Activity-Based Budgeting (ABB) focuses on allocating resources based on the specific activities that drive costs within an organization, offering a more accurate and detailed approach to budgeting. This method helps businesses identify cost drivers, improve efficiency, and align budgeting processes with strategic objectives. Discover how implementing ABB can optimize your financial planning by exploring the full article.

Table of Comparison

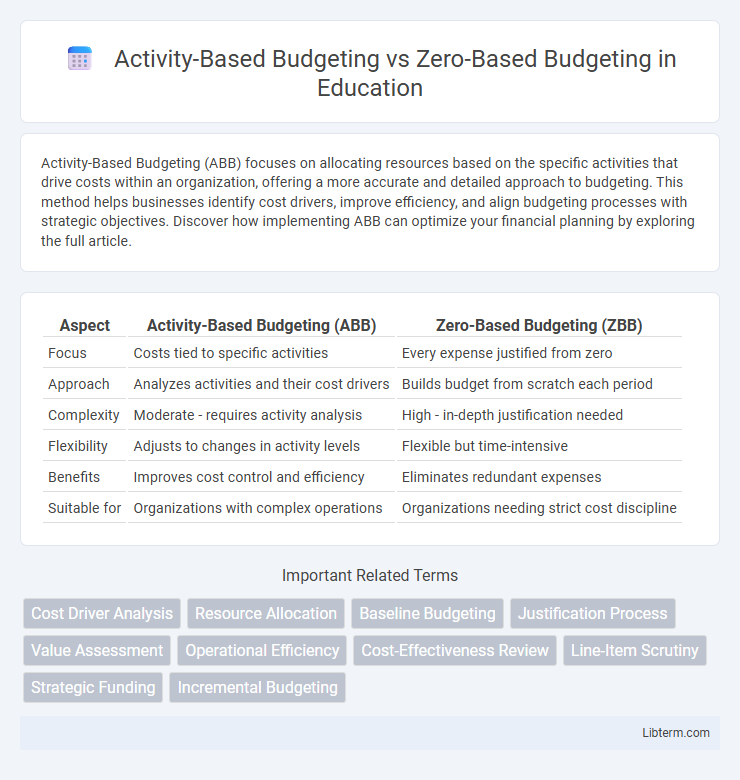

| Aspect | Activity-Based Budgeting (ABB) | Zero-Based Budgeting (ZBB) |

|---|---|---|

| Focus | Costs tied to specific activities | Every expense justified from zero |

| Approach | Analyzes activities and their cost drivers | Builds budget from scratch each period |

| Complexity | Moderate - requires activity analysis | High - in-depth justification needed |

| Flexibility | Adjusts to changes in activity levels | Flexible but time-intensive |

| Benefits | Improves cost control and efficiency | Eliminates redundant expenses |

| Suitable for | Organizations with complex operations | Organizations needing strict cost discipline |

Introduction to Modern Budgeting Methods

Activity-Based Budgeting allocates costs based on actual activities driving expenses, enhancing precision in resource management and aligning budgets with operational efficiency. Zero-Based Budgeting requires each expense to be justified from scratch each budgeting period, promoting cost-effectiveness and eliminating legacy expenditures. Both methods represent modern budgeting techniques aimed at improving financial transparency and strategic decision-making in organizations.

Defining Activity-Based Budgeting (ABB)

Activity-Based Budgeting (ABB) allocates resources based on the cost drivers of business activities, prioritizing activities that generate value over traditional line-item budgeting. ABB enhances cost accuracy by linking expenditures directly to specific operational processes, enabling more strategic financial planning. This approach contrasts with Zero-Based Budgeting by focusing on activity costs rather than just building budgets from zero each cycle.

Understanding Zero-Based Budgeting (ZBB)

Zero-Based Budgeting (ZBB) requires building the budget from scratch each period, starting at zero and justifying every expense to align costs with organizational goals. Unlike Activity-Based Budgeting, which allocates resources based on activity cost drivers, ZBB emphasizes rigorous cost justification to eliminate inefficiencies and prioritize essential activities. This approach enhances financial discipline and supports strategic resource allocation by challenging the necessity of all expenditures annually.

Core Principles of ABB vs ZBB

Activity-Based Budgeting (ABB) centers on identifying and analyzing the cost of activities necessary to produce goods or services, allocating resources based on activity cost drivers to improve accuracy in budgeting. Zero-Based Budgeting (ZBB) requires justifying every expense from zero for each budget period, focusing on prioritizing resources by evaluating the necessity and benefit of all expenditures. ABB emphasizes cost management linked to operational activities, while ZBB stresses resource allocation based on strategic priorities and cost justification.

Key Differences Between ABB and ZBB

Activity-Based Budgeting (ABB) allocates costs based on specific activities driving expenses, emphasizing the relationship between resources and business processes, while Zero-Based Budgeting (ZBB) requires building the budget from scratch each period, justifying every expense without reference to prior budgets. ABB focuses on improving cost management through detailed activity analysis and resource optimization, whereas ZBB aims to eliminate waste by challenging all expenditures and prioritizing funding based on necessity and impact. ABB provides a more continuous and process-oriented approach, whereas ZBB adopts a periodic, comprehensive reevaluation of all budget elements.

Advantages of Activity-Based Budgeting

Activity-Based Budgeting (ABB) offers precise cost control by allocating resources based on actual business activities and their cost drivers, enhancing financial efficiency. ABB improves decision-making through detailed insights into operational processes, enabling better resource prioritization and waste reduction. Compared to Zero-Based Budgeting, ABB requires less time and effort in budget preparation, making it more practical for continuous financial management and performance evaluation.

Benefits of Zero-Based Budgeting

Zero-Based Budgeting (ZBB) enhances financial efficiency by requiring every expense to be justified from scratch, eliminating unnecessary costs often perpetuated in Activity-Based Budgeting (ABB). ZBB promotes strategic alignment as it compels organizations to prioritize funding based on current objectives rather than historical expenditures. This budgeting approach fosters a culture of accountability and cost awareness, leading to more effective resource allocation and improved financial performance.

Common Challenges in Implementation

Activity-Based Budgeting (ABB) and Zero-Based Budgeting (ZBB) both require detailed analysis and justification of expenses, creating challenges in time consumption and resource allocation. Organizations often face resistance from employees due to increased scrutiny and the need for cultural change toward cost accountability. Data accuracy and integration issues further complicate the implementation process, hindering the effective tracking of activities or justifications in each budgeting cycle.

Best Use Cases for ABB and ZBB

Activity-Based Budgeting (ABB) excels in organizations with complex operations where detailed cost analysis of activities drives more accurate budget allocation, such as manufacturing firms or service companies aiming to optimize resource use based on specific operational activities. Zero-Based Budgeting (ZBB) is best suited for businesses facing financial constraints or significant change, requiring a fresh justification of all expenses from zero, commonly used in startups, cost-cutting scenarios, or departments undergoing strategic re-evaluation. ABB supports continuous improvement and efficiency by linking budget to operational drivers, while ZBB enables radical cost control and prioritization in volatile or restructuring environments.

Choosing the Right Budgeting Approach

Selecting between Activity-Based Budgeting (ABB) and Zero-Based Budgeting (ZBB) depends on an organization's financial goals and operational complexity. ABB allocates costs based on actual activities driving expenses, ideal for companies seeking precise cost management and operational efficiency, while ZBB requires building budgets from zero, promoting cost justification and prioritization, suitable for restructuring or cost-cutting scenarios. Understanding the business context, resource availability, and strategic objectives is crucial to determine the most effective budgeting approach.

Activity-Based Budgeting Infographic

libterm.com

libterm.com