Fraudulent purpose involves intentionally deceiving others to gain unfair or unlawful advantage, often resulting in financial loss or damage to reputation. Understanding the legal implications and identifying signs of fraudulent intent can protect your interests and prevent significant harm. Explore the rest of the article to learn how to recognize and address fraudulent activities effectively.

Table of Comparison

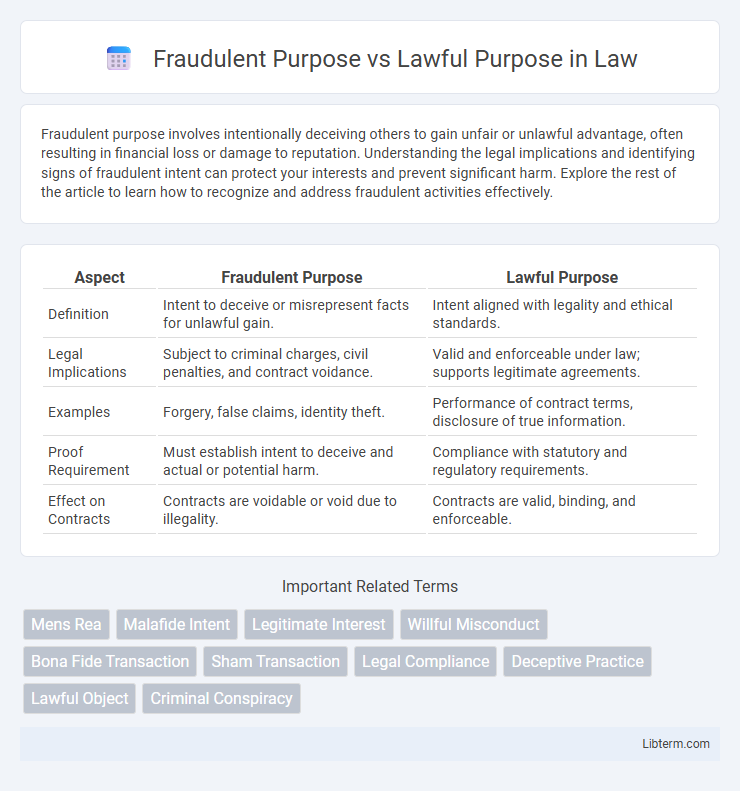

| Aspect | Fraudulent Purpose | Lawful Purpose |

|---|---|---|

| Definition | Intent to deceive or misrepresent facts for unlawful gain. | Intent aligned with legality and ethical standards. |

| Legal Implications | Subject to criminal charges, civil penalties, and contract voidance. | Valid and enforceable under law; supports legitimate agreements. |

| Examples | Forgery, false claims, identity theft. | Performance of contract terms, disclosure of true information. |

| Proof Requirement | Must establish intent to deceive and actual or potential harm. | Compliance with statutory and regulatory requirements. |

| Effect on Contracts | Contracts are voidable or void due to illegality. | Contracts are valid, binding, and enforceable. |

Understanding Fraudulent vs Lawful Purpose

Understanding fraudulent purpose involves recognizing actions intended to deceive or manipulate for unlawful gain, often violating legal standards and ethical norms. A lawful purpose aligns with legal requirements and ethical principles, ensuring transparency, honesty, and compliance in transactions or decisions. Distinguishing between fraudulent and lawful purposes is crucial for legal accountability and maintaining trust in business and personal dealings.

Defining Fraudulent Purpose in Legal Context

Fraudulent purpose in a legal context refers to an intention to deceive or mislead another party to gain an unlawful advantage or cause harm. It involves deliberate misrepresentation, concealment of material facts, or manipulation to induce reliance that results in damage or loss. Courts often assess intent, evidence of deception, and resulting harm to determine the presence of a fraudulent purpose.

Characteristics of Lawful Purpose

A lawful purpose involves actions or transactions conducted within the boundaries of legal statutes, ensuring compliance with regulatory frameworks and ethical standards. Key characteristics of lawful purpose include transparency, legitimate intent, and adherence to contractual obligations without intent to deceive or defraud. Such purposes promote trust, facilitate fair business practices, and uphold the integrity of legal and financial systems.

Key Differences Between Fraudulent and Lawful Purpose

Fraudulent purpose involves intentional deception to secure unfair or unlawful gain, often violating legal and ethical standards, whereas lawful purpose adheres to legal regulations and ethical principles without intent to deceive. The key differences lie in the intent behind actions, where fraudulent activities aim to manipulate or mislead, contrasting with lawful purposes that ensure transparency and integrity in transactions. Legal consequences arise from fraudulent purposes, including fines and imprisonment, while lawful purposes maintain compliance and uphold trust in business and personal dealings.

Legal Consequences of Fraudulent Purpose

Fraudulent purpose involves intentionally deceiving another party to secure unfair or unlawful gain, leading to severe legal consequences such as civil liability, criminal charges, and potential imprisonment. Courts impose sanctions including voiding contracts or awarding damages to victims when a party acts with fraudulent intent. Legal systems prioritize deterrence and compensation, emphasizing the importance of proving intent to defraud for successful prosecution or civil claims.

Importance of Lawful Purpose in Contracts

Contracts grounded in a lawful purpose ensure enforceability and uphold the integrity of legal agreements, protecting parties from potential disputes and penalties. Fraudulent purposes in contracts not only render agreements void but also expose involved parties to legal sanctions and reputational harm. Emphasizing a lawful purpose in contractual terms safeguards business relationships and promotes trust in commercial transactions.

Case Studies: Fraudulent Purpose in Action

Case studies of fraudulent purpose in action reveal how individuals or entities manipulate contracts, financial statements, or transactions to deceive stakeholders and gain unlawful benefits. In landmark cases like United States v. Carpenter and SEC v. Texas Gulf Sulphur Co., courts identified clear misuse of information and deliberate misrepresentations intended to defraud investors or regulatory bodies. These examples highlight the critical distinction between actions driven by lawful purpose, aimed at legitimate business objectives, and fraudulent intent, which undermines trust and violates legal standards.

Protecting Against Fraudulent Activities

Protecting against fraudulent activities requires distinguishing between fraudulent purpose and lawful purpose in transactions and agreements. Implementing stringent verification processes, such as identity authentication and transaction monitoring, helps detect and prevent actions intended to deceive or unlawfully gain benefits. Compliance with regulatory frameworks like the Anti-Money Laundering (AML) laws further strengthens defenses against fraudulent schemes targeting financial and commercial operations.

Jurisdictional Approaches to Fraudulent and Lawful Purpose

Jurisdictional approaches to distinguishing fraudulent purpose from lawful purpose vary significantly, with common law jurisdictions emphasizing the intent to deceive as a critical factor in defining fraud. Civil law systems often focus on statutory definitions and require clear evidence of misrepresentation or harm to establish fraudulent purpose, while lawful purpose is generally interpreted as compliance with legal and ethical standards. Courts in both jurisdictions utilize a combination of objective evidence and subjective intent to assess transactions, ensuring that actions motivated by fraudulent purpose are invalidated, whereas those with lawful purpose are upheld and protected by law.

Ensuring Compliance with Lawful Purpose Standards

Ensuring compliance with lawful purpose standards requires implementing robust verification mechanisms to distinguish fraudulent intent from legitimate objectives effectively. Organizations must enforce strict documentation and audit trails to validate the purpose of transactions, reducing risks of criminal misuse. Employing advanced data analytics and real-time monitoring tools enhances the ability to detect deviations from lawful practices, safeguarding regulatory compliance and mitigating financial crime exposure.

Fraudulent Purpose Infographic

libterm.com

libterm.com