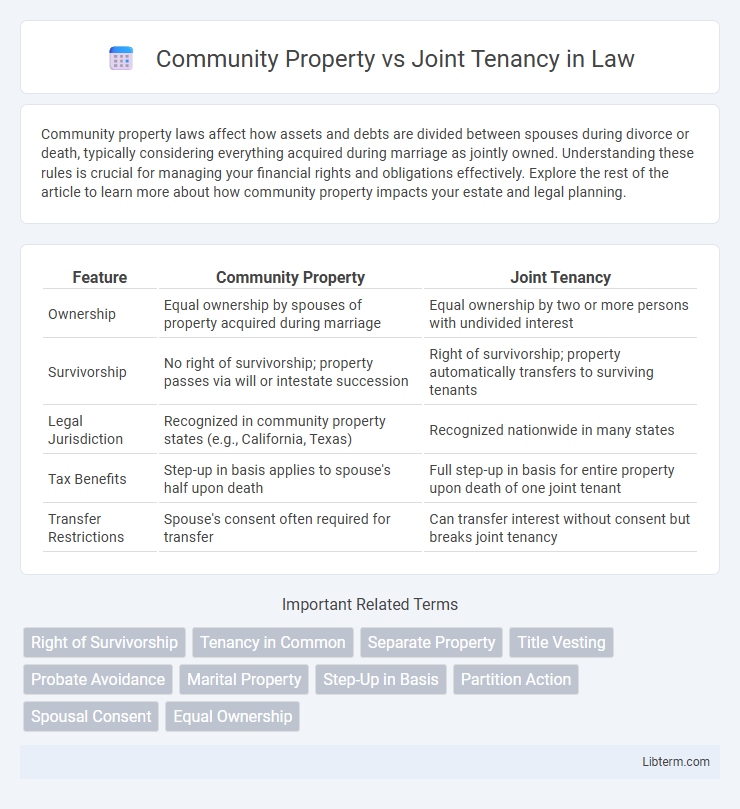

Community property laws affect how assets and debts are divided between spouses during divorce or death, typically considering everything acquired during marriage as jointly owned. Understanding these rules is crucial for managing your financial rights and obligations effectively. Explore the rest of the article to learn more about how community property impacts your estate and legal planning.

Table of Comparison

| Feature | Community Property | Joint Tenancy |

|---|---|---|

| Ownership | Equal ownership by spouses of property acquired during marriage | Equal ownership by two or more persons with undivided interest |

| Survivorship | No right of survivorship; property passes via will or intestate succession | Right of survivorship; property automatically transfers to surviving tenants |

| Legal Jurisdiction | Recognized in community property states (e.g., California, Texas) | Recognized nationwide in many states |

| Tax Benefits | Step-up in basis applies to spouse's half upon death | Full step-up in basis for entire property upon death of one joint tenant |

| Transfer Restrictions | Spouse's consent often required for transfer | Can transfer interest without consent but breaks joint tenancy |

Understanding Community Property

Community property is a legal framework primarily recognized in nine U.S. states, where assets acquired during marriage are considered equally owned by both spouses, regardless of whose name is on the title. Each spouse holds an undivided one-half interest in all community property, which includes income, real estate, and personal property obtained during the marriage. This ownership structure impacts taxation, estate planning, and creditor claims differently compared to joint tenancy, making it essential for couples to understand its implications on financial and legal responsibilities.

Key Features of Joint Tenancy

Joint Tenancy features equal ownership shares with the right of survivorship, meaning when one tenant dies, their interest automatically passes to the surviving joint tenants. This form of co-ownership requires the four unities: time, title, interest, and possession, ensuring all owners acquire their interest simultaneously and hold identical rights. Unlike community property, joint tenancy does not necessarily involve spouses and can be established among any number of co-owners.

Legal Differences Between Community Property and Joint Tenancy

Community property involves equal ownership of assets acquired during marriage, with each spouse holding a 50% interest that passes to the surviving spouse without probate. Joint tenancy features equal ownership with right of survivorship, allowing the surviving co-owner to automatically inherit the deceased owner's share, bypassing probate as well. Unlike community property, joint tenancy can be created between non-spouses and may involve unequal contributions, but both require specific legal formalities to establish ownership rights.

Ownership Rights: Community Property vs Joint Tenancy

Community property grants spouses equal ownership rights to assets acquired during marriage, with both partners holding a 50% interest. Joint tenancy provides equal ownership rights with the added benefit of survivorship, allowing the surviving joint tenant to inherit the deceased tenant's share automatically. Unlike community property, joint tenancy assets can be owned by unrelated parties and do not require marital status for ownership.

Spousal Rights and Inheritance

Community property laws grant spouses equal ownership of assets acquired during marriage, ensuring automatic 50% interest for each partner, which can simplify inheritance without probate. Joint tenancy includes the right of survivorship, allowing the surviving spouse to inherit the entire property interest immediately upon the other's death, bypassing probate but requiring both parties to acquire the property simultaneously. Understanding the nuances between community property and joint tenancy is crucial for estate planning, as community property states often require additional steps for spousal inheritance, while joint tenancy directly transfers ownership to the surviving spouse.

Tax Implications of Each Ownership Type

Community property offers a stepped-up basis on the entire property value upon the death of one spouse, potentially minimizing capital gains taxes for the surviving spouse, while joint tenancy provides a stepped-up basis only on the deceased's share. Property held as community property may allow for more favorable estate tax advantages in states recognizing this form of ownership, whereas joint tenancy avoids probate by passing property directly to the surviving tenant. Understanding the nuances of capital gains taxes, estate taxes, and probate implications is essential when choosing between community property and joint tenancy ownership types for tax planning.

Property Management and Control

Community property allows equal ownership and control between spouses, with both having management rights over the property, making decisions jointly essential for property management. Joint tenancy grants equal ownership with the right of survivorship, but management control can be exercised individually unless otherwise agreed upon by co-owners. Property management under community property requires spousal consent for transactions, while joint tenancy allows each tenant to manage their interest independently, impacting control and decision-making in property use or sale.

Impact on Divorce or Separation

In community property states, assets acquired during marriage are equally divided upon divorce or separation, providing a clear and predictable split of property. Joint tenancy allows ownership rights to pass automatically to the surviving spouse, but during divorce, the joint tenancy is typically severed, requiring equitable property division based on state laws. Understanding how each ownership type affects asset division and survivor benefits is crucial for spouses planning their estate or navigating separation.

Choosing the Right Ownership Structure

Choosing the right ownership structure between community property and joint tenancy depends on factors such as state laws, tax implications, and the goals for asset control and transferability. Community property provides equal ownership with automatic survivorship rights limited to certain states, while joint tenancy offers equal shares with rights of survivorship nationwide, allowing seamless transfer to surviving owners. Understanding differences in tax benefits, creditor protection, and probate avoidance is crucial for optimizing estate planning and financial goals.

Frequently Asked Questions on Property Ownership

Community property and joint tenancy are distinct forms of property ownership commonly used by married couples, with community property recognizing shared ownership of assets acquired during marriage, while joint tenancy includes the right of survivorship, allowing property to pass directly to the surviving owner(s) without probate. Frequently asked questions about these ownership types involve how property is divided upon death or divorce, tax implications, and rights to sell or transfer interest without consent from the other owner. Understanding the legal definitions, state-specific variations, and consequences for estate planning ensures informed decisions between community property and joint tenancy ownership structures.

Community Property Infographic

libterm.com

libterm.com