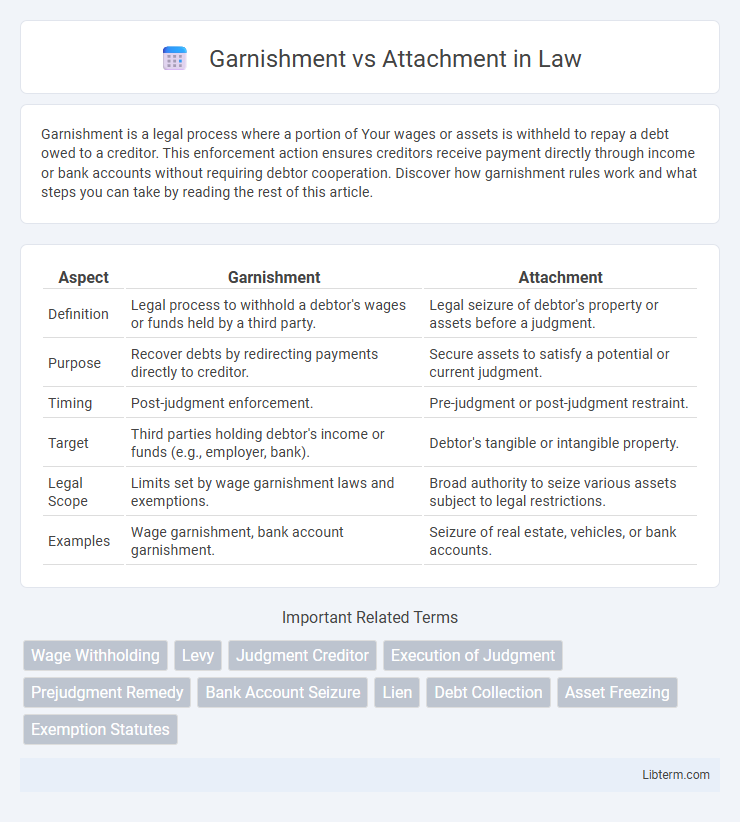

Garnishment is a legal process where a portion of Your wages or assets is withheld to repay a debt owed to a creditor. This enforcement action ensures creditors receive payment directly through income or bank accounts without requiring debtor cooperation. Discover how garnishment rules work and what steps you can take by reading the rest of this article.

Table of Comparison

| Aspect | Garnishment | Attachment |

|---|---|---|

| Definition | Legal process to withhold a debtor's wages or funds held by a third party. | Legal seizure of debtor's property or assets before a judgment. |

| Purpose | Recover debts by redirecting payments directly to creditor. | Secure assets to satisfy a potential or current judgment. |

| Timing | Post-judgment enforcement. | Pre-judgment or post-judgment restraint. |

| Target | Third parties holding debtor's income or funds (e.g., employer, bank). | Debtor's tangible or intangible property. |

| Legal Scope | Limits set by wage garnishment laws and exemptions. | Broad authority to seize various assets subject to legal restrictions. |

| Examples | Wage garnishment, bank account garnishment. | Seizure of real estate, vehicles, or bank accounts. |

Understanding Garnishment: A Basic Overview

Garnishment is a legal process where a creditor collects a debtor's funds directly from a third party, often the debtor's employer, to satisfy a court-ordered debt. This method differs from attachment, which involves seizing a debtor's property or assets before a judgment is final. Understanding garnishment involves recognizing its role in wage garnishment, bank account levies, and the limits set by laws like the Consumer Credit Protection Act.

Defining Attachment in Legal Terms

Attachment is a legal process that allows a creditor to secure a debtor's property before a judgment is rendered, ensuring the availability of assets for satisfying a future court order. It involves a court order directing law enforcement to seize specific property, which may be real estate, personal property, or financial accounts, to prevent the debtor from disposing of it. Unlike garnishment, attachment targets property directly rather than wages or third-party holdings, serving as a pre-judgment remedy in civil litigation.

Key Differences Between Garnishment and Attachment

Garnishment involves a court-ordered withholding of a debtor's wages or bank accounts to satisfy a debt, whereas attachment refers to the legal seizure of a debtor's property before a judgment to secure the claim. Garnishment directly targets income or funds held by a third party, while attachment immobilizes assets like real estate or personal property to prevent disposal. The timing differs as garnishment typically occurs post-judgment, and attachment is a pre-judgment remedy securing assets for potential enforcement.

Common Situations Requiring Garnishment

Common situations requiring garnishment typically involve unpaid debts such as credit card balances, student loans, child support, and tax obligations. In garnishment cases, a court orders a third party, like an employer or bank, to withhold funds directly from the debtor's wages or accounts to satisfy the creditor's claim. Garnishment is often used when a creditor has obtained a judgment and seeks regular payments without seizing property, unlike attachment which directly targets specific assets prior to judgment.

Scenarios Where Attachment is Applied

Attachment is applied primarily in scenarios where a creditor seeks to secure or seize a debtor's property before a final judgment is made, typically in cases involving fraud, hidden assets, or risk of asset dissipation. Common situations include freezing bank accounts, seizing real estate, or taking control of personal property to satisfy future judgments. This legal remedy ensures the debtor's assets remain available to satisfy the creditor's claim pending litigation.

Legal Procedures for Garnishment

Garnishment is a legal procedure that allows a creditor to collect debts by seizing funds directly from a debtor's wages or bank accounts through a court order. The process typically involves filing a petition with the court, obtaining a garnishment order, and notifying the third party, such as an employer or financial institution, to withhold funds. Unlike attachment, which often targets specific property before judgment, garnishment focuses on post-judgment debt recovery by intercepting income or assets in possession of third parties.

Legal Steps Involved in Attachment

Attachment involves a legal process where a court orders the seizure or freezing of a debtor's property before judgment to secure a potential future award. The plaintiff initiates attachment by filing a motion supported by an affidavit demonstrating probable cause and the risk of asset dissipation. The court reviews the evidence and may issue a writ of attachment, allowing law enforcement to take custody of the designated property until the case is resolved.

Rights and Protections for Debtors

Garnishment allows creditors to collect debts directly from a debtor's wages or bank accounts, but federal and state laws limit the amount that can be garnished to protect the debtor's basic living expenses. Attachment involves seizing a debtor's property before a judgment is entered, yet debtors have rights such as challenging the attachment and exemptions that protect certain assets from being seized. Both processes require strict adherence to legal procedures, ensuring debtors receive notice and have opportunities to contest actions that affect their financial rights and assets.

Implications for Creditors: Garnishment vs Attachment

Garnishment allows creditors to collect debts directly from a debtor's wages or bank accounts, providing a steady source of repayment but often limited by legal caps and exemptions. Attachment secures specific debtor assets before judgment, preserving value for potential seizure but requiring court approval and possibly delaying funds collection. Creditors must weigh garnishment's ongoing income flow against attachment's asset protection to optimize debt recovery outcomes.

Choosing the Right Legal Remedy: Factors to Consider

Choosing between garnishment and attachment depends on factors such as the type of debt, the debtor's available assets, and the speed of enforcement required. Garnishment targets third parties holding the debtor's funds, like employers or banks, making it effective for wage or bank account collections, whereas attachment involves seizing the debtor's tangible property prior to judgment or enforcement. Legal costs, jurisdictional rules, and the debtor's asset structure also influence the decision, ensuring the selected remedy maximizes recovery while minimizing procedural delays.

Garnishment Infographic

libterm.com

libterm.com