Second category products often offer enhanced features and improved performance compared to basic models, meeting the needs of more discerning users. Choosing items within this category can provide better value while balancing cost and quality. Explore the detailed benefits of second category options in the rest of the article to make an informed decision.

Table of Comparison

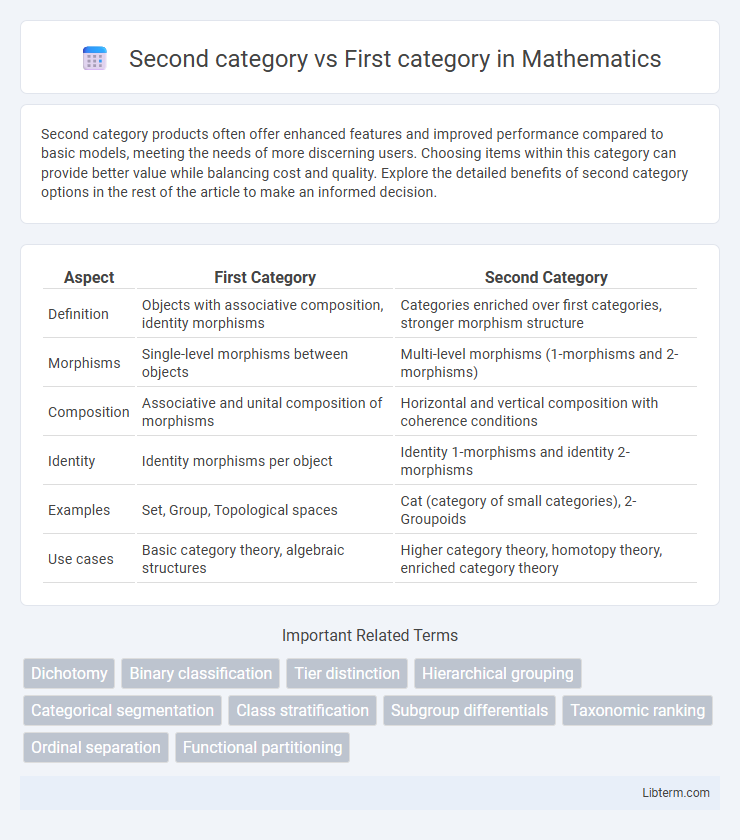

| Aspect | First Category | Second Category |

|---|---|---|

| Definition | Objects with associative composition, identity morphisms | Categories enriched over first categories, stronger morphism structure |

| Morphisms | Single-level morphisms between objects | Multi-level morphisms (1-morphisms and 2-morphisms) |

| Composition | Associative and unital composition of morphisms | Horizontal and vertical composition with coherence conditions |

| Identity | Identity morphisms per object | Identity 1-morphisms and identity 2-morphisms |

| Examples | Set, Group, Topological spaces | Cat (category of small categories), 2-Groupoids |

| Use cases | Basic category theory, algebraic structures | Higher category theory, homotopy theory, enriched category theory |

Understanding the First and Second Categories

The first category typically refers to primary or foundational elements that form the basis of a system, while the second category involves secondary or derived components dependent on the first. Understanding the first category requires analyzing core principles and essential features, whereas the second category emphasizes variations, adaptations, or extensions based on those fundamentals. This distinction aids in grasping hierarchical structures and the relationships between foundational and supplementary elements in data classification, taxonomy, or system design.

Key Differences Between First and Second Category

The second category typically refers to items or entities that are more specific, specialized, or advanced compared to the broader and more general first category. Key differences between the first and second category include variations in complexity, scope, and application, where the first category covers foundational or introductory elements, while the second category involves more detailed, nuanced, or specialized aspects. These distinctions impact classification criteria, usage contexts, and target audiences, making the second category often more tailored to expert or niche requirements.

Defining the First Category

The First Category typically refers to the highest tier of classification based on criteria such as quality, revenue generation, or regulatory standards, often encompassing premium products or services. This category is characterized by stricter compliance requirements, superior performance metrics, and greater market influence compared to the Second Category. Understanding the First Category's parameters helps delineate competitive advantages and operational benchmarks within various industries.

What Constitutes the Second Category

The second category primarily includes income derived from salary, wages, bonuses, and pensions, distinguishing it from the first category which covers income from property such as rents or royalties. It encompasses all taxable earnings related to employment and service contracts, contributing significantly to individual taxable income. Understanding the components of the second category is essential for accurate tax reporting and compliance under income tax laws.

Benefits of Belonging to the First Category

Belonging to the First Category offers significant advantages such as higher social status, enhanced access to exclusive resources, and greater recognition within a community or organization. Members often receive increased opportunities for professional growth, priority in decision-making processes, and superior benefits compared to those in the Second Category. This categorization typically reflects a hierarchy that rewards experience, merit, or contribution, leading to improved overall well-being and influence.

Advantages of the Second Category

The Second category offers enhanced flexibility and scalability compared to the First category, allowing businesses to adapt quickly to changing market demands. It typically incorporates advanced technology and improved user interfaces, leading to higher efficiency and better customer satisfaction. Cost-effectiveness and streamlined operations are additional advantages, making the Second category a preferred choice for modern enterprises.

Challenges Faced in Each Category

Second category entities often encounter challenges related to regulatory compliance complexities and stricter tax audit frequencies, contrasting with the first category's more straightforward reporting requirements. First category businesses typically face operational hurdles such as scaling limitations and resource constraints, whereas second category organizations manage increased administrative burdens and intricate documentation processes. Differences in financial reporting standards also present unique difficulties, with the second category requiring more detailed disclosures and higher accuracy to meet regulatory scrutiny.

Criteria for Classification

The classification between the second category and first category is primarily determined by specific criteria such as income thresholds, nature of business activities, and regulatory obligations. First category typically includes entities with higher revenue brackets and more stringent compliance requirements, while the second category encompasses smaller enterprises with reduced reporting responsibilities. These criteria ensure appropriate taxation and legal frameworks tailored to the scale and scope of each category.

Real-World Examples of Both Categories

First category examples include luxury cars such as Tesla Model S and Apple iPhone, which prioritize innovation, premium quality, and exclusive features targeting affluent consumers. Second category products, like Toyota Corolla and Samsung Galaxy A series, emphasize affordability, reliability, and value for a broader market segment. Real-world data shows the first category drives brand prestige while the second category dominates volume sales due to accessibility and practicality.

Choosing Between First and Second Category

Choosing between the first and second category hinges on factors such as tax implications, income level, and business structure. First category tax typically applies to corporate income with lower rates and specific deductions, while second category tax targets individual income, often involving progressive rates and personal allowances. Evaluating the nature of income and applicable regulations ensures optimal tax strategy and compliance.

Second category Infographic

libterm.com

libterm.com