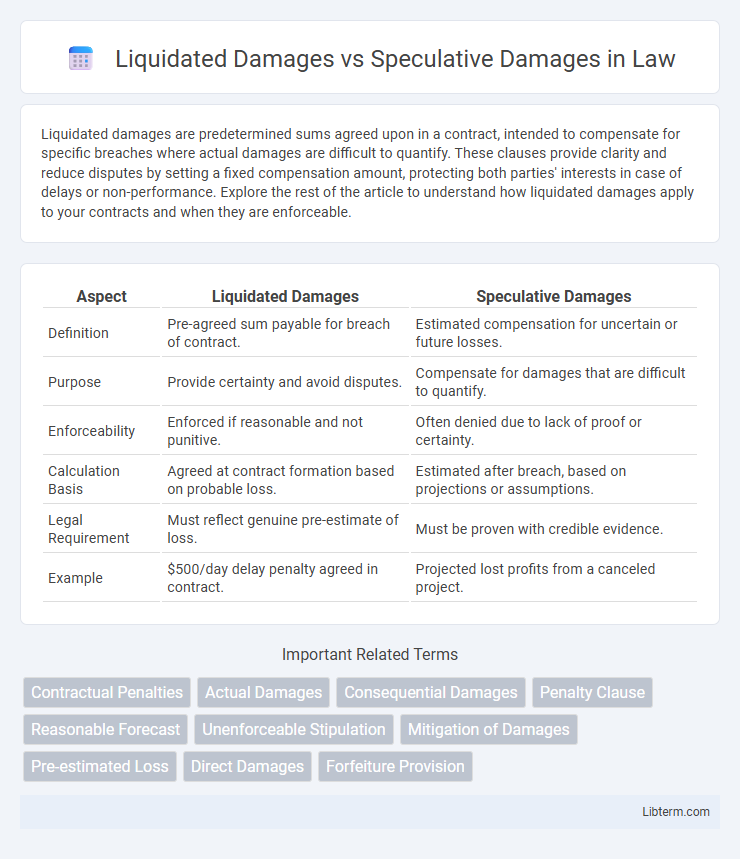

Liquidated damages are predetermined sums agreed upon in a contract, intended to compensate for specific breaches where actual damages are difficult to quantify. These clauses provide clarity and reduce disputes by setting a fixed compensation amount, protecting both parties' interests in case of delays or non-performance. Explore the rest of the article to understand how liquidated damages apply to your contracts and when they are enforceable.

Table of Comparison

| Aspect | Liquidated Damages | Speculative Damages |

|---|---|---|

| Definition | Pre-agreed sum payable for breach of contract. | Estimated compensation for uncertain or future losses. |

| Purpose | Provide certainty and avoid disputes. | Compensate for damages that are difficult to quantify. |

| Enforceability | Enforced if reasonable and not punitive. | Often denied due to lack of proof or certainty. |

| Calculation Basis | Agreed at contract formation based on probable loss. | Estimated after breach, based on projections or assumptions. |

| Legal Requirement | Must reflect genuine pre-estimate of loss. | Must be proven with credible evidence. |

| Example | $500/day delay penalty agreed in contract. | Projected lost profits from a canceled project. |

Understanding Liquidated Damages

Liquidated damages represent a predetermined sum agreed upon by parties in a contract to compensate for breach, offering certainty and avoiding protracted litigation over actual losses. These damages must be a reasonable estimate of potential harm at the time of contract formation, preventing them from being deemed punitive or unenforceable. Understanding liquidated damages helps businesses manage risk by providing clear financial consequences for non-performance compared to speculative damages, which involve uncertain and often unprovable losses.

Defining Speculative Damages

Speculative damages refer to compensation for losses that are uncertain or not reasonably measurable at the time of a breach of contract, often lacking concrete evidence to quantify actual harm. Unlike liquidated damages, which are predetermined and agreed upon in the contract, speculative damages rely on projections or assumptions about potential future losses. Courts typically disallow speculative damages due to their lack of factual basis and the difficulty in proving exact amounts.

Key Legal Differences

Liquidated damages are predetermined amounts agreed upon in a contract to compensate for breach, ensuring enforceability by being a reasonable estimate of actual loss. Speculative damages lack this certainty as they are unquantified, uncertain losses that courts typically do not enforce due to difficulty in proving actual harm. The key legal difference lies in enforceability: liquidated damages must be a genuine pre-estimate of damages, whereas speculative damages are generally considered too uncertain and thus non-recoverable.

Purpose and Application in Contracts

Liquidated damages serve to predetermine compensation for breach of contract, providing clear financial expectations and enforcing accountability without requiring proof of actual loss. Speculative damages, conversely, involve uncertain, hypothetical losses that are difficult to quantify, and courts typically reject them due to their lack of concrete evidence. In contracts, liquidated damages clauses are strategically applied to manage risk and streamline dispute resolution, while speculative damages are generally considered unreliable and not enforceable.

Enforceability in Court

Liquidated damages are predetermined amounts agreed upon in a contract, making them more enforceable in court due to their clarity and mutual consent. Speculative damages lack definite quantification, often leading courts to reject them because they are based on conjecture rather than concrete evidence. Courts favor liquidated damages when they represent a reasonable estimate of actual harm, while speculative damages face challenges in proving actual loss and causation.

Calculating Liquidated Damages

Calculating liquidated damages involves pre-determining a reasonable estimate of loss in the contract, reflecting the actual harm likely to arise from a breach, which must be specified clearly to avoid being deemed a penalty. Courts enforce liquidated damages clauses when the agreed sum is a genuine pre-estimate of damages, based on factors such as contract value, duration of delay, and projected financial impact. Unlike speculative damages, which are uncertain and require proof after breach, liquidated damages streamline compensation by setting a fixed amount agreed upon at contract formation.

Proving Speculative Damages

Proving speculative damages requires concrete evidence demonstrating a reasonable certainty of loss, such as financial records or expert testimony, rather than mere conjecture or hypothetical scenarios. Courts reject damages that lack a factual basis or cannot be reliably quantified, emphasizing the need for detailed documentation of causation and valuation. Unlike liquidated damages, which are predetermined and agreed upon in a contract, speculative damages demand rigorous proof to establish actual monetary harm resulting from the breach.

Common Contract Clauses

Common contract clauses distinguish liquidated damages from speculative damages by predefining a specific monetary amount payable upon breach, ensuring predictable financial consequences. Liquidated damages clauses are enforceable when the amount is a reasonable forecast of actual harm, avoiding penalties or punitive sums. Speculative damages, lacking precise quantification and based on uncertain future losses, are typically excluded in contracts to mitigate disputes over unverifiable claims.

Risks and Limitations

Liquidated damages provide a predetermined monetary compensation for breach of contract, minimizing uncertainty and risk by offering clear, enforceable penalties agreed upon by both parties. Speculative damages, however, are uncertain and difficult to quantify, exposing parties to significant risks in litigation as courts may reject or significantly reduce these claims due to their conjectural nature. The primary limitation of liquidated damages lies in their enforceability, requiring reasonableness and proportionality to actual harm, whereas speculative damages face inherent challenges in proving causation and precise financial impact.

Best Practices for Drafting Damage Provisions

Drafting damage provisions requires precision by clearly defining liquidated damages to reflect a genuine pre-estimate of loss, ensuring enforceability and avoiding penalties that courts may reject. Speculative damages should be excluded or narrowly tailored due to their uncertainty and difficulty in proof, reducing litigation risks. Best practices also include using specific, quantifiable criteria for damages calculation and incorporating limitations of liability clauses for clarity and risk management.

Liquidated Damages Infographic

libterm.com

libterm.com