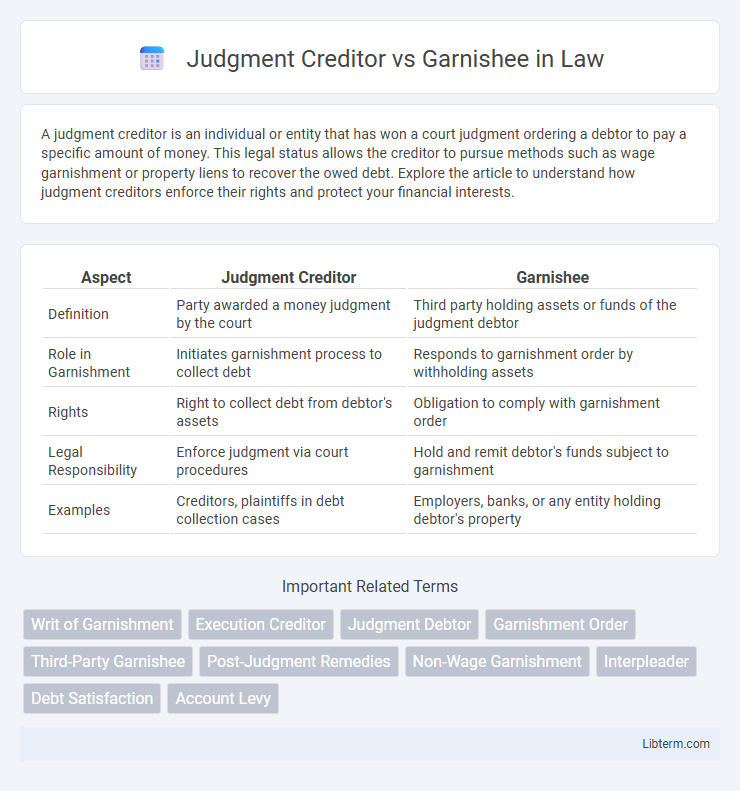

A judgment creditor is an individual or entity that has won a court judgment ordering a debtor to pay a specific amount of money. This legal status allows the creditor to pursue methods such as wage garnishment or property liens to recover the owed debt. Explore the article to understand how judgment creditors enforce their rights and protect your financial interests.

Table of Comparison

| Aspect | Judgment Creditor | Garnishee |

|---|---|---|

| Definition | Party awarded a money judgment by the court | Third party holding assets or funds of the judgment debtor |

| Role in Garnishment | Initiates garnishment process to collect debt | Responds to garnishment order by withholding assets |

| Rights | Right to collect debt from debtor's assets | Obligation to comply with garnishment order |

| Legal Responsibility | Enforce judgment via court procedures | Hold and remit debtor's funds subject to garnishment |

| Examples | Creditors, plaintiffs in debt collection cases | Employers, banks, or any entity holding debtor's property |

Understanding Judgment Creditor

A judgment creditor is an individual or entity that has obtained a court order confirming that a debtor owes them a specific amount of money. This legal recognition entitles the creditor to take enforcement actions such as garnishment to collect the debt from the debtor's assets or third parties holding the debtor's funds. Understanding the judgment creditor's rights and legal procedures is essential for effective debt recovery and ensuring compliance with court judgments.

Defining the Garnishee

A garnishee is a third party legally ordered by a court to withhold assets or wages of a debtor to satisfy a judgment awarded to the judgment creditor. The garnishee holds funds or property belonging to the debtor but does not owe a personal debt to the judgment creditor. This role is pivotal in garnishment proceedings, enabling the judgment creditor to collect debts without direct seizure from the debtor.

Legal Relationship: Creditor vs Garnishee

The legal relationship between a judgment creditor and garnishee involves the creditor seeking to satisfy a court judgment by obtaining funds directly from the garnishee, who holds money or property owed to the judgment debtor. The judgment creditor holds a right to collect the debt through garnishment, while the garnishee acts as a neutral third party obligated to withhold the specified amount from the debtor's assets. This dynamic establishes a tri-party legal connection, where the creditor enforces payment, the garnishee complies with court orders, and the debtor's rights are protected within garnishment limits.

Roles and Responsibilities Explained

A judgment creditor is the party awarded a monetary judgment by the court, responsible for initiating the garnishment process to collect the debt owed by the judgment debtor. The garnishee, typically a third party such as an employer or bank, holds assets or wages of the debtor and is legally obligated to withhold and remit those funds to the judgment creditor. Both parties play crucial roles in ensuring the enforcement of court judgments, with the judgment creditor pursuing collection and the garnishee facilitating payment compliance.

How Garnishment Works

A judgment creditor obtains a court order to collect a debt by initiating garnishment, which directs a third party, known as the garnishee, to withhold funds from the debtor's wages or bank accounts. The garnishee is legally obligated to comply with the court order by freezing or diverting the specified amount until the debt is satisfied or the court lifts the garnishment. This process streamlines debt recovery by bypassing the debtor, ensuring the judgment creditor can collect owed amounts directly through the garnishee.

Process of Enforcing a Judgment

The process of enforcing a judgment begins when the judgment creditor initiates post-judgment remedies to collect the debt owed by the judgment debtor. A garnishee, often a third party such as an employer or bank, is ordered by the court to withhold non-exempt funds or assets from the debtor and remit them directly to the judgment creditor. This garnishment procedure ensures the creditor can satisfy the debt through legally mandated enforcement mechanisms without requiring direct action against the debtor's property.

Rights of the Judgment Creditor

The judgment creditor holds the legal right to enforce a court-ordered debt by initiating garnishment, allowing them to collect funds directly from a third party holding assets of the judgment debtor. This enforcement power includes obtaining a garnishment order to seize wages, bank accounts, or other receivables owed to the debtor. The judgment creditor's rights ensure priority in debt recovery over other creditors by legally compelling the garnishee to satisfy the debt from the debtor's assets in the garnishee's possession.

Obligations of the Garnishee

The garnishee is legally obligated to withhold and remit any funds or property owed to the judgment debtor upon receiving a garnishment order. This includes freezing bank accounts or withholding wages to satisfy the judgment creditor's claim. Failure to comply with these obligations can result in the garnishee facing contempt of court or liability for the amount owed to the judgment creditor.

Common Challenges in Garnishment

Judgment creditor faces common challenges in garnishment such as locating garnishees, ensuring compliance with court orders, and navigating exemptions that protect a debtor's essential income. Garnishees often struggle with the administrative burden of withholding wages or funds while avoiding legal penalties for errors or delays. Disputes frequently arise over the accurate calculation of garnishable amounts and timely remittance to the creditor.

Key Differences Between Creditor and Garnishee

A judgment creditor is an individual or entity awarded a legal right to collect a debt following a court judgment, while a garnishee is a third party, often an employer or bank, ordered to withhold or pay the debtor's funds to the creditor. The key difference lies in their roles: the creditor holds the debt claim and initiates collection, whereas the garnishee acts as a custodian or intermediary who enforces the garnishment order. Understanding this distinction is essential for correctly applying legal procedures in debt recovery and garnishment cases.

Judgment Creditor Infographic

libterm.com

libterm.com