The reinstatement period is a critical window during which you can restore a canceled insurance policy or subscription without losing coverage benefits. Understanding the specific terms and deadlines involved is essential to avoid lapses that could lead to higher costs or denied claims. Explore the article to learn how to navigate your policy's reinstatement period effectively.

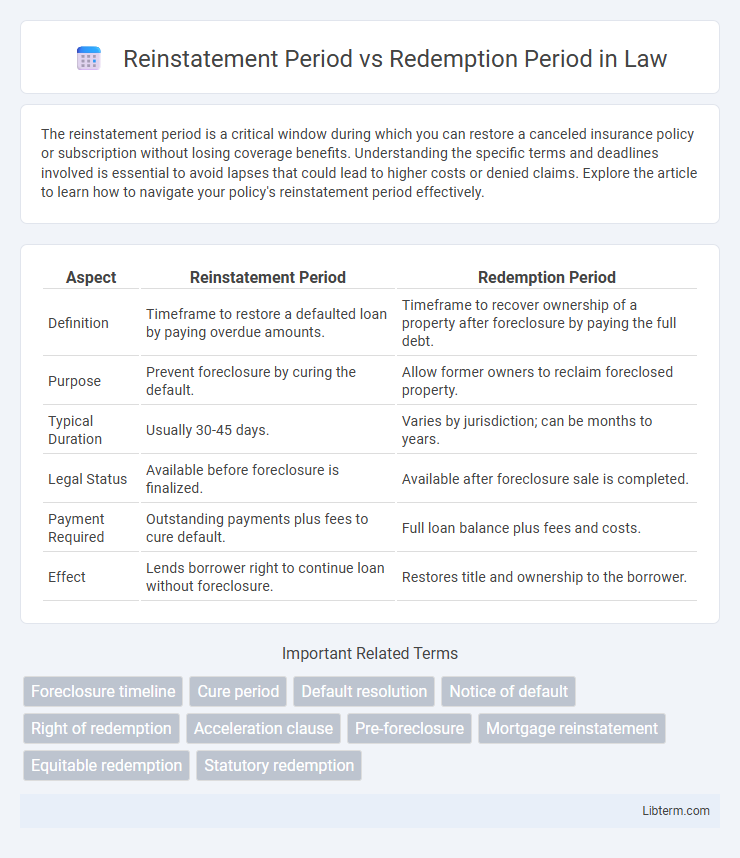

Table of Comparison

| Aspect | Reinstatement Period | Redemption Period |

|---|---|---|

| Definition | Timeframe to restore a defaulted loan by paying overdue amounts. | Timeframe to recover ownership of a property after foreclosure by paying the full debt. |

| Purpose | Prevent foreclosure by curing the default. | Allow former owners to reclaim foreclosed property. |

| Typical Duration | Usually 30-45 days. | Varies by jurisdiction; can be months to years. |

| Legal Status | Available before foreclosure is finalized. | Available after foreclosure sale is completed. |

| Payment Required | Outstanding payments plus fees to cure default. | Full loan balance plus fees and costs. |

| Effect | Lends borrower right to continue loan without foreclosure. | Restores title and ownership to the borrower. |

Understanding the Reinstatement Period

The reinstatement period is a specific timeframe during which a borrower can restore a lapsed loan by paying all missed payments and fees, preventing foreclosure from progressing. This period varies by state law but typically occurs early in the default process, offering a crucial opportunity to avoid losing the property. Understanding the reinstatement period is essential for homeowners to halt foreclosure without undergoing a full redemption process.

Defining the Redemption Period

The redemption period is a legally defined timeframe during which a property owner can reclaim their foreclosed property by paying off the outstanding debt, including fees and interest. This period varies by state law but typically ranges from a few months to one year, providing a final opportunity to avoid permanent loss of the property. Understanding the redemption period is crucial for both lenders and borrowers to manage foreclosure rights and obligations effectively.

Key Differences: Reinstatement vs Redemption

The reinstatement period allows homeowners to cure a default and resume their mortgage by paying past due amounts before foreclosure is finalized, preserving the original loan terms. In contrast, the redemption period permits borrowers to reclaim their property after foreclosure by paying the full sale price plus related costs, usually within a state-specific timeframe. Key differences include timing, payment requirements, and legal rights, with reinstatement occurring pre-foreclosure and redemption post-foreclosure sale.

Legal Framework Governing Both Periods

The legal framework governing the reinstatement period typically allows a borrower to restore a defaulted loan to its original terms by paying overdue amounts before foreclosure proceedings commence, often regulated by state-specific statutes or mortgage agreements. The redemption period, governed by state foreclosure laws, permits a borrower to reclaim the foreclosed property by paying the full sale price plus allowable costs after the foreclosure sale but within a limited timeframe. Both periods are designed to protect borrower rights, with reinstatement preventing foreclosure and redemption offering a last opportunity to avoid losing property ownership, shaped by nuanced jurisdictional legal provisions.

State Law Variations Affecting Each Period

Reinstatement and redemption periods vary significantly by state, with some states allowing reinstatement only before the foreclosure sale while others permit redemption after the sale. States like California emphasize a short reinstatement period, typically up to five days before the sale, while states such as Texas provide a redemption period lasting from six months to one year following foreclosure. Understanding state-specific laws is crucial for property owners and lenders since these variations impact the timeline and rights associated with reclaiming a foreclosed property.

Homeowner Rights During Each Period

Homeowners have specific rights during the Reinstatement Period, allowing them to pay the overdue mortgage amount plus fees to stop foreclosure and retain ownership. During the Redemption Period, homeowners can reclaim their property even after foreclosure by paying the full sale price or remaining mortgage balance, depending on state laws. These periods provide critical opportunities for homeowners to protect their property rights and avoid permanent loss.

Impacts on Foreclosure Proceedings

The reinstatement period allows borrowers to stop foreclosure by paying overdue amounts before the sale, directly impacting the timeline and potential recovery of the property by lenders. The redemption period follows the foreclosure sale, offering a limited window for borrowers to reclaim the property by paying the full sale price plus additional fees, which can delay the final transfer of ownership. Understanding the distinct legal rights and financial obligations during these periods is crucial for both lenders and borrowers to navigate foreclosure proceedings effectively.

Financial Implications for Borrowers

The reinstatement period allows borrowers to restore the original loan terms by paying the overdue amount before foreclosure, minimizing additional costs and preserving credit standing. In contrast, during the redemption period, borrowers must pay the full outstanding loan balance plus fees to reclaim property, often resulting in higher financial outlay and potential legal expenses. Understanding these periods helps borrowers manage foreclosure risks and financial liabilities effectively.

Steps to Exercise Reinstatement and Redemption

The reinstatement period allows borrowers to resume their mortgage loan by paying past due amounts, including fees and penalties, before the foreclosure sale, typically requiring a completed reinstatement form and proof of payment. The redemption period follows the foreclosure sale and enables former owners to reclaim their property by paying the full foreclosure sale price plus any additional costs, necessitating filing a redemption claim and settling the total amount within a strict timeline. Both processes demand timely communication with lenders or trustees and meeting specific legal requirements to successfully restore ownership rights.

Frequently Asked Questions: Reinstatement and Redemption Periods

The reinstatement period allows policyholders to restore a lapsed insurance policy by paying overdue premiums within a specified timeframe, typically 30 to 90 days. The redemption period, often seen in mortgage or tax lien cases, gives property owners additional time--usually 6 months to 1 year--to reclaim the property after foreclosure or sale by paying the owed amounts plus fees. Understanding the differences between these periods helps clarify rights and deadlines for regaining coverage or property ownership.

Reinstatement Period Infographic

libterm.com

libterm.com