Fee tail is a legal mechanism designed to keep property within a family lineage by restricting its sale or inheritance to direct descendants, preserving estates over generations. This form of ownership prevents heirs from freely transferring or selling the property, ensuring it remains tied to a specific bloodline. Explore the rest of the article to understand how fee tail impacts your property rights and inheritance planning.

Table of Comparison

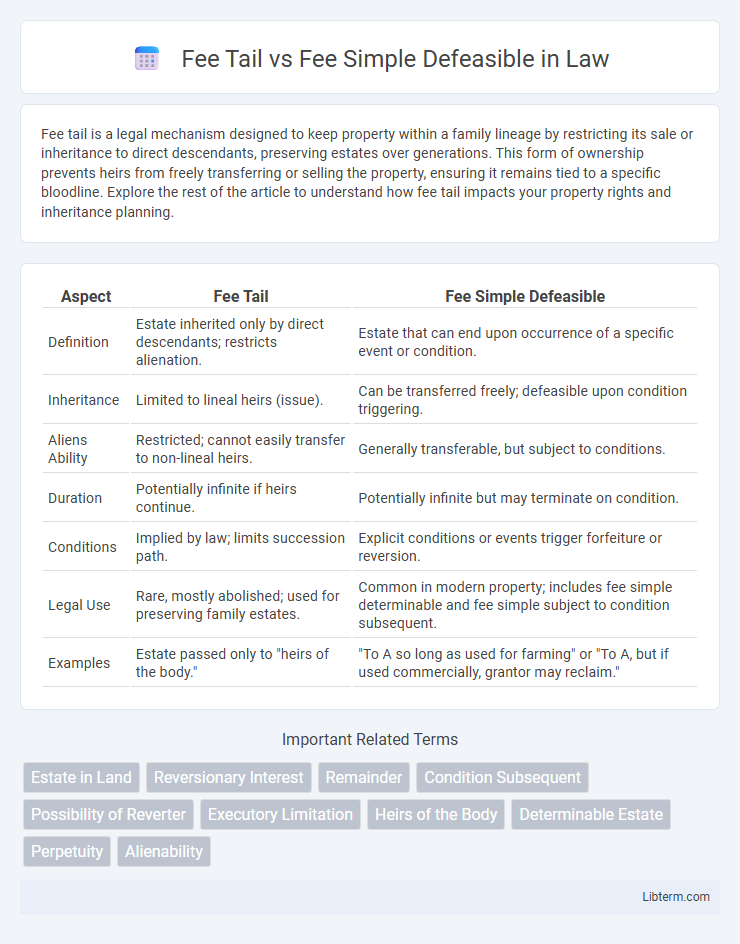

| Aspect | Fee Tail | Fee Simple Defeasible |

|---|---|---|

| Definition | Estate inherited only by direct descendants; restricts alienation. | Estate that can end upon occurrence of a specific event or condition. |

| Inheritance | Limited to lineal heirs (issue). | Can be transferred freely; defeasible upon condition triggering. |

| Aliens Ability | Restricted; cannot easily transfer to non-lineal heirs. | Generally transferable, but subject to conditions. |

| Duration | Potentially infinite if heirs continue. | Potentially infinite but may terminate on condition. |

| Conditions | Implied by law; limits succession path. | Explicit conditions or events trigger forfeiture or reversion. |

| Legal Use | Rare, mostly abolished; used for preserving family estates. | Common in modern property; includes fee simple determinable and fee simple subject to condition subsequent. |

| Examples | Estate passed only to "heirs of the body." | "To A so long as used for farming" or "To A, but if used commercially, grantor may reclaim." |

Introduction to Property Ownership: Fee Tail vs Fee Simple Defeasible

Fee tail is a type of property ownership that restricts inheritance to direct descendants, ensuring the estate remains within a family line, while fee simple defeasible grants ownership conditionally, allowing the estate to revert to the original grantor if specific conditions are violated or occur. Both forms create limitations on absolute ownership, but fee tail focuses on lineage continuity, whereas fee simple defeasible emphasizes conditional use and ownership restrictions. Understanding these distinctions is crucial for estate planning and managing future property interests under property law.

Historical Background and Legal Evolution

Fee tail originated in English common law during the Middle Ages to keep estates within a family lineage by restricting inheritance to direct descendants, preventing land sales outside the bloodline. Fee simple defeasible evolved later as a more flexible property interest, allowing ownership to continue until a specified condition occurs, reflecting changes in societal and economic needs for land use and transferability. Legal reforms over centuries, especially in the 19th and 20th centuries, gradually curtailed fee tail's rigidity, favoring fee simple defeasible's conditional ownership that balances individual rights and contractual obligations.

Defining Fee Tail: Characteristics and Limitations

Fee tail is a hereditary estate in land that restricts inheritance to a specific lineage, typically confined to direct descendants, preventing the property from being sold or transferred outside the family. Its characteristics include automatic succession according to predetermined family lines and the limitation on alienation, which often results in a perpetuation of estate ownership within one bloodline. Fee tail estates face legal limitations today in many jurisdictions, as they hinder free market transaction of property and can lead to legal complexities in estate planning.

Exploring Fee Simple Defeasible: Types and Features

Fee Simple Defeasible is a type of property ownership that grants full possessory rights subject to conditions that can cause the estate to terminate. The two main types, Fee Simple Determinable and Fee Simple Subject to Condition Subsequent, differ in how ownership ends: the former automatically reverts to the grantor upon breach, while the latter requires the grantor to take action to reclaim the property. Key features include conditional ownership, potential for automatic or conditional forfeiture, and the ability for future interests like possibility of reverter or right of entry to be created.

Key Differences Between Fee Tail and Fee Simple Defeasible

Fee Tail restricts inheritance to the direct descendants of the original grantee, preventing the property from being sold or inherited outside the family line. Fee Simple Defeasible grants full ownership but includes conditions that, if violated, can result in the property reverting to the grantor or a third party. The primary difference lies in Fee Tail's focus on lineage-based inheritance, whereas Fee Simple Defeasible centers on conditional ownership subject to potential termination.

Legal Implications and Restrictions

Fee Tail estate restricts property inheritance to direct descendants, limiting the owner's ability to sell or bequeath the land freely, thus maintaining family lineage control but reducing marketability. Fee Simple Defeasible grants ownership subject to conditions that, if violated, result in automatic reversion or forfeiture, introducing potential uncertainty and legal disputes over property rights. Both estates impose legal constraints that affect transferability, with Fee Tail emphasizing lineage preservation and Fee Simple Defeasible focusing on conditional ownership and enforceability.

Transferability and Inheritance Issues

Fee Tail restricts transferability by limiting ownership to direct descendants, preventing alienation outside the bloodline and ensuring property remains within the family lineage through inheritance. Fee Simple Defeasible allows transferability but subjects ownership to conditions that, if violated, cause automatic forfeiture, complicating inheritance due to potential reversion or termination of estate interests. Issues arise in Fee Tail with statutory abolishment or conversion to Fee Simple, while Fee Simple Defeasible presents challenges in clarity of title and certainty during estate planning and probate.

Modern Relevance and Jurisdictional Variations

Fee tail estates, historically designed to keep property within a family line, have largely been abolished or transformed into fee simple estates in modern jurisdictions due to their restrictive nature and complications in property transfers. Fee simple defeasible interests, which grant ownership subject to conditions that can void the estate, remain relevant in contemporary law for creating conditional property rights, but their enforcement and application vary significantly across jurisdictions based on statutory reforms and case law interpretations. Understanding these variations is crucial for property owners and legal practitioners navigating estate planning and real property transactions in different states or countries.

Advantages and Disadvantages of Each Estate

Fee tail restricts property inheritance to direct descendants, ensuring family land retention but limiting the owner's ability to sell or bequeath freely. Fee simple defeasible grants ownership with conditions that, if violated, can revert the property to the original grantor, offering flexibility but introducing risk of forfeiture. Fee tail's advantage lies in preserving lineage control, while fee simple defeasible allows conditional transfer, though both estates have inherent limitations in property alienation and permanence.

Conclusion: Choosing the Right Estate for Property Ownership

Selecting between Fee Tail and Fee Simple Defeasible estates hinges on control versus flexibility in property ownership. Fee Tail restricts inheritance to direct descendants, preserving family lineage but limiting transferability and marketability. Fee Simple Defeasible grants ownership subject to conditions, offering more flexibility but requiring careful attention to terms to avoid unintentional loss of property rights.

Fee Tail Infographic

libterm.com

libterm.com