Incremental budgeting focuses on adjusting the previous period's budget by adding a percentage increase or decrease based on anticipated changes. This method simplifies the budgeting process by using historical data as a baseline, making it easier to predict expenses and allocate resources efficiently. Explore the full article to understand how incremental budgeting can optimize your financial planning.

Table of Comparison

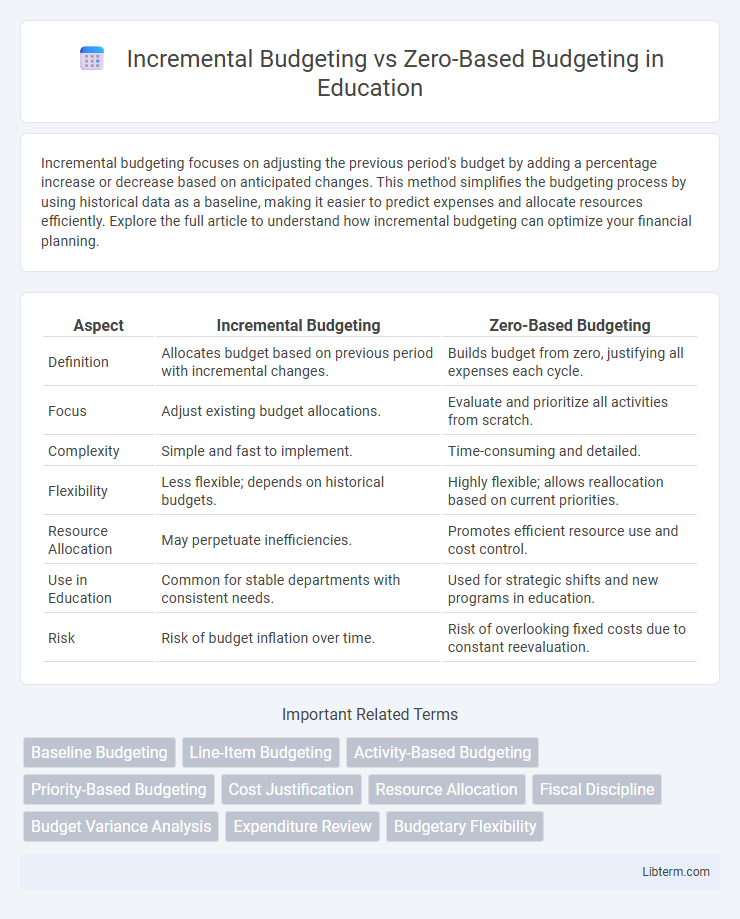

| Aspect | Incremental Budgeting | Zero-Based Budgeting |

|---|---|---|

| Definition | Allocates budget based on previous period with incremental changes. | Builds budget from zero, justifying all expenses each cycle. |

| Focus | Adjust existing budget allocations. | Evaluate and prioritize all activities from scratch. |

| Complexity | Simple and fast to implement. | Time-consuming and detailed. |

| Flexibility | Less flexible; depends on historical budgets. | Highly flexible; allows reallocation based on current priorities. |

| Resource Allocation | May perpetuate inefficiencies. | Promotes efficient resource use and cost control. |

| Use in Education | Common for stable departments with consistent needs. | Used for strategic shifts and new programs in education. |

| Risk | Risk of budget inflation over time. | Risk of overlooking fixed costs due to constant reevaluation. |

Introduction to Budgeting Approaches

Incremental budgeting allocates funds based on the previous period's budget, adjusting for minor changes in expenses, making it straightforward but potentially inefficient over time. Zero-based budgeting requires building the budget from scratch each cycle, justifying every expense, which promotes cost-efficiency and resource optimization. Organizations choose budgeting approaches based on their strategic goals, operational complexity, and the need for financial control.

What Is Incremental Budgeting?

Incremental budgeting is a financial planning method that uses the previous period's budget as a baseline, adjusting only for incremental changes such as inflation, growth, or reduction in activities. This approach simplifies the budgeting process by assuming that the existing budget allocations are mostly valid, requiring minimal justification for the adjusted amounts. Incremental budgeting is commonly used in organizations with stable operations, where changes are predictable and limited to specific areas.

What Is Zero-Based Budgeting?

Zero-Based Budgeting (ZBB) is a budgeting method where every expense must be justified from scratch for each new period, starting from a "zero base." Unlike Incremental Budgeting, which adjusts previous budgets by increments, ZBB requires detailed evaluation of all activities and expenses, promoting cost-efficiency and resource optimization. This approach helps organizations identify redundant spending and prioritize funding based on current needs and strategic goals.

Key Principles of Incremental Budgeting

Incremental budgeting builds future budgets based on past spending levels, adjusting for incremental changes like inflation or new projects, which simplifies the process and ensures continuity. It relies on historical data and assumes previous budgets were generally effective, minimizing detailed review and evaluation of each expense. This method emphasizes stability and predictability but may perpetuate inefficiencies embedded in prior budgets.

Core Features of Zero-Based Budgeting

Zero-Based Budgeting (ZBB) requires each expense to be justified from scratch, ensuring every budget cycle starts at zero rather than adjusting previous budgets as in Incremental Budgeting. Core features of ZBB include detailed analysis of all activities, prioritization based on organizational goals, and alignment of resource allocation with current needs and strategic objectives. This rigorous approach enhances cost control, promotes efficient use of funds, and reduces unnecessary expenditures by challenging the status quo.

Advantages of Incremental Budgeting

Incremental budgeting offers simplicity and ease of implementation by adjusting previous budgets with incremental changes, saving time and reducing complexity. It provides stability and predictability, which helps organizations maintain consistent financial planning and control. This method fosters efficient resource allocation when historical data is reliable and operational environments remain relatively stable.

Benefits of Zero-Based Budgeting

Zero-Based Budgeting (ZBB) promotes efficient resource allocation by requiring each expense to be justified from scratch, eliminating unnecessary costs inherent in Incremental Budgeting. This method enhances organizational transparency and accountability, as every budget item must be reviewed and approved annually, leading to more strategic financial planning. ZBB also fosters innovation and cost management by encouraging managers to critically evaluate spending priorities without relying on previous budget baselines.

Limitations and Challenges of Incremental Budgeting

Incremental budgeting often faces limitations such as perpetuating inefficiencies by basing new budgets on previous allocations rather than actual needs, which can lead to resource misallocation. It challenges organizations with its resistance to change and innovation since it assumes that all current expenditures are necessary and justified. Furthermore, incremental budgeting may overlook emerging priorities and fail to adequately address dynamic market conditions or strategic shifts.

Drawbacks and Challenges of Zero-Based Budgeting

Zero-Based Budgeting (ZBB) presents challenges such as its time-consuming nature and complexity, requiring detailed justification of every expense from scratch, which can overwhelm financial teams. This method often demands significant managerial effort and resources, potentially leading to slower budget cycles and resistance from employees accustomed to incremental budgeting. Moreover, ZBB's intensive scrutiny may result in short-term cost-cutting that overlooks long-term strategic investments and organizational growth.

Incremental Budgeting vs Zero-Based Budgeting: Which Is Better?

Incremental budgeting adjusts previous budgets by a fixed percentage, offering simplicity and stability, while zero-based budgeting requires justifying every expense from scratch, promoting efficiency and resource allocation optimization. Incremental budgeting benefits organizations with steady, predictable expenses, whereas zero-based budgeting suits dynamic environments demanding cost control and strategic spending. Choosing between them depends on organizational goals, with incremental budgeting favoring ease and continuity, and zero-based budgeting ensuring financial rigor and adaptability.

Incremental Budgeting Infographic

libterm.com

libterm.com