Crafting a marketable title hinges on using compelling keywords that resonate with your target audience while clearly conveying the content's value. Focus on clarity, relevance, and emotional appeal to increase clicks and engagement. Explore the rest of the article to master techniques that make your titles stand out and drive more traffic.

Table of Comparison

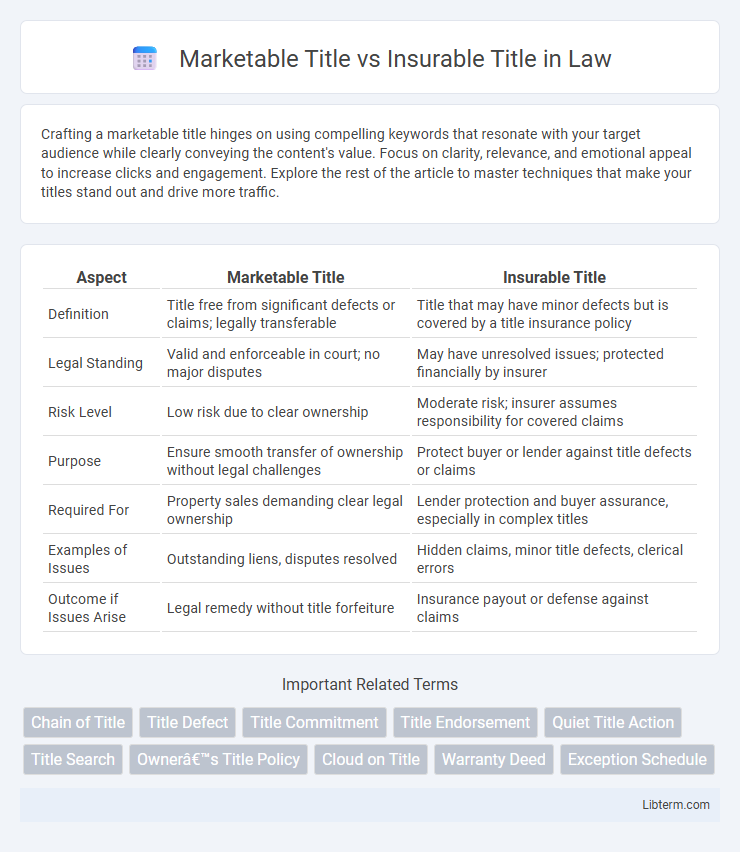

| Aspect | Marketable Title | Insurable Title |

|---|---|---|

| Definition | Title free from significant defects or claims; legally transferable | Title that may have minor defects but is covered by a title insurance policy |

| Legal Standing | Valid and enforceable in court; no major disputes | May have unresolved issues; protected financially by insurer |

| Risk Level | Low risk due to clear ownership | Moderate risk; insurer assumes responsibility for covered claims |

| Purpose | Ensure smooth transfer of ownership without legal challenges | Protect buyer or lender against title defects or claims |

| Required For | Property sales demanding clear legal ownership | Lender protection and buyer assurance, especially in complex titles |

| Examples of Issues | Outstanding liens, disputes resolved | Hidden claims, minor title defects, clerical errors |

| Outcome if Issues Arise | Legal remedy without title forfeiture | Insurance payout or defense against claims |

Understanding Marketable Title: Definition and Key Features

Marketable title refers to a property title that is free from significant defects or legal disputes, ensuring the owner can sell or mortgage the property without issues. It guarantees clear ownership by confirming there are no liens, encumbrances, or claims that could impair the transfer of title. Key features include verified chain of ownership, absence of unresolved legal problems, and assurance that the title can withstand reasonable legal scrutiny.

What Is an Insurable Title? An Overview

An insurable title guarantees protection against financial loss from defects or disputes in property ownership, backed by a title insurance policy. Unlike a marketable title, which must be free of significant legal questions and accepted by a reasonable buyer, an insurable title acknowledges potential issues but provides coverage for unknown or hidden risks. Title insurance companies assess and insure these risks, offering peace of mind to buyers and lenders during real estate transactions.

Legal Requirements for Marketable and Insurable Titles

Marketable title requires clear ownership with no significant defects or undisclosed liens that could affect the property's transferability, meeting strict legal standards for ownership clarity and chain of title. Insurable title must be acceptable to a title insurance company, addressing potential risks or defects that might not prevent sale but require assurance through insurance coverage. Legal requirements for marketable titles emphasize defect-free, verifiable ownership, while insurable titles focus on managing risks via title insurance policies despite minor or latent title issues.

Differences Between Marketable and Insurable Title

Marketable title guarantees clear ownership free of significant legal defects, ensuring the property can be sold or financed without dispute. Insurable title may contain minor defects or risks but can be protected by title insurance, reducing potential financial loss for the buyer or lender. The primary difference lies in marketable title's absolute clarity and insurable title's reliance on insurance to cover possible title issues.

Common Defects Affecting Marketable Title

Common defects affecting marketable title include unresolved liens, encumbrances such as easements, and errors in public records like incorrect property descriptions. Marketable title requires clear ownership without significant risks of litigation, while insurable title is guaranteed by a title insurance policy protecting against hidden defects. Issues like unpaid taxes, boundary disputes, or undisclosed heirs can cloud marketable title, potentially impacting real estate transactions and requiring resolution for marketability.

How Title Insurance Protects Insurable Titles

Title insurance protects insurable titles by covering financial losses arising from hidden defects or claims not discovered during the initial title search, such as fraud, forgery, or undisclosed heirs. Unlike marketable titles that may simply indicate a property's clear ownership status, insurable titles acknowledge some risks that can be mitigated through insurance policies. This protection ensures that property owners and lenders are safeguarded against potential legal disputes and financial liabilities related to title defects.

Buyer and Seller Considerations: Which Title Should You Pursue?

Buyers prioritize a marketable title to ensure ownership is free from substantial legal disputes, offering peace of mind and ease in future property transfers. Sellers prefer a marketable title as it enhances property value and expedites closing by reducing title objections. While insurable title protects buyers and lenders against unforeseen title defects through insurance, pursuing a marketable title generally provides stronger assurance of clear ownership for both parties during real estate transactions.

Risks Involved With Non-Marketable or Uninsurable Titles

Non-marketable or uninsurable titles pose significant risks, including potential ownership disputes, undisclosed liens, and fraudulent claims that can result in loss of property rights or financial loss. These titles may hinder property transactions due to unclear legal standing, making it difficult to secure financing or resell the property. Title insurance protects against such risks by guaranteeing clear ownership, while marketable titles provide a legally defensible claim free from defects and encumbrances.

Resolving Title Issues Before Closing

Resolving title issues before closing is crucial for ensuring a marketable title, which guarantees clear ownership free of significant legal claims or defects affecting transferability. An insurable title, while providing protection through title insurance against unknown future claims, may still allow minor defects that require resolution prior to closing to avoid claims disputes. Addressing liens, encumbrances, and clerical errors in advance ensures a seamless transfer and protects both buyers and lenders from post-closing title challenges.

Expert Tips for Securing Clear Title in Real Estate Transactions

Marketable title ensures ownership free from significant legal disputes, while insurable title guarantees coverage against defects through title insurance. Expert tips for securing clear title include conducting thorough title searches, resolving liens and encumbrances, and obtaining a comprehensive title insurance policy. Working with experienced title companies and real estate attorneys minimizes risks and safeguards property investments.

Marketable Title Infographic

libterm.com

libterm.com