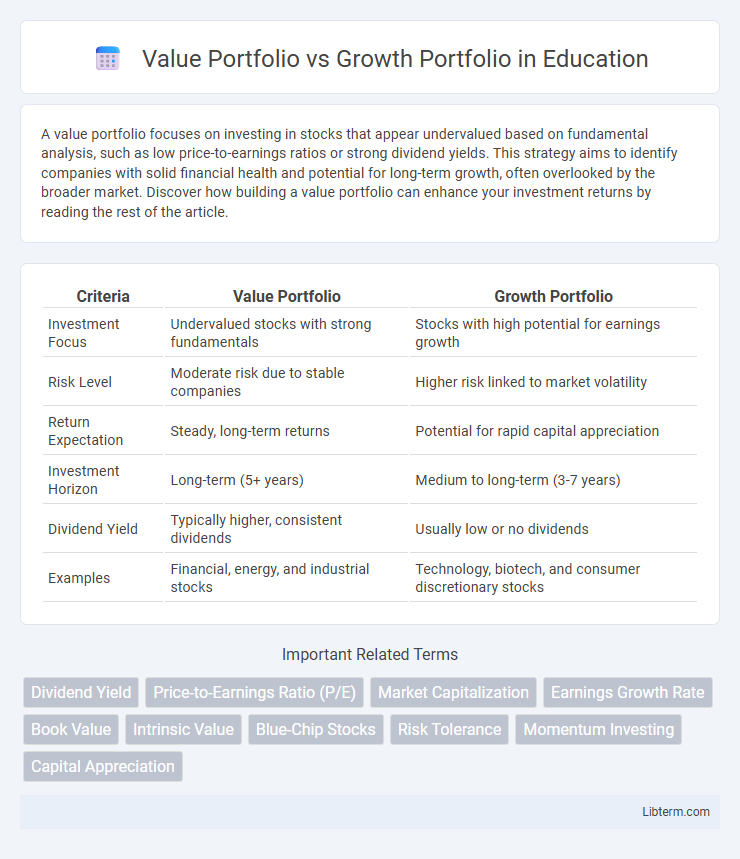

A value portfolio focuses on investing in stocks that appear undervalued based on fundamental analysis, such as low price-to-earnings ratios or strong dividend yields. This strategy aims to identify companies with solid financial health and potential for long-term growth, often overlooked by the broader market. Discover how building a value portfolio can enhance your investment returns by reading the rest of the article.

Table of Comparison

| Criteria | Value Portfolio | Growth Portfolio |

|---|---|---|

| Investment Focus | Undervalued stocks with strong fundamentals | Stocks with high potential for earnings growth |

| Risk Level | Moderate risk due to stable companies | Higher risk linked to market volatility |

| Return Expectation | Steady, long-term returns | Potential for rapid capital appreciation |

| Investment Horizon | Long-term (5+ years) | Medium to long-term (3-7 years) |

| Dividend Yield | Typically higher, consistent dividends | Usually low or no dividends |

| Examples | Financial, energy, and industrial stocks | Technology, biotech, and consumer discretionary stocks |

Understanding Value and Growth Investing

Value investing targets undervalued stocks with low price-to-earnings ratios and strong fundamentals, aiming for long-term stability and dividend income. Growth investing focuses on companies with high revenue and earnings growth rates, emphasizing capital appreciation despite higher volatility and valuation multiples. Understanding these strategies helps investors align portfolios with risk tolerance and market outlook for optimized returns.

Key Characteristics of Value Portfolios

Value portfolios focus on companies with strong fundamentals, including low price-to-earnings (P/E) ratios and high dividend yields, indicating undervaluation relative to their intrinsic worth. These portfolios typically emphasize stable earnings, solid cash flow, and mature businesses with less volatility compared to growth portfolios. Investors in value portfolios seek long-term capital appreciation coupled with income generation through dividends.

Key Characteristics of Growth Portfolios

Growth portfolios primarily focus on investing in companies with high potential for earnings expansion, often in sectors like technology and healthcare. These portfolios emphasize capital appreciation over dividend income, targeting stocks with above-average revenue and profit growth rates. Risk tolerance is typically higher due to the volatility associated with growth stocks, yet investors expect substantial long-term returns.

Risk and Reward: Value vs Growth Comparison

Value portfolios typically exhibit lower volatility due to investments in established companies with stable earnings and strong fundamentals, offering steady dividends and downside protection. Growth portfolios carry higher risk as they focus on companies with rapid earnings expansion and reinvested profits, aiming for significant capital appreciation but with greater price fluctuations. Investors seeking a balance between risk and reward often blend value's stability and growth's potential to optimize portfolio performance.

Performance Trends: Historical Data Insights

Value portfolios historically outperform growth portfolios during market downturns due to their emphasis on stable, undervalued companies with strong fundamentals. Growth portfolios tend to deliver higher returns in bull markets driven by rapid earnings expansion and innovation but exhibit greater volatility. Analysis of market cycles from the past two decades shows value strategies outperforming growth in recovery phases, while growth excels during sustained economic expansions.

Types of Stocks in Each Portfolio

Value portfolios predominantly contain stocks of established companies trading below their intrinsic value, often characterized by low price-to-earnings (P/E) ratios and high dividend yields. Growth portfolios focus on stocks of companies with strong earnings growth potential, typically featuring high price-to-earnings ratios and reinvested earnings instead of dividends. Consumer discretionary, technology, and healthcare sectors frequently populate growth portfolios, while financials, utilities, and industrials are common in value portfolios.

Suitability for Different Investor Profiles

Value portfolios suit conservative investors seeking stable dividends and lower volatility, often appealing to retirees or those prioritizing capital preservation. Growth portfolios attract aggressive investors aiming for high capital appreciation, typically younger individuals with higher risk tolerance and longer investment horizons. Balancing these portfolios depends on individual financial goals, risk appetite, and investment timeframes.

Economic Cycles and Portfolio Performance

Value portfolios tend to outperform during economic recoveries and expansions as undervalued stocks benefit from improving fundamentals and rising investor confidence. Growth portfolios typically excel in early-stage expansions and low interest rate environments, driven by strong earnings expectations and innovation momentum. Portfolio performance varies across economic cycles, with value strategies offering greater downside protection in downturns and growth strategies capturing outsized gains during robust growth phases.

Building a Diversified Investment Strategy

Value portfolios target undervalued stocks with strong fundamentals, emphasizing stable dividends and lower volatility, while growth portfolios invest in companies with high earnings potential and capital appreciation. Building a diversified investment strategy involves blending both value and growth stocks to balance risk and return, capturing steady income alongside aggressive growth opportunities. This approach leverages the complementary performance cycles of value and growth assets, enhancing portfolio resilience across varying market conditions.

Choosing Between Value and Growth Portfolios

Choosing between value and growth portfolios depends on an investor's risk tolerance, investment horizon, and market outlook. Value portfolios emphasize undervalued stocks with strong fundamentals and stable dividends, suitable for conservative investors seeking steady returns. Growth portfolios focus on companies with high earnings potential and rapid expansion, appealing to those willing to accept higher volatility for the possibility of significant capital appreciation.

Value Portfolio Infographic

libterm.com

libterm.com