An executor manages the distribution of assets according to a will, ensuring that debts are paid and beneficiaries receive their rightful inheritances. Selecting a capable executor is crucial for preventing legal complications and expediting the probate process. Explore the rest of the article to understand the executor's responsibilities and how you can choose the right one for your estate.

Table of Comparison

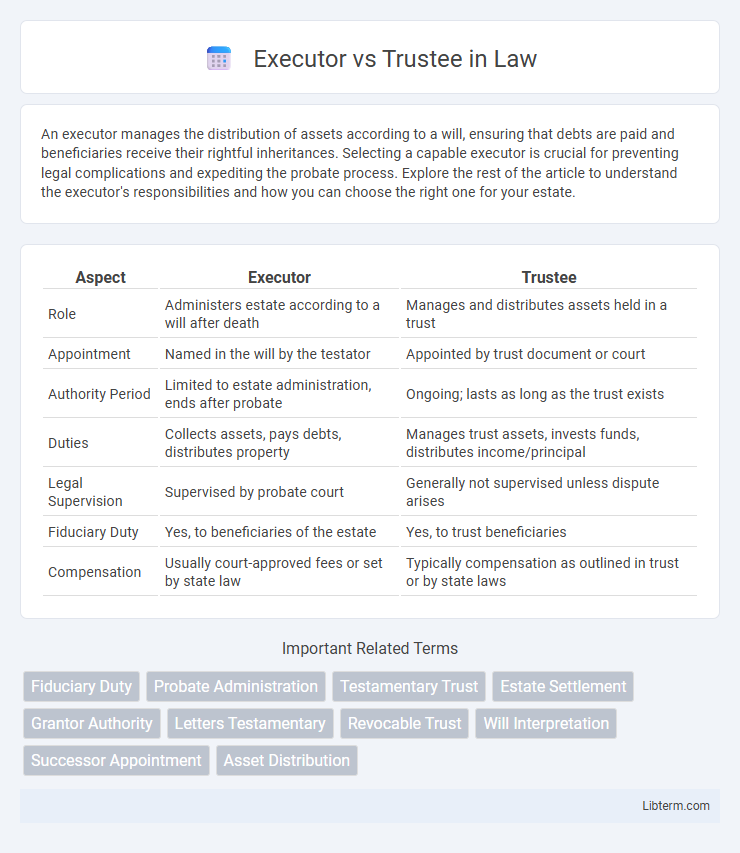

| Aspect | Executor | Trustee |

|---|---|---|

| Role | Administers estate according to a will after death | Manages and distributes assets held in a trust |

| Appointment | Named in the will by the testator | Appointed by trust document or court |

| Authority Period | Limited to estate administration, ends after probate | Ongoing; lasts as long as the trust exists |

| Duties | Collects assets, pays debts, distributes property | Manages trust assets, invests funds, distributes income/principal |

| Legal Supervision | Supervised by probate court | Generally not supervised unless dispute arises |

| Fiduciary Duty | Yes, to beneficiaries of the estate | Yes, to trust beneficiaries |

| Compensation | Usually court-approved fees or set by state law | Typically compensation as outlined in trust or by state laws |

Executor vs Trustee: Key Differences

The executor manages the distribution of assets and ensures the deceased's will is followed during probate, while the trustee administers assets held in a trust according to the trust document. Executors are appointed by the court or named in a will, whereas trustees are typically designated by the trust creator and serve without court involvement. Understanding these key differences is crucial for effective estate planning and asset management.

Defining Roles: Who Is an Executor?

An executor is a legally appointed individual responsible for administering the deceased's estate according to the will, ensuring assets are collected, debts are paid, and remaining property is distributed to beneficiaries. The executor's duties include filing necessary court documents, managing estate finances, and safeguarding estate assets throughout probate. Unlike a trustee, whose role focuses on managing trust assets according to trust terms, the executor's role is limited to estate settlement during probate.

Understanding the Trustee’s Responsibilities

A trustee holds a legal duty to manage and protect trust assets in accordance with the terms set forth in the trust document, ensuring fiduciary responsibility to beneficiaries. Unlike an executor who administers a deceased person's estate through probate, a trustee oversees ongoing management, distribution, and investment of trust property. Key responsibilities include prudent asset administration, timely distribution to beneficiaries, accurate record-keeping, and adherence to the trust's instructions and relevant state laws.

Appointment Process: Executor and Trustee

The appointment process for an executor begins with the testator naming the individual in their will, who must then be formally approved and granted probate by the court. A trustee is appointed through a trust document created by the grantor, specifying terms and conditions for managing the trust assets without court intervention. Executors primarily handle estate administration after death, while trustees manage trust assets during the trust's duration, often without court oversight.

Legal Powers: Executor versus Trustee

Executors hold legal authority to administer estates, including collecting assets, paying debts, and distributing property according to a will after death. Trustees have ongoing fiduciary powers to manage and invest trust assets, ensuring compliance with trust terms and beneficiaries' interests over time. Legal powers of executors cease upon estate distribution, whereas trustees maintain authority throughout the trust's duration.

Timeline of Duties: Probate vs Trust Administration

An executor manages probate by initiating court proceedings, identifying assets, paying debts, and distributing property, typically within 6 to 12 months depending on complexity. A trustee administers a trust without court intervention, handling asset management, income distribution, and beneficiary communications, often continuing for many years according to the trust terms. Probate timelines involve formal validation of a will, while trust administration follows the trust's directives, enabling faster and more private asset transfer.

Handling Assets: Estate Distributions and Trust Management

Executors manage the probate process by collecting, valuing, and distributing a deceased person's assets according to the will, ensuring creditor claims are settled before estate distribution. Trustees oversee trust assets during the trust's duration, managing investments, making distributions to beneficiaries as specified, and maintaining fiduciary responsibilities. Both roles require meticulous record-keeping and adherence to legal obligations to protect beneficiaries' interests.

Accountability: Reporting and Fiduciary Duties

Executors and trustees are legally accountable for managing estate or trust assets, with executors responsible for probate administration and trustees overseeing ongoing trust distributions. Executors must file detailed probate accountings with the court, providing transparency to beneficiaries, while trustees produce regular trust reports demonstrating compliance with fiduciary obligations. Both roles require strict adherence to fiduciary duties such as loyalty, prudence, and impartiality, ensuring asset protection and accurate financial disclosures.

Common Challenges in Each Role

Executors frequently encounter challenges such as locating and managing estate assets, handling creditor claims, and navigating probate court procedures, which can be time-consuming and complex. Trustees often face difficulties in balancing fiduciary duties, managing trust investments prudently, and distributing assets according to trust terms while addressing beneficiary disputes. Both roles require meticulous record-keeping and clear communication to mitigate legal risks and ensure compliance with state laws.

Choosing the Right Person: Executor or Trustee

Selecting the right person as an executor or trustee hinges on their capability to manage legal, financial, and fiduciary duties with integrity and attention to detail. Executors typically handle probate processes and asset distribution after death, while trustees manage ongoing trust administration and asset protection for beneficiaries. Prioritize individuals with financial acumen, organizational skills, and a trustworthy reputation to ensure your estate or trust is managed effectively and according to your wishes.

Executor Infographic

libterm.com

libterm.com