Choosing the perfect gift requires understanding the recipient's preferences, occasion, and the message you want to convey through your present. Personalized gifts often create lasting impressions by showing thoughtfulness and care, while practical gifts offer usefulness and everyday value. Explore our article to discover expert tips and creative ideas that will help you find the ideal gift for any occasion.

Table of Comparison

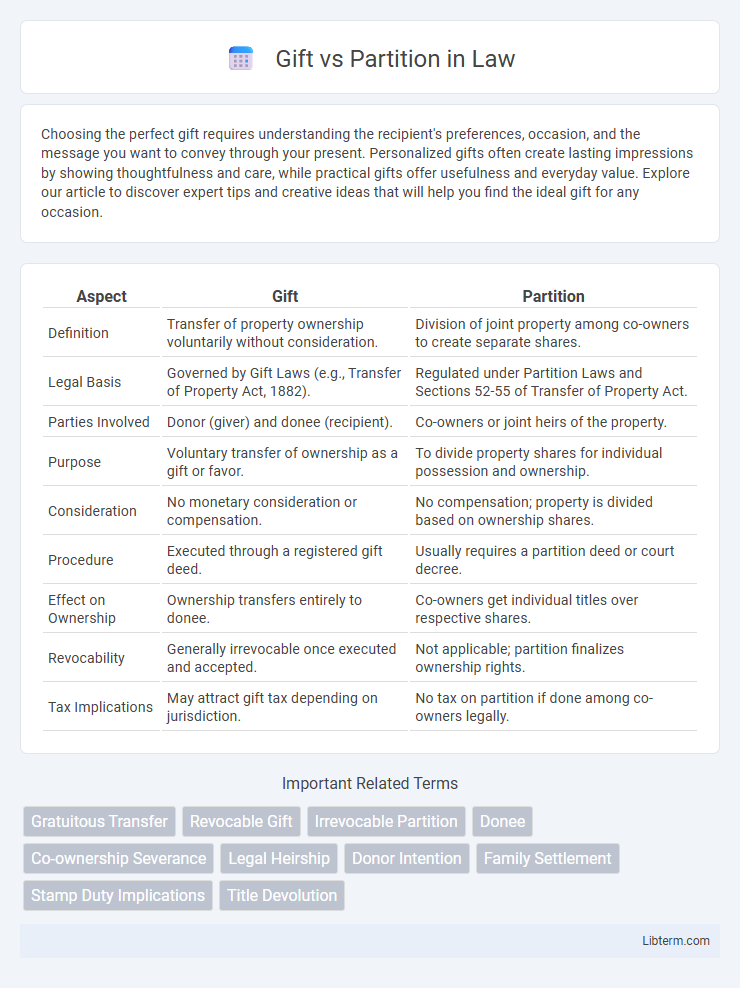

| Aspect | Gift | Partition |

|---|---|---|

| Definition | Transfer of property ownership voluntarily without consideration. | Division of joint property among co-owners to create separate shares. |

| Legal Basis | Governed by Gift Laws (e.g., Transfer of Property Act, 1882). | Regulated under Partition Laws and Sections 52-55 of Transfer of Property Act. |

| Parties Involved | Donor (giver) and donee (recipient). | Co-owners or joint heirs of the property. |

| Purpose | Voluntary transfer of ownership as a gift or favor. | To divide property shares for individual possession and ownership. |

| Consideration | No monetary consideration or compensation. | No compensation; property is divided based on ownership shares. |

| Procedure | Executed through a registered gift deed. | Usually requires a partition deed or court decree. |

| Effect on Ownership | Ownership transfers entirely to donee. | Co-owners get individual titles over respective shares. |

| Revocability | Generally irrevocable once executed and accepted. | Not applicable; partition finalizes ownership rights. |

| Tax Implications | May attract gift tax depending on jurisdiction. | No tax on partition if done among co-owners legally. |

Understanding the Concepts: Gift vs Partition

Gift refers to the voluntary transfer of property or assets from one person to another without any exchange of money, often used for estate planning or family transfers. Partition involves dividing jointly owned property among co-owners, legally separating their shares to provide individual ownership and control. Understanding the distinction between gift and partition clarifies legal rights, tax implications, and property management responsibilities for involved parties.

Legal Definitions: Gift and Partition

A gift is a voluntary transfer of property or assets from one person to another without consideration or compensation, typically formalized through a deed of gift or similar legal documentation. A partition, in legal terms, refers to the division of jointly owned property among co-owners, either by agreement or court order, to terminate shared ownership. While a gift creates a new separate ownership interest, a partition dissolves existing joint ownership by allocating distinct portions to the involved parties.

Key Differences Between Gift and Partition

Gift involves the voluntary transfer of property ownership without compensation, typically requiring a legal deed and acceptance by the recipient. Partition refers to the division of jointly owned property among co-owners, often necessitating a court order when amicable agreement is absent. The primary difference lies in gift being unilateral and gratuitous, whereas partition is a legal process to dissolve joint ownership and distribute assets equitably.

Eligibility Criteria for Gift and Partition

Eligibility criteria for a gift include the donor's capacity to transfer ownership voluntarily without consideration, where the donor must be of sound mind and competent to execute the gift deed, and the gift must be accepted by the donee during the donor's lifetime. Partition eligibility requires co-owners or coparceners to hold joint ownership or interest in the property, necessitating mutual consent or legal intervention when amicable division is impossible. Both processes demand clear documentation, with gift deeds registered under the Transfer of Property Act and partitions proceeding under the Partition Act or applicable personal laws.

Documentation Required for Gift and Partition

Documentation required for a gift typically includes a gift deed, which must clearly state the donor's intent to transfer ownership without consideration, along with proof of ownership and identity documents. For a partition, necessary documents involve a partition deed or agreement that outlines the division of jointly owned property, along with title deeds, property tax receipts, and sometimes a court order if the partition is contested. Both processes may require registration documents under the applicable property laws to validate the transaction legally.

Tax Implications: Gift vs Partition

Gift transactions typically attract gift tax based on the fair market value of the property transferred, with exemptions and slab rates varying by jurisdiction. Partition of property among co-owners generally does not trigger tax liabilities since it involves dividing existing ownership interests without transferring ownership to unrelated parties. Understanding the distinct tax implications helps in strategic estate planning and minimizing tax burdens during property distribution.

Registration Process: Gift vs Partition

The registration process for a gift involves executing a gift deed, which must be registered with the relevant sub-registrar office under the Indian Registration Act, ensuring the transfer of ownership without monetary consideration. In contrast, partition requires preparing a partition deed that divides joint property among co-owners, also mandatorily registered to validate each party's share legally. Both processes require payment of stamp duty and registration fees based on property value and local state laws to complete the transfer of rights.

Revocability and Irrevocability: Gift vs Partition

Gifts are typically irrevocable transfers of property where the donor relinquishes all rights and control permanently, making revocation difficult except under specific legal grounds like fraud or undue influence. In contrast, partitions involve dividing jointly owned property among co-owners and are generally considered irrevocable once finalized, as the partition legally terminates joint ownership interests. Understanding the distinctions in revocability between gifts and partitions is crucial for property owners to manage their rights and obligations effectively.

Rights and Liabilities: Gift vs Partition

In the context of rights and liabilities, a gift transfers ownership of property without consideration, thereby relieving the giver of any future liabilities associated with the asset, while the recipient gains full rights but no obligations for past debts. Partition involves dividing jointly held property among co-owners, preserving each party's proportional rights and liabilities based on their shares, often leading to shared responsibilities for expenses and liabilities until partition is finalized. Legal enforcement in partition ensures equitable distribution of rights and liabilities, whereas in gifting, these rights and liabilities shift entirely to the donee upon execution.

Choosing Between Gift and Partition: Factors to Consider

Choosing between gift and partition involves evaluating tax implications, emotional considerations, and legal complexities. Gifts transfer ownership without compensation but may trigger gift tax and affect estate planning. Partitions divide jointly owned property, requiring consensus among owners and sometimes court intervention, impacting family dynamics and legal fees.

Gift Infographic

libterm.com

libterm.com