The Taxing and Spending Clause grants Congress the power to levy taxes and allocate federal funds to promote the general welfare. This constitutional provision shapes government policy by influencing economic and social programs that impact your daily life. Explore the rest of the article to understand how this clause affects legislation and public services.

Table of Comparison

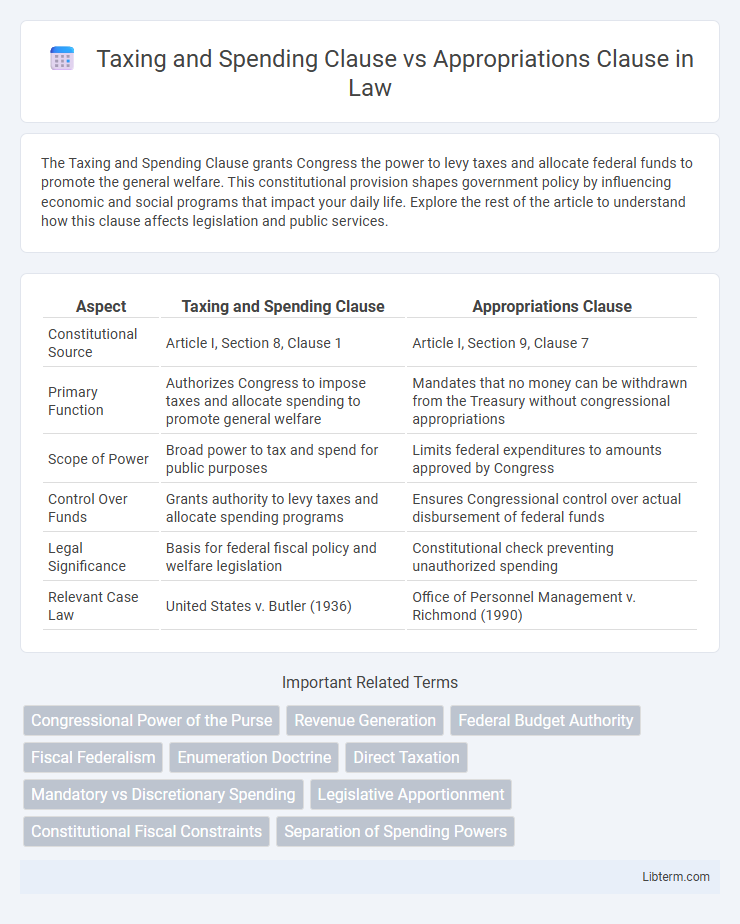

| Aspect | Taxing and Spending Clause | Appropriations Clause |

|---|---|---|

| Constitutional Source | Article I, Section 8, Clause 1 | Article I, Section 9, Clause 7 |

| Primary Function | Authorizes Congress to impose taxes and allocate spending to promote general welfare | Mandates that no money can be withdrawn from the Treasury without congressional appropriations |

| Scope of Power | Broad power to tax and spend for public purposes | Limits federal expenditures to amounts approved by Congress |

| Control Over Funds | Grants authority to levy taxes and allocate spending programs | Ensures Congressional control over actual disbursement of federal funds |

| Legal Significance | Basis for federal fiscal policy and welfare legislation | Constitutional check preventing unauthorized spending |

| Relevant Case Law | United States v. Butler (1936) | Office of Personnel Management v. Richmond (1990) |

Introduction to Fiscal Powers in the U.S. Constitution

The Taxing and Spending Clause, found in Article I, Section 8, Clause 1 of the U.S. Constitution, grants Congress the power to levy taxes and allocate federal funds to provide for the general welfare of the United States. The Appropriations Clause, located in Article I, Section 9, Clause 7, requires that no money be drawn from the Treasury without the passage of an appropriations law by Congress, ensuring legislative control over federal expenditures. Together, these clauses establish the foundational fiscal powers that enable Congress to generate revenue and authorize government spending in a constitutionally regulated manner.

Understanding the Taxing and Spending Clause

The Taxing and Spending Clause grants Congress the power to levy taxes and allocate funds to promote the general welfare, establishing the constitutional foundation for federal fiscal policy. This clause empowers Congress to generate revenue and direct expenditures that serve national interests, distinguishing it from the Appropriations Clause, which controls the actual disbursement of those funds. Understanding the Taxing and Spending Clause is essential for recognizing how legislative authority shapes government funding priorities and economic regulation.

Scope and Limits of the Taxing and Spending Clause

The Taxing and Spending Clause grants Congress broad authority to levy taxes and allocate funds to promote the general welfare, but this power is limited by constitutional constraints such as uniformity in taxation and prohibition against taxes on exports. Unlike the Appropriations Clause, which specifically controls the timing and manner of federal expenditures, the Taxing and Spending Clause primarily addresses the scope of Congress's power to generate revenue and impose conditions on spending programs. Courts have recognized that while Congress can incentivize behavior through spending, it cannot coerce states, ensuring limits on the reach of conditional federal funding under the Taxing and Spending Clause.

Appropriations Clause: Definition and Purpose

The Appropriations Clause, located in Article I, Section 9, Clause 7 of the U.S. Constitution, mandates that no money can be drawn from the Treasury except through appropriations made by law, ensuring congressional control over federal expenditures. Its primary purpose is to grant Congress exclusive authority to decide when, how, and on what public funds are spent, thereby maintaining checks and balances on the executive branch's financial activities. This clause serves as a critical mechanism for legislative oversight and fiscal accountability within the federal government.

Mechanisms of Federal Spending Authorization

The Taxing and Spending Clause empowers Congress to levy taxes and allocate funds for the general welfare, establishing broad legislative authority to generate revenue and finance government programs. The Appropriations Clause requires that federal expenditures be explicitly authorized through annual appropriations bills, ensuring a specific legislative approval mechanism for disbursing public funds. Together, these clauses create a two-step federal spending authorization process: first, taxing and generating revenue under Article I, Section 8, and second, the control and approval of fund disbursement under Article I, Section 9, clause 7.

Constitutional Interpretation: Key Supreme Court Cases

The Taxing and Spending Clause grants Congress broad authority to levy taxes and allocate federal funds, confirmed by cases like *South Dakota v. Dole* (1987), where conditional spending was upheld to promote national interests. The Appropriations Clause restricts federal expenditures, requiring that no money be drawn from the Treasury without a proper appropriation, as emphasized in *Office of Personnel Management v. Richmond* (1990), enforcing strict adherence to funding statutes. These cases highlight the balance between Congressional power to tax and spend and constitutional limits ensuring legislative control over public funds.

Distinctions Between Taxing and Spending vs. Appropriations

The Taxing and Spending Clause grants Congress the power to levy taxes and allocate funds for the general welfare, enabling broad legislative discretion in fiscal policy. The Appropriations Clause specifically requires that no money be drawn from the Treasury without a formal appropriation made by law, ensuring congressional control over spending. Distinguishing these clauses, the Taxing and Spending Clause authorizes revenue collection and expenditure directions, whereas the Appropriations Clause mandates the procedural approval for disbursing federal funds.

Practical Implications for Congressional Power

The Taxing and Spending Clause grants Congress broad authority to levy taxes and allocate funds to promote the general welfare, enabling expansive policy initiatives. The Appropriations Clause, however, restricts spending authority by requiring explicit congressional approval for federal expenditures, ensuring precise control over government disbursements. Together, these clauses shape Congressional power by balancing flexible fiscal policy-making with stringent budgetary oversight.

Impact on Federal Fiscal Policy and Governance

The Taxing and Spending Clause grants Congress broad authority to levy taxes and allocate funds for general welfare, shaping fiscal policy by enabling expansive government programs and priorities. The Appropriations Clause mandates that no money shall be drawn from the Treasury except through appropriations made by law, enforcing strict legislative control over federal expenditures and ensuring accountability in governance. Together, these clauses balance fiscal flexibility with expenditure oversight, directly influencing budgetary processes and federal financial management.

Contemporary Debates and Future Trends

Contemporary debates on the Taxing and Spending Clause center on the scope of congressional power to tax and allocate funds for general welfare, often scrutinizing whether certain expenditures exceed constitutional limits. The Appropriations Clause draws attention to congressional control over federal expenditures, with ongoing tensions regarding executive branch spending authority and the requirement of explicit congressional approval. Future trends suggest increased legal challenges and legislative reforms aimed at clarifying the balance between taxation, spending authority, and the separation of powers in budgetary processes.

Taxing and Spending Clause Infographic

libterm.com

libterm.com