A surety is a legally binding guarantee that ensures one party will fulfill their obligations to another, typically seen in bonds or loans. This commitment protects creditors by transferring risk to the surety company if the primary party defaults. To understand how surety can safeguard your financial and contractual interests, continue reading the rest of the article.

Table of Comparison

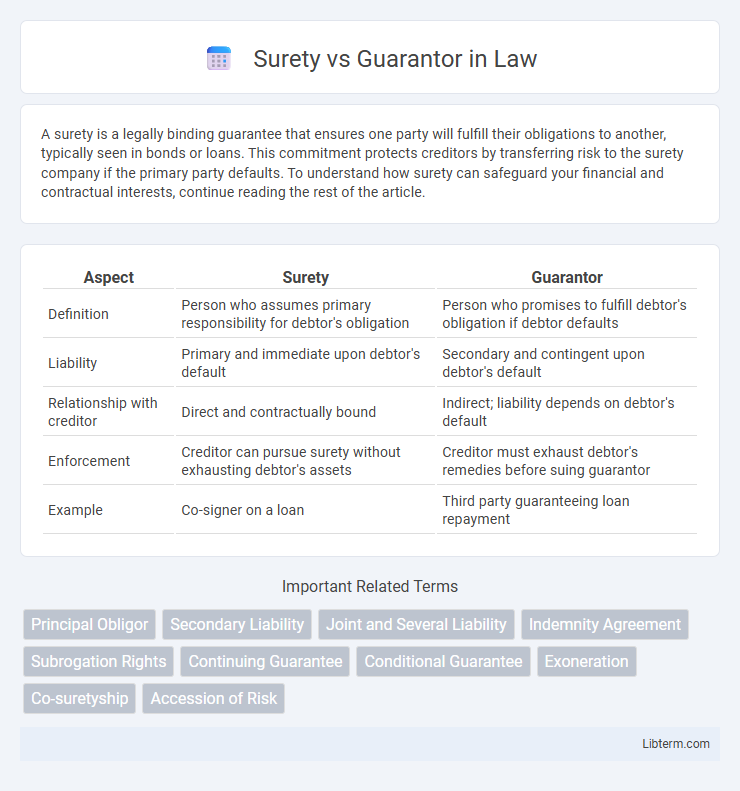

| Aspect | Surety | Guarantor |

|---|---|---|

| Definition | Person who assumes primary responsibility for debtor's obligation | Person who promises to fulfill debtor's obligation if debtor defaults |

| Liability | Primary and immediate upon debtor's default | Secondary and contingent upon debtor's default |

| Relationship with creditor | Direct and contractually bound | Indirect; liability depends on debtor's default |

| Enforcement | Creditor can pursue surety without exhausting debtor's assets | Creditor must exhaust debtor's remedies before suing guarantor |

| Example | Co-signer on a loan | Third party guaranteeing loan repayment |

Definition of Surety

A surety is a party who takes responsibility for the debt or obligation of another, ensuring payment or performance if the original obligor fails. Unlike a guarantor, whose liability is secondary and contingent upon the principal's default, a surety's liability is primary and immediate upon default. This distinction is crucial in contracts, bonds, and financial agreements where risk management and credit assurance are involved.

Definition of Guarantor

A guarantor is an individual or entity that agrees to fulfill the obligations of a borrower if the primary debtor defaults on a loan or contract, providing an additional layer of financial security for the lender or obligee. Unlike a surety, whose liability is primary and direct, the guarantor's commitment is secondary, activated only after the primary party fails to meet their obligations. This role is critical in loan agreements and credit transactions, ensuring creditors have recourse through the guarantor if the original debtor does not pay.

Legal Distinctions between Surety and Guarantor

Surety assumes direct liability for the debt or obligation, making the surety primarily responsible alongside the principal debtor, whereas a guarantor's liability is secondary and arises only if the principal defaults. Legally, suretyship creates a joint contract binding the surety immediately, while guarantorship involves a contract of guarantee, contingent upon default. Courts often interpret surety agreements strictly due to the surety's direct liability, contrasting with the guarantor's more limited, conditional responsibility under contract law.

Types of Surety Agreements

Surety agreements include contract surety bonds, which guarantee the performance of contractual obligations, and court surety bonds, ensuring compliance with judicial requirements. Commercial surety bonds cover license and permit bonds, fidelity bonds, and financial guarantees, each protecting different business interests. Performance bonds and payment bonds are common types that secure project completion and subcontractor payments, representing critical risk management tools in surety agreements.

Types of Guarantee Agreements

Types of guarantee agreements primarily include suretyship and guaranty, where suretyship involves a surety who directly promises to fulfill the obligation if the principal defaults, creating a primary liability. In contrast, a guarantor's promise is secondary and contingent upon the creditor's unsuccessful attempts to collect from the principal debtor. Contractual variations such as performance guarantees, payment guarantees, and bid bonds further illustrate diverse applications within surety and guarantor agreements tailored to specific risk mitigation needs.

Key Responsibilities of a Surety

A surety is legally obligated to fulfill the debt or obligation if the primary party defaults, ensuring the creditor receives payment or performance as agreed. Key responsibilities of a surety include thoroughly evaluating the creditworthiness of the principal, providing a binding guarantee to the obligee, and maintaining financial capacity to cover the obligation if called upon. Unlike a guarantor, the surety holds direct liability alongside the principal, creating a more immediate and enforceable commitment.

Key Obligations of a Guarantor

A guarantor assumes a secondary responsibility to fulfill the debtor's obligation if the primary party defaults, ensuring the creditor's financial risk is mitigated. Key obligations of a guarantor include guaranteeing payment, providing consent to the terms of the original contract, and remaining liable until the principal debt is fully discharged. Unlike a surety, who may have immediate liability, a guarantor's obligation typically activates only after the debtor's failure to perform.

Rights of the Surety versus Guarantor

The surety holds the right to be indemnified by the principal debtor and can demand payment from them directly upon default, whereas the guarantor's liability arises only after the principal debtor's default and the creditor must exhaust remedies against the principal before pursuing the guarantor. Sureties possess a right of subrogation, allowing them to step into the creditor's shoes after satisfying the debt to recover the amount from the principal debtor, while guarantors generally have no such immediate claim. The surety may also exercise the right to require the creditor to proceed against the principal debtor before enforcing the guarantee, contrasting with a guarantor whose obligation is secondary and contingent.

When to Choose Surety or Guarantor

Choose a surety when direct and immediate responsibility for debt or performance is required, as sureties are equally liable with the principal debtor from the outset. Opt for a guarantor when a backup assurance is needed, where the guarantor's liability activates only upon the primary debtor's default. Surety agreements suit construction projects or business loans needing prompt claim enforcement, while guarantor arrangements are ideal for personal loans or leases with secondary liability.

Common Misconceptions about Surety and Guarantor

Common misconceptions about surety and guarantor roles often confuse their legal responsibilities and liabilities. A surety is directly liable to the creditor from the moment the contract is made, whereas a guarantor's liability arises only when the principal debtor defaults. Many mistakenly believe both roles are identical, ignoring that a surety's obligation is primary and immediate, contrasting with the secondary nature of a guarantor's commitment.

Surety Infographic

libterm.com

libterm.com