Territorial-progressive taxation applies higher tax rates to income earned within a nation's borders, ensuring residents contribute more as their local earnings increase. This system promotes fiscal equity by taxing domestic income progressively while potentially excluding foreign income from local taxes. Discover how this approach impacts your financial planning and the broader economic landscape by reading the full article.

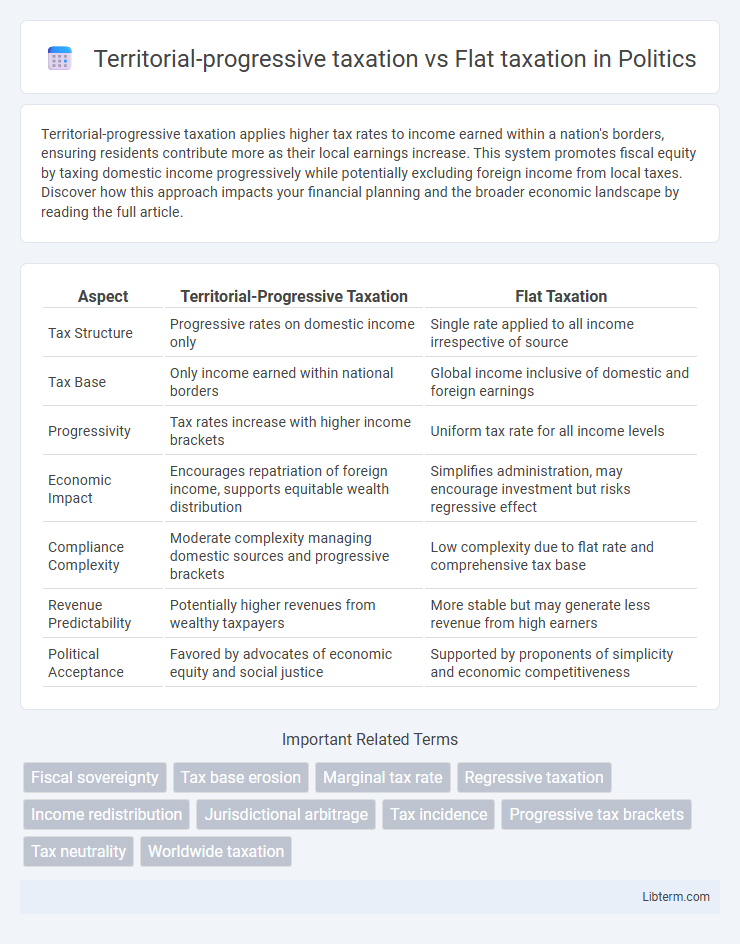

Table of Comparison

| Aspect | Territorial-Progressive Taxation | Flat Taxation |

|---|---|---|

| Tax Structure | Progressive rates on domestic income only | Single rate applied to all income irrespective of source |

| Tax Base | Only income earned within national borders | Global income inclusive of domestic and foreign earnings |

| Progressivity | Tax rates increase with higher income brackets | Uniform tax rate for all income levels |

| Economic Impact | Encourages repatriation of foreign income, supports equitable wealth distribution | Simplifies administration, may encourage investment but risks regressive effect |

| Compliance Complexity | Moderate complexity managing domestic sources and progressive brackets | Low complexity due to flat rate and comprehensive tax base |

| Revenue Predictability | Potentially higher revenues from wealthy taxpayers | More stable but may generate less revenue from high earners |

| Political Acceptance | Favored by advocates of economic equity and social justice | Supported by proponents of simplicity and economic competitiveness |

Understanding Territorial-Progressive Taxation

Territorial-progressive taxation applies taxes on income earned within a jurisdiction, with rates increasing as income rises, incentivizing equitable wealth distribution while encouraging foreign investment. This system contrasts with flat taxation, where a single uniform rate applies regardless of income level, potentially reducing tax fairness but simplifying compliance. Understanding territorial-progressive taxation requires analyzing its impact on mobility of capital and multinational corporations, along with its role in regional economic development strategies.

Key Features of Flat Taxation Systems

Flat taxation systems feature a single, uniform tax rate applied to all levels of income, eliminating multiple tax brackets to simplify compliance and administration. These systems often exclude deductions and credits, broadening the tax base and minimizing loopholes, which enhances transparency and efficiency. Unlike territorial-progressive taxation that taxes income based on source and applies escalating rates, flat tax models provide predictability and neutrality by taxing all income uniformly regardless of origin.

Historical Evolution of Tax Structures

Territorial-progressive taxation has evolved primarily in countries aiming to balance domestic revenue needs with global economic integration, with roots tracing back to early 20th-century reforms emphasizing ability to pay and income redistribution. Flat taxation gained prominence in the late 20th century, particularly in Eastern Europe and post-Soviet states during economic liberalization, promoting simplicity and efficiency by taxing all income at a single rate regardless of source. The historical evolution reflects shifting fiscal philosophies, from progressive scales emphasizing social equity to flat models prioritizing economic growth and administrative ease.

Economic Impacts: Progressive vs Flat Tax

Territorial-progressive taxation directs higher rates at increased income levels within a country's borders, promoting wealth redistribution and potentially reducing economic inequality by taxing domestic earnings progressively. Flat taxation applies a uniform rate on all income, regardless of the amount, simplifying tax compliance and potentially encouraging investment, but may lead to less equitable income distribution. The economic impact of progressive systems often includes increased government revenue for social programs, whereas flat tax systems can stimulate economic growth through lower marginal rates but risk widening income disparities.

Social Equity and Wealth Distribution

Territorial-progressive taxation targets income earned within a country at increasing rates based on income brackets, promoting social equity by redistributing wealth and funding public services that reduce economic disparities. Flat taxation applies a single rate to all income levels, which may simplify tax administration but often results in less wealth redistribution, potentially exacerbating social inequality. Empirical studies indicate that progressive territorial tax systems more effectively address wealth concentration and improve social equity compared to flat tax regimes.

Administrative Complexity and Compliance

Territorial-progressive taxation involves taxing residents based on their domestic income with rates increasing according to income brackets, leading to higher administrative complexity due to income source tracking and progressive rate calculations. Flat taxation applies a single rate to all taxable income, simplifying compliance and reducing administrative burdens by eliminating the need for detailed income categorization and scale-based assessments. Studies show that flat tax systems generally lower compliance costs and simplify tax administration compared to territorial-progressive models, which require more robust enforcement and reporting mechanisms.

Incentives for Investment and Growth

Territorial-progressive taxation encourages domestic investment by taxing only income earned within national borders with higher rates on increasing income brackets, motivating reinvestment and income redistribution. Flat taxation applies a uniform tax rate on all income, providing simplicity and predictability but may reduce incentives for reinvestment as it does not differentiate based on income levels or sources. Gradual tax rates under territorial-progressive systems support progressive economic growth by promoting equity and targeted investment, while flat taxes appeal to high earners seeking minimal tax complexity and fixed rates.

International Case Studies and Comparisons

Territorial-progressive taxation systems, implemented in countries like the United States and Japan, tax only income earned within national borders, utilizing progressive rates to address income inequality and fund social services, contrasting with flat taxation models seen in nations such as Estonia and Russia, which apply a single tax rate on global or domestic income to enhance simplicity and economic competitiveness. Studies reveal that territorial-progressive systems tend to generate higher tax revenues and better support redistributive policies, while flat tax regimes often attract foreign investment due to lower compliance costs and straightforward structures. Comparative analyses indicate that blending territorial taxation with progressive rates may balance economic growth with social equity, providing valuable policy insights for countries evaluating tax reform initiatives.

Political Perspectives on Tax Reform

Territorial-progressive taxation appeals to political groups favoring social equity, aiming to redistribute wealth by taxing income based on residency and ability to pay, which supports public services and reduces inequality. Flat taxation attracts proponents advocating economic simplicity and stimulation, arguing a uniform tax rate promotes investment, transparency, and economic growth by minimizing loopholes and administrative costs. Debates often center on the trade-offs between fiscal fairness and economic efficiency, reflecting ideological divides between progressive taxation advocates and flat tax supporters.

Future Trends in Global Taxation

Territorial-progressive taxation is expected to gain traction as countries aim to balance equity with economic competitiveness, taxing only domestic income with graduated rates based on ability to pay. Flat taxation, characterized by a single, fixed rate on all income regardless of source, may decline in popularity due to growing concerns over income inequality and the demand for more redistributive fiscal policies. Future trends indicate a shift towards hybrid models leveraging digital reporting technologies to ensure compliance while enhancing fairness and economic growth globally.

Territorial-progressive taxation Infographic

libterm.com

libterm.com