Regressive taxation imposes a higher relative burden on lower-income individuals, reducing their disposable income and widening economic inequality. Such tax systems often include sales taxes or flat taxes that do not adjust based on the taxpayer's ability to pay. Explore the rest of this article to understand how regressive taxes impact your finances and society as a whole.

Table of Comparison

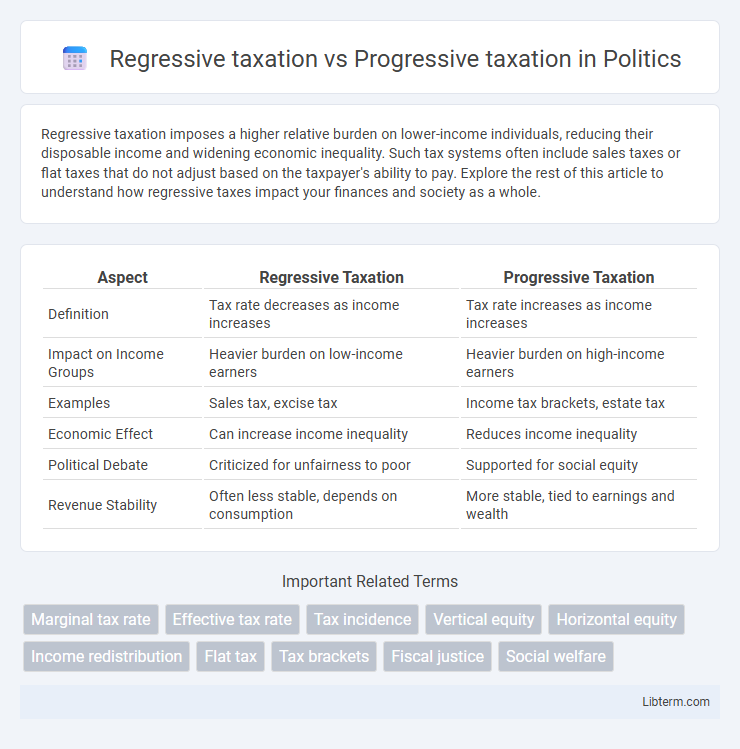

| Aspect | Regressive Taxation | Progressive Taxation |

|---|---|---|

| Definition | Tax rate decreases as income increases | Tax rate increases as income increases |

| Impact on Income Groups | Heavier burden on low-income earners | Heavier burden on high-income earners |

| Examples | Sales tax, excise tax | Income tax brackets, estate tax |

| Economic Effect | Can increase income inequality | Reduces income inequality |

| Political Debate | Criticized for unfairness to poor | Supported for social equity |

| Revenue Stability | Often less stable, depends on consumption | More stable, tied to earnings and wealth |

Introduction to Taxation Systems

Regressive taxation applies a higher tax rate to lower-income individuals, reducing their disposable income and increasing inequality, while progressive taxation levies higher rates on higher incomes, promoting wealth redistribution and social equity. Taxation systems vary globally, with progressive models prevalent in developed economies to fund public services and social programs effectively. Understanding these tax structures is crucial for evaluating fiscal policies and their economic and social impacts.

Defining Regressive and Progressive Taxation

Regressive taxation is a tax system where the tax rate decreases as the taxpayer's income increases, placing a heavier burden on lower-income individuals. Progressive taxation, in contrast, imposes higher tax rates on higher income brackets, ensuring that wealthier individuals contribute a larger percentage of their income. These definitions highlight the fundamental difference in how tax equity and income distribution are addressed through varying tax structures.

Historical Context of Tax Structures

Regressive taxation, historically prominent in early economies, imposed a higher burden on lower-income individuals due to fixed tax rates regardless of income level, exemplified by consumption taxes like sales tax. Progressive taxation emerged during the late 19th and early 20th centuries as industrialization heightened income disparities, leading governments, such as the United States with the Revenue Act of 1913, to introduce graduated income tax rates aimed at wealth redistribution. The evolution of these tax structures reflects socio-economic shifts and policy responses to inequality, shaping modern fiscal systems worldwide.

How Regressive Taxation Works

Regressive taxation imposes a higher relative burden on low-income earners by taxing a smaller percentage of income as earnings increase, often seen in sales taxes or flat taxes on essential goods. This system decreases tax rates as the taxpayer's ability to pay improves, disproportionately impacting those with lower earnings and reducing their disposable income. Regressive taxes lack income sensitivity, making them less equitable compared to progressive taxation, which increases tax rates based on higher income brackets.

How Progressive Taxation Functions

Progressive taxation functions by imposing higher tax rates on individuals with increasing income levels, ensuring that those who earn more contribute a larger percentage of their earnings to government revenues. This tax system utilizes multiple brackets, where income thresholds determine the applicable tax rate, promoting income redistribution and reducing economic inequality. By adjusting rates based on income, progressive taxation funds public services and social programs aimed at supporting lower-income groups and fostering economic equity.

Economic Implications of Tax Models

Regressive taxation places a heavier burden on lower-income individuals by taxing a larger proportion of their income, which can exacerbate income inequality and reduce disposable income for essential spending. Progressive taxation increases tax rates with higher income brackets, promoting wealth redistribution and funding social programs that stimulate economic growth and reduce poverty. The economic implications of these models influence consumer demand, investment incentives, and overall fiscal equity, affecting long-term economic stability and social welfare.

Social Impact: Equity and Fairness

Progressive taxation enhances social equity by imposing higher tax rates on individuals with greater income, thereby redistributing wealth and reducing income inequality. Regressive taxation disproportionately burdens low-income earners, exacerbating economic disparities and undermining fairness in the distribution of tax obligations. The social impact of progressive taxation promotes inclusivity and supports public services that benefit marginalized communities, while regressive systems risk increasing poverty and limiting access to essential resources.

Examples of Regressive vs Progressive Taxes

Sales taxes and excise taxes are common examples of regressive taxation, disproportionately impacting lower-income individuals by consuming a larger share of their earnings. Progressive taxes include income tax systems where tax rates increase with higher income brackets, such as the federal U.S. income tax and many European countries' tax codes. Property taxes can vary but are often considered regressive when lower-income households pay a larger percentage of their income compared to wealthier homeowners.

Policy Debates and Global Perspectives

Regressive taxation, which places a heavier burden on lower-income earners, sparks policy debates centered on economic inequality and social justice, contrasting sharply with progressive taxation that increases tax rates as income rises to promote wealth redistribution. Globally, countries like the United States and Sweden illustrate divergent approaches, where progressive systems aim to fund social programs and reduce poverty, while some developing nations rely on regressive taxes such as sales taxes due to administrative constraints. Policy discussions increasingly emphasize the balance between efficiency, equity, and economic growth, shaping tax reforms that reflect varying economic structures and societal values worldwide.

Future Trends in Taxation Systems

Future trends in taxation systems indicate a shift towards hybrid models that combine elements of regressive and progressive taxation to balance equity and revenue needs. Advances in data analytics and AI enable more precise tax assessments, targeting wealth disparities effectively while minimizing economic distortion. Governments are increasingly exploring dynamic tax brackets and real-time adjustments to accommodate fluctuating income levels and economic conditions, promoting fairness and sustainability.

Regressive taxation Infographic

libterm.com

libterm.com