Isolating yourself can negatively impact your mental health and hinder personal growth by limiting social interaction and emotional support. Building meaningful connections enhances your well-being and provides a sense of belonging. Discover effective strategies to avoid isolation and improve your social life by reading the rest of the article.

Table of Comparison

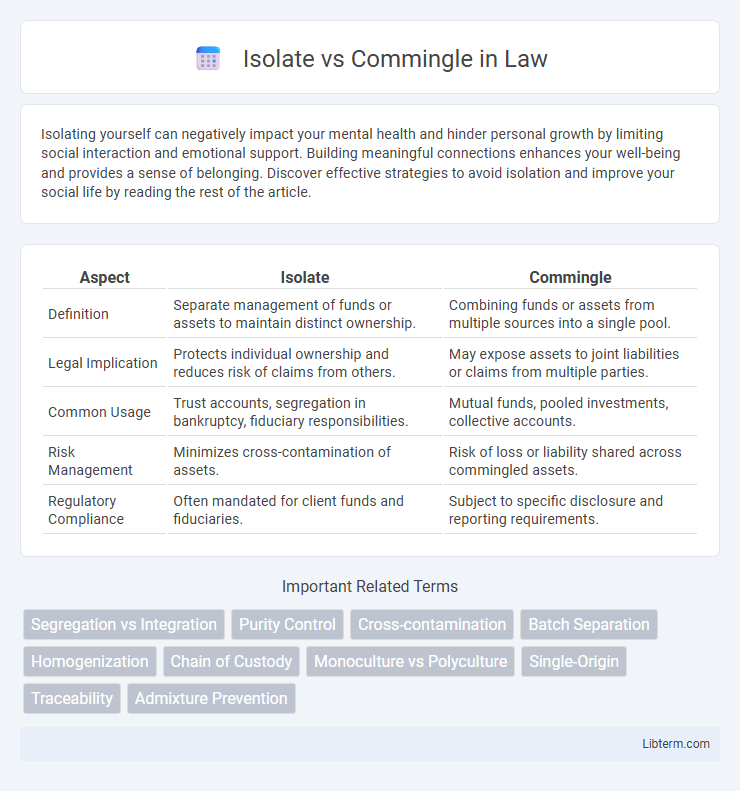

| Aspect | Isolate | Commingle |

|---|---|---|

| Definition | Separate management of funds or assets to maintain distinct ownership. | Combining funds or assets from multiple sources into a single pool. |

| Legal Implication | Protects individual ownership and reduces risk of claims from others. | May expose assets to joint liabilities or claims from multiple parties. |

| Common Usage | Trust accounts, segregation in bankruptcy, fiduciary responsibilities. | Mutual funds, pooled investments, collective accounts. |

| Risk Management | Minimizes cross-contamination of assets. | Risk of loss or liability shared across commingled assets. |

| Regulatory Compliance | Often mandated for client funds and fiduciaries. | Subject to specific disclosure and reporting requirements. |

Introduction to Isolate and Commingle

Isolate and commingle refer to methods of handling materials or data in logistics, recycling, and finance. Isolate involves keeping items or data separate to maintain purity, prevent contamination, or ensure traceability. Commingle allows combining different items or data, streamlining processes but potentially reducing specificity and increasing complexity in tracking.

Defining Isolate: Meaning and Use Cases

Isolate refers to the process of separating a specific material or component from a mixture to ensure purity and prevent contamination, commonly used in industries like pharmaceuticals and manufacturing. This method is essential when precise composition is required, such as isolating DNA samples in genetics or extracting active ingredients in drug production. Isolate supports controlled environments where cross-contamination can compromise product integrity or analytical accuracy.

Understanding Commingle: Concept and Applications

Commingle refers to the practice of combining different types of assets, funds, or resources into a single pool, facilitating efficient management and allocation. This approach is commonly applied in investment funds, where commingling allows for diversified portfolios by merging multiple investors' contributions. In supply chain logistics, commingling optimizes storage and distribution by blending inventory from various sources while maintaining tracking and accountability.

Key Differences Between Isolate and Commingle

Isolate investing involves separating assets from others to reduce risk and improve transparency, while commingling pools funds from multiple investors into a single account to achieve diversification and lower management costs. Isolate structures offer greater control and customization, whereas commingled funds provide economies of scale and simplified administration. Key differences include risk isolation, investor control, fee structures, and regulatory implications.

Pros and Cons of Isolating

Isolating assets separate client funds from the firm's own capital, significantly reducing the risk of loss due to the firm's insolvency and enhancing investor protection. This method ensures transparent accounting and simplifies regulatory compliance but can be costlier due to increased administrative overhead. However, isolation might limit operational flexibility and delay transaction processing compared to commingling funds.

Pros and Cons of Commingling

Commingling assets can simplify management by consolidating funds into a single account, enhancing liquidity and operational flexibility. However, it introduces risks such as reduced transparency, potential legal complications, and difficulty in tracking individual asset performance. While commingling may lower administrative costs, it can hinder precise financial reporting and increase the complexity of regulatory compliance.

Factors Influencing the Choice: Isolate vs Commingle

Factors influencing the choice between isolate and commingle systems include contamination risk, operational efficiency, and product quality requirements. Isolate systems minimize cross-contamination by separating waste streams, making them suitable for hazardous or high-purity materials, while commingle systems combine waste for streamlined collection but require extensive sorting later. Cost considerations, available technology, and regulatory compliance also play crucial roles in determining the optimal waste management approach.

Industry Examples: Isolate vs Commingle in Practice

Isolate and commingle approaches are prominently utilized in waste management and financial asset handling industries. In waste management, isolating recyclables like plastics or metals ensures purity for high-quality recycling, whereas commingling mixed materials reduces collection costs but lowers recycling precision. Financial institutions often isolate client assets in separate accounts to protect against commingled risk, while some funds commingle assets to optimize liquidity and management efficiency.

Best Practices for Managing Isolation and Commingling

Best practices for managing isolation and commingling emphasize strict segregation of client funds in dedicated accounts to prevent mixing with operational assets, ensuring compliance with regulatory requirements such as SEC Rule 15c3-3 or FCA Client Money rules. Implementing robust reconciliation procedures and real-time monitoring systems helps detect and resolve discrepancies quickly, reducing risks of unauthorized use or misallocation of funds. Clear documentation and transparent reporting enhance accountability and build client trust, while periodic audits reinforce the integrity of isolation or commingling processes.

Conclusion: Deciding Between Isolate and Commingle

Choosing between isolate and commingle methods depends on factors such as data security requirements, cost efficiency, and operational complexity. Isolate offers superior data protection by segregating resources, ideal for sensitive information or regulatory compliance, while commingle is more cost-effective and scalable for less critical data. Businesses should assess their specific needs, compliance mandates, and budget constraints to determine the optimal approach.

Isolate Infographic

libterm.com

libterm.com