An indicator is a measurable variable or tool used to assess the state or performance of a system, process, or phenomenon. It helps in tracking progress, making data-driven decisions, and identifying areas needing improvement. Discover how understanding different types of indicators can enhance your analysis by reading the rest of this article.

Table of Comparison

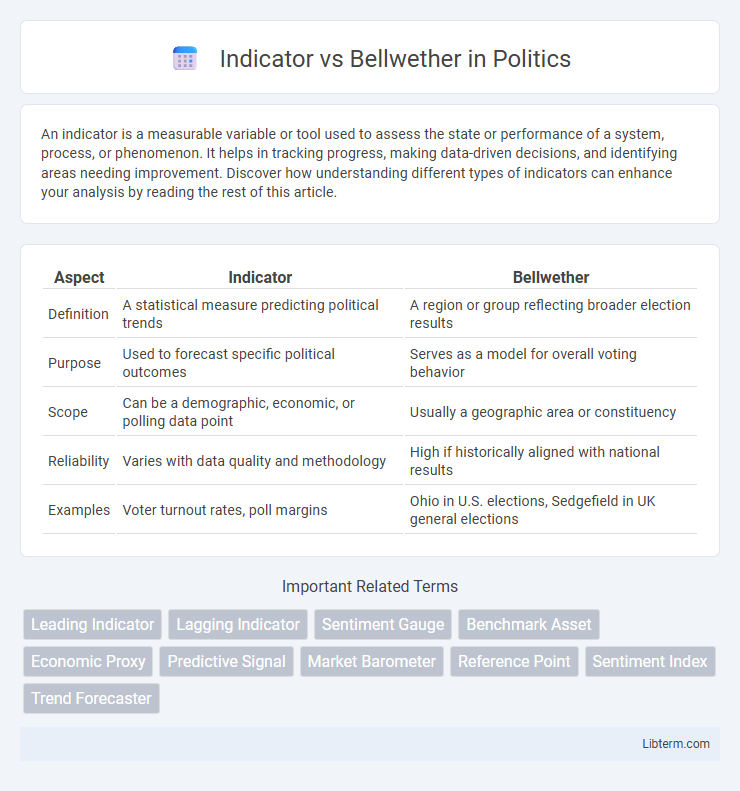

| Aspect | Indicator | Bellwether |

|---|---|---|

| Definition | A statistical measure predicting political trends | A region or group reflecting broader election results |

| Purpose | Used to forecast specific political outcomes | Serves as a model for overall voting behavior |

| Scope | Can be a demographic, economic, or polling data point | Usually a geographic area or constituency |

| Reliability | Varies with data quality and methodology | High if historically aligned with national results |

| Examples | Voter turnout rates, poll margins | Ohio in U.S. elections, Sedgefield in UK general elections |

Introduction to Indicator and Bellwether

An indicator is a quantitative measure or data point used to assess economic performance or predict future market trends, often derived from statistical analysis and real-time metrics. Bellwethers serve as leading signals or reference points, typically companies, stocks, or sectors, whose performance reflects broader market or economic conditions. Understanding the distinction between indicators and bellwethers is crucial for investors and analysts aiming to interpret market movements accurately.

Defining Indicator: Meaning and Usage

An indicator is a measurable variable or data point used to assess economic, social, or environmental conditions, providing insight into trends and potential future outcomes. It serves as a quantitative tool in forecasting and decision-making across fields like finance, health, and policy analysis. Unlike bellwethers that signal general direction through leading examples, indicators offer specific, data-driven evidence for evaluating current status or predicting changes.

Understanding Bellwether: Definition and Significance

Bellwether refers to an entity or metric that reliably predicts future trends or outcomes in a specific domain, often serving as a leading indicator in markets, politics, or social behavior. Recognizing a bellwether's significance enables strategic decision-making by anticipating changes before they become widespread. Unlike general indicators that may reflect current conditions, bellwethers provide forward-looking insight crucial for forecasting and trend analysis.

Key Differences Between Indicator and Bellwether

Indicators are specific data points or metrics that signal potential economic or market trends, measuring quantifiable aspects such as unemployment rates or stock performance. Bellwethers are representative entities, like leading companies or regions, whose behavior or results predict broader market movements, often serving as proxies for overall economic health. The key difference lies in indicators providing numerical evidence, while bellwethers offer qualitative predictions based on their status as trendsetters or market leaders.

Common Examples of Indicators

Common examples of indicators include unemployment rates, consumer price index (CPI), and gross domestic product (GDP) growth, which signal current economic health. Stock market trends and manufacturing output also serve as indicators reflecting business confidence and production levels. These metrics provide valuable data for analyzing economic conditions and guiding investment decisions.

Notable Bellwether Cases in History

Notable bellwether cases in history, such as Bush v. Gore (2000) and Roe v. Wade (1973), have significantly influenced broader legal and political trends by accurately predicting or shaping future outcomes. These cases serve as critical benchmarks for understanding judicial behavior and electoral dynamics, unlike generic indicators that provide data points without direct causative insight. Examining bellwether decisions offers valuable context on how specific rulings can forecast shifts in public policy and societal attitudes.

Importance of Indicators in Data Analysis

Indicators serve as measurable variables that provide essential insights into trends and patterns within data analysis, facilitating informed decision-making through accurate predictions. Bellwethers, while significant, primarily denote leading examples or trends that signal broader shifts but lack the quantitative specificity that indicators offer. The importance of indicators lies in their ability to quantify changes, enabling analysts to monitor performance, detect anomalies, and guide strategic planning effectively.

Role of Bellwethers in Predictive Trends

Bellwethers serve as key market leaders or early movers whose performance often signals broader economic or industry trends, making them vital for predictive trend analysis. Unlike general indicators that provide data points or metrics, bellwethers represent a subset of influential entities whose success or failure can foreshadow shifts in consumer behavior, stock markets, or sector dynamics. Identifying bellwether stocks, companies, or regions enables analysts and investors to anticipate future movements with greater accuracy by leveraging their predictive power in trend forecasting.

When to Use Indicator vs Bellwether

Use an indicator when tracking measurable data points that predict or reflect changes in economic trends, such as unemployment rates or inflation figures. Bellwethers are best employed to identify leading entities or events that signal a broader market or industry direction, like stock performance of a dominant company signaling sector health. Choose indicators for quantifiable metrics and bellwethers for qualitative insights into future market conditions.

Conclusion: Choosing the Right Term in Context

Selecting between indicator and bellwether depends on the context and the specific signaling role required; indicators provide measurable data points reflecting current or future trends, while bellwethers act as predictive leaders or trendsetters in a domain. Financial markets often rely on bellwether stocks to gauge overall market direction, whereas economic indicators like unemployment rates or GDP growth offer quantifiable insights into economic health. Careful consideration of scope and function ensures the chosen term accurately represents the signal's nature and reliability within its field.

Indicator Infographic

libterm.com

libterm.com