation and reserves held by commercial banks at the central bank. It serves as the foundation for the money supply, influencing the potential maximum amount of money created through the money multiplier effect. Understanding the monetary base is crucial for analyzing central bank policies and their impact on inflation and economic growth.

Understanding the Money Multiplier

The money multiplier represents the ratio of the money supply to the monetary base, indicating how much the money supply expands for each unit of base money. It depends on factors such as the reserve requirement set by central banks, currency holdings by the public, and banks' excess reserves. Understanding the money multiplier helps in analyzing the effectiveness of monetary policy and the influence of banking behavior on money creation.

Key Differences Between Monetary Base and Money Multiplier

The monetary base consists of currency in circulation and reserves held by banks at the central bank, forming the foundation of the money supply. The money multiplier measures the maximum amount of commercial bank money that can be created from a unit of the monetary base through fractional reserve banking. Key differences include that the monetary base is controlled by the central bank and represents actual money, while the money multiplier is a theoretical ratio indicating money expansion in the economy.

Components of the Monetary Base

The monetary base consists primarily of currency in circulation and bank reserves held at the central bank, serving as the foundation for money supply creation. Currency in circulation refers to physical money held by the public, while bank reserves include mandatory reserve requirements and excess reserves banks keep. Understanding these components is crucial for analyzing how the money multiplier amplifies the monetary base into broader money supply measures like M1 and M2.

Factors Influencing the Money Multiplier

The money multiplier is influenced by factors such as reserve requirements set by central banks, currency circulation preferences, and banks' willingness to lend. Higher reserve ratios reduce the money multiplier by limiting banks' capacity to create loans, while increased cash holdings by the public decrease deposits, lowering the multiplier effect. Lending standards and financial regulations also impact how efficiently the monetary base is converted into broader money supply through credit creation.

Central Bank’s Role in Monetary Base Management

The central bank controls the monetary base by adjusting reserve requirements, conducting open market operations, and setting discount rates to influence the amount of currency and reserves in the banking system. This management directly impacts the money multiplier, which determines the total money supply generated from each unit of the monetary base through commercial bank lending activities. Effective central bank policies ensure stability in liquidity and credit availability, guiding inflation and economic growth.

Impacts on Money Supply and Economy

The monetary base, consisting of currency in circulation and central bank reserves, directly influences the money supply by serving as the foundation for commercial bank lending and deposit creation. The money multiplier reflects the extent to which banks can expand the money supply based on reserve requirements and lending activities, amplifying the initial monetary base. Changes in the monetary base or the money multiplier significantly impact inflation, interest rates, and overall economic growth by altering the liquidity available within the financial system.

Real-World Examples and Case Studies

The monetary base, comprising physical currency and central bank reserves, serves as the foundation for money supply growth through the money multiplier effect observed in economies like the United States and Japan. During the 2008 financial crisis, the Federal Reserve expanded the monetary base dramatically via quantitative easing, yet the money multiplier declined due to banks' reluctance to lend, highlighting the complex relationship between base money and broad money supply. In contrast, China's controlled banking sector maintained a relatively stable money multiplier despite significant increases in the monetary base, demonstrating varied outcomes in different regulatory environments.

Conclusion: Implications for Policy and Banking

The monetary base directly influences the banking system's capacity to create money through reserves, making central bank control crucial for monetary policy effectiveness. A stable money multiplier ensures predictable expansion of the money supply, facilitating targeted inflation and economic growth management. Policymakers must monitor both metrics to balance liquidity and credit availability, maintaining financial stability and supporting sustainable economic development.

Monetary base Infographic

libterm.com

libterm.com