The Securities Exchange Act of 1934 established the foundational framework for regulating secondary securities trading in the United States, including the creation of the Securities and Exchange Commission (SEC). It requires public companies to disclose ongoing financial information to promote transparency and protect investors from fraud. Explore the full article to understand how this law shapes your investment landscape today.

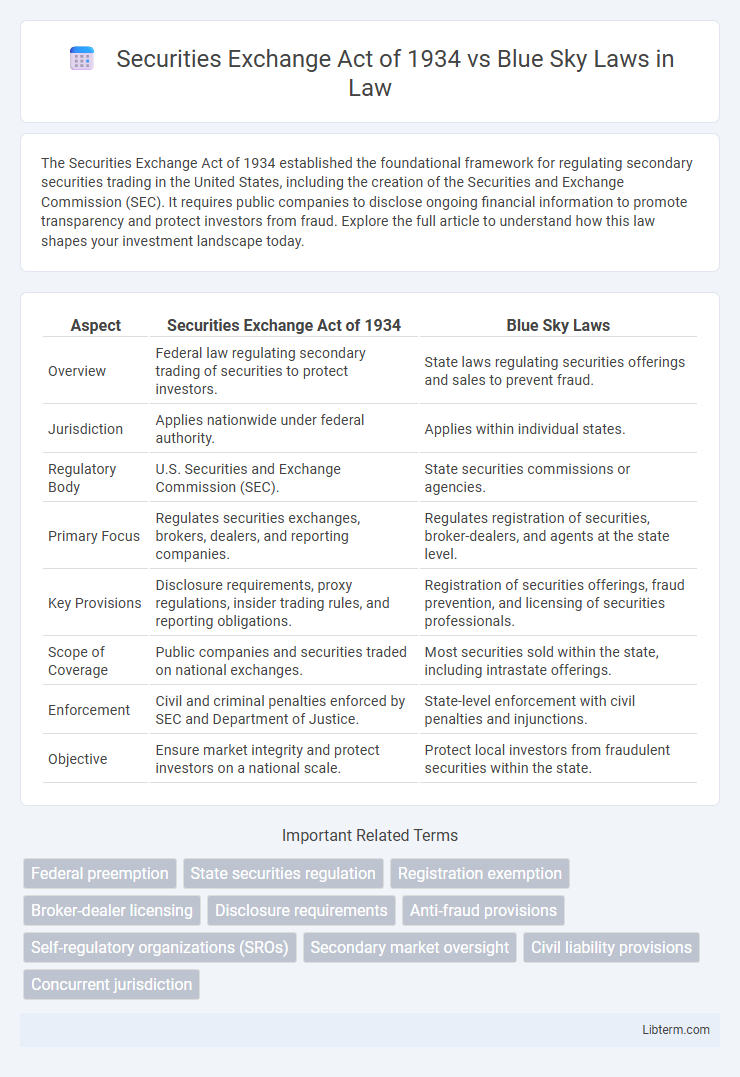

Table of Comparison

| Aspect | Securities Exchange Act of 1934 | Blue Sky Laws |

|---|---|---|

| Overview | Federal law regulating secondary trading of securities to protect investors. | State laws regulating securities offerings and sales to prevent fraud. |

| Jurisdiction | Applies nationwide under federal authority. | Applies within individual states. |

| Regulatory Body | U.S. Securities and Exchange Commission (SEC). | State securities commissions or agencies. |

| Primary Focus | Regulates securities exchanges, brokers, dealers, and reporting companies. | Regulates registration of securities, broker-dealers, and agents at the state level. |

| Key Provisions | Disclosure requirements, proxy regulations, insider trading rules, and reporting obligations. | Registration of securities offerings, fraud prevention, and licensing of securities professionals. |

| Scope of Coverage | Public companies and securities traded on national exchanges. | Most securities sold within the state, including intrastate offerings. |

| Enforcement | Civil and criminal penalties enforced by SEC and Department of Justice. | State-level enforcement with civil penalties and injunctions. |

| Objective | Ensure market integrity and protect investors on a national scale. | Protect local investors from fraudulent securities within the state. |

Overview of the Securities Exchange Act of 1934

The Securities Exchange Act of 1934 established the Securities and Exchange Commission (SEC) to regulate secondary trading of securities, ensuring fair and orderly markets. It mandates disclosure requirements for publicly traded companies and prohibits fraudulent practices in securities transactions. This federal law complements state-level Blue Sky Laws, which primarily govern the initial offering and sale of securities at the state level.

Defining Blue Sky Laws

Blue Sky Laws are state securities regulations designed to protect investors from fraudulent sales practices and ensure transparency in securities transactions. Unlike the Securities Exchange Act of 1934, which is a federal law regulating securities trading, Blue Sky Laws vary by state in scope and enforcement. These laws require registration of securities offerings and brokers, aiming to prevent deceptive practices at the state level.

Historical Context: Federal vs. State Regulation

The Securities Exchange Act of 1934 established comprehensive federal regulation over securities markets, introduced the Securities and Exchange Commission (SEC), and aimed to curb fraudulent activities in securities trading after the 1929 stock market crash. Blue Sky Laws originated earlier at the state level in the early 20th century to protect investors from fraudulent securities offerings by requiring state registration and disclosure before sale. The historical tension between the Act's federal oversight and Blue Sky Laws' state authority reflects the dual regulatory framework balancing investor protection and market efficiency across jurisdictions.

Key Provisions of the Securities Exchange Act of 1934

The Securities Exchange Act of 1934 primarily governs the secondary trading of securities, mandating periodic financial disclosures by public companies to ensure transparency and protect investors. It established the Securities and Exchange Commission (SEC) to enforce federal securities laws, regulate stock exchanges, and prevent fraudulent trading practices. Unlike state Blue Sky Laws that regulate securities within individual states, the 1934 Act provides a uniform federal framework for overseeing securities markets nationwide.

Scope and Application of Blue Sky Laws

The Securities Exchange Act of 1934 primarily regulates secondary trading of securities in national markets, focusing on exchanges and brokers to prevent fraud and ensure transparency. Blue Sky Laws, by contrast, are state-level regulations that govern the offering and sale of securities within individual states, aiming to protect investors from fraudulent sales practices under broader, localized enforcement. The scope of Blue Sky Laws includes registration requirements and disclosures specific to each state, making compliance essential for issuers and brokers operating across multiple jurisdictions.

Regulatory Authorities: SEC vs. State Agencies

The Securities Exchange Act of 1934 established the Securities and Exchange Commission (SEC) as the primary federal regulatory authority overseeing securities transactions, enforcing disclosure requirements, and preventing fraud in national markets. Blue Sky Laws are state-specific securities regulations administered by respective state agencies to protect investors from fraud and ensure transparency within intrastate securities offerings. While the SEC governs interstate and national securities markets, state agencies under Blue Sky Laws regulate local securities transactions and licensing, often requiring registration alongside federal compliance.

Registration Requirements: National vs. State-Level

The Securities Exchange Act of 1934 establishes federal registration requirements for securities traded on national exchanges, mandating comprehensive disclosures and ongoing reporting for publicly traded companies to protect investors. Blue Sky Laws operate at the state level, requiring securities offerings to register with state regulators to prevent fraud and ensure transparency within individual states. While the 1934 Act centralizes regulation for national markets, Blue Sky Laws provide an additional layer of oversight tailored to state-specific investor protections and registration standards.

Compliance and Enforcement Mechanisms

The Securities Exchange Act of 1934 establishes comprehensive federal compliance and enforcement mechanisms including registration requirements for securities exchanges, ongoing disclosure obligations for public companies, and anti-fraud provisions enforced primarily by the Securities and Exchange Commission (SEC). Blue Sky Laws operate at the state level, requiring issuers to register securities offerings and sales in the state and empowering state securities regulators to enforce compliance, investigate fraud, and impose penalties or injunctive relief. Together, these laws create a dual-layer regulatory framework ensuring investor protection through both federal oversight and state-level enforcement actions.

Preemption and Interaction Between Federal and State Laws

The Securities Exchange Act of 1934 primarily governs securities trading at the federal level, often preempting state Blue Sky Laws to ensure uniform regulation of securities markets. While the 1934 Act preempts state laws in areas such as registration and reporting requirements, Blue Sky Laws still apply to aspects like fraud and offer additional investor protections. The interaction between these laws creates a layered regulatory framework where federal rules provide baseline standards and state laws supplement protections to address local concerns.

Implications for Investors and Market Participants

The Securities Exchange Act of 1934 established comprehensive federal regulation of trading securities, requiring periodic reporting and fostering transparency to protect investors from fraud and market manipulation. Blue Sky Laws, enacted at the state level, regulate securities offerings and sales within individual states to prevent fraudulent practices and provide additional investor safeguards. Together, these laws create a dual framework that enhances investor protection and enforces market integrity, ensuring confidence among market participants through rigorous disclosure and anti-fraud provisions.

Securities Exchange Act of 1934 Infographic

libterm.com

libterm.com