Periodic alimony refers to ongoing payments made by one spouse to another following a divorce or separation to provide financial support. These payments are typically awarded for a specified duration or until certain conditions, such as remarriage or cohabitation, occur. Explore the rest of the article to understand how periodic alimony may impact your financial planning and legal rights.

Table of Comparison

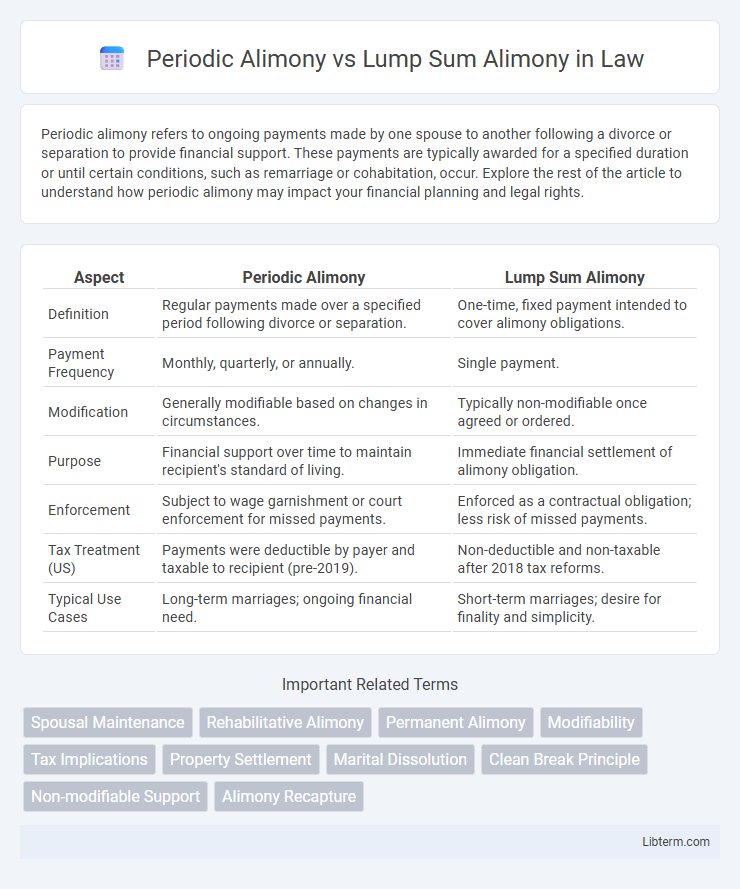

| Aspect | Periodic Alimony | Lump Sum Alimony |

|---|---|---|

| Definition | Regular payments made over a specified period following divorce or separation. | One-time, fixed payment intended to cover alimony obligations. |

| Payment Frequency | Monthly, quarterly, or annually. | Single payment. |

| Modification | Generally modifiable based on changes in circumstances. | Typically non-modifiable once agreed or ordered. |

| Purpose | Financial support over time to maintain recipient's standard of living. | Immediate financial settlement of alimony obligation. |

| Enforcement | Subject to wage garnishment or court enforcement for missed payments. | Enforced as a contractual obligation; less risk of missed payments. |

| Tax Treatment (US) | Payments were deductible by payer and taxable to recipient (pre-2019). | Non-deductible and non-taxable after 2018 tax reforms. |

| Typical Use Cases | Long-term marriages; ongoing financial need. | Short-term marriages; desire for finality and simplicity. |

Understanding Alimony: An Overview

Periodic alimony involves ongoing, scheduled payments to support a former spouse, ensuring consistent financial assistance over time, often reviewed and modified by courts based on changing circumstances. Lump sum alimony is a one-time, fixed payment that settles alimony obligations permanently, providing immediate financial security without future adjustments. Understanding alimony requires recognizing the key differences in payment structure, duration, and enforceability between periodic and lump sum options.

What is Periodic Alimony?

Periodic alimony refers to ongoing, regular payments made by one spouse to the other after divorce, typically on a monthly or weekly basis, to provide financial support. It is designed to continue for a specified duration or until a triggering event, such as remarriage or death, occurs. Courts often determine the amount based on factors like the recipient's needs, payer's income, and length of the marriage.

What is Lump Sum Alimony?

Lump sum alimony is a fixed amount of money awarded by the court to the recipient spouse, paid in one or several installments, rather than ongoing payments. Unlike periodic alimony, which is paid regularly over time and can be modified, lump sum alimony is final, non-modifiable, and typically used when the payor has a lump sum of assets available. This form of alimony provides financial certainty and closure, often used in cases involving property settlements or when one party requires immediate, substantial financial support.

Key Differences Between Periodic and Lump Sum Alimony

Periodic alimony involves ongoing, scheduled payments typically determined by the court based on factors like the recipient's financial needs and the payer's income, offering flexibility to adjust amounts over time. Lump sum alimony represents a single, fixed payment agreed upon or court-ordered, providing finality and preventing future modification. Key differences include payment structure, modifiability, and enforcement mechanisms, with periodic alimony subject to change upon circumstances and lump sum alimony generally non-modifiable and immediately collectible upon default.

Pros and Cons of Periodic Alimony

Periodic alimony provides ongoing financial support, typically paid monthly, allowing adjustments based on changes in income or needs, which maintains fairness over time. However, its duration can lead to prolonged financial dependence and potential uncertainty for the paying spouse due to future obligation risks. Unlike lump sum alimony, periodic payments offer flexibility but may require continuous enforcement and court modifications.

Pros and Cons of Lump Sum Alimony

Lump sum alimony offers clear advantages such as providing immediate financial security and finality, eliminating prolonged court involvement. Its primary drawbacks include the risk of depleted funds if the recipient mismanages the payment and the difficulty of modifying the award once settled. This type of alimony is often favored in cases where financial independence is achievable or when one party wants to avoid ongoing support obligations.

Factors Courts Consider When Awarding Alimony

Courts evaluate factors such as the duration of the marriage, each spouse's income and earning capacity, and the recipient's financial needs when deciding between periodic alimony and lump sum alimony. The ability of the payor to make consistent payments over time versus a single, complete payment impacts the form of alimony awarded. Considerations also include the presence of any marital misconduct, the age and health of both parties, and whether the recipient requires ongoing support or a one-time settlement.

Tax Implications of Periodic vs Lump Sum Alimony

Periodic alimony payments are generally taxable income for the recipient and tax-deductible for the payer under pre-2019 divorce agreements, while lump sum alimony is considered a property settlement and not taxable or deductible. Since the enactment of the Tax Cuts and Jobs Act of 2017, alimony payments for divorces finalized after December 31, 2018, are no longer deductible by the payer nor taxable to the recipient. This distinction significantly impacts the financial planning and tax liabilities of both parties in divorce settlements.

Which Alimony Option is Right for You?

Choosing between periodic alimony and lump sum alimony depends on financial stability, court jurisdiction, and long-term needs. Periodic alimony provides ongoing, structured payments suited for those requiring steady support, while lump sum alimony offers a one-time payment that can provide immediate financial security but carries risks like depletion or lack of modification options. Consulting with a family law attorney can help assess income, asset division, and future obligations to determine the most appropriate alimony arrangement for your circumstances.

Frequently Asked Questions About Alimony Payments

Periodic alimony involves scheduled payments made over time to provide ongoing financial support following a divorce, often subject to modification based on changes in circumstances. Lump sum alimony consists of a single, fixed payment that resolves alimony obligations without future adjustments. Common questions address the tax implications, enforceability, and conditions under which courts may alter or terminate these payments.

Periodic Alimony Infographic

libterm.com

libterm.com