Mutual ownership empowers you by giving equal stakes to all members, fostering a community-driven approach to business decisions and profits. This model enhances transparency and aligns interests, creating a sustainable and cooperative environment. Discover how mutual ownership can transform your organization by reading the rest of the article.

Table of Comparison

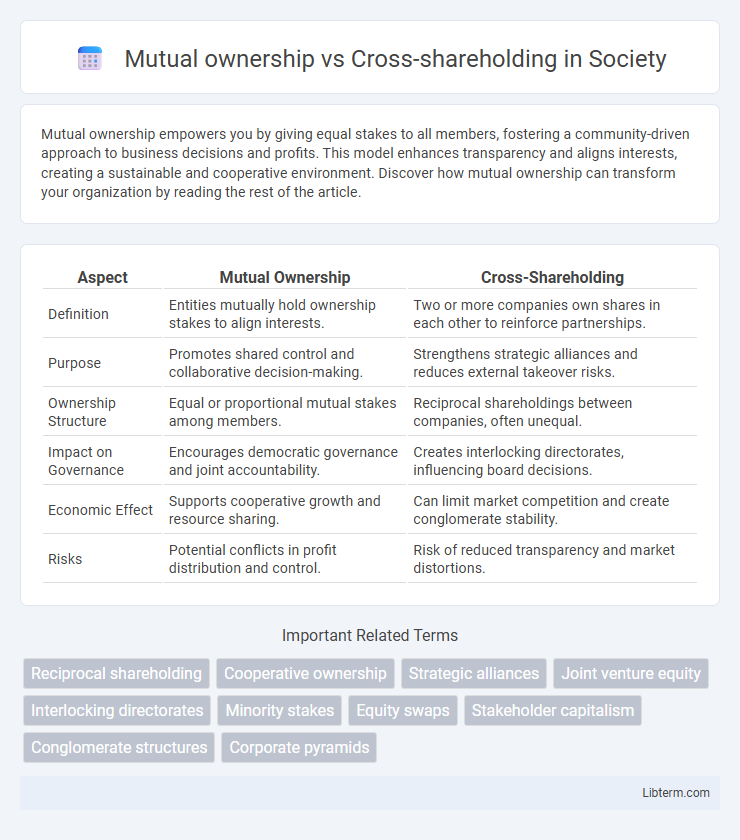

| Aspect | Mutual Ownership | Cross-Shareholding |

|---|---|---|

| Definition | Entities mutually hold ownership stakes to align interests. | Two or more companies own shares in each other to reinforce partnerships. |

| Purpose | Promotes shared control and collaborative decision-making. | Strengthens strategic alliances and reduces external takeover risks. |

| Ownership Structure | Equal or proportional mutual stakes among members. | Reciprocal shareholdings between companies, often unequal. |

| Impact on Governance | Encourages democratic governance and joint accountability. | Creates interlocking directorates, influencing board decisions. |

| Economic Effect | Supports cooperative growth and resource sharing. | Can limit market competition and create conglomerate stability. |

| Risks | Potential conflicts in profit distribution and control. | Risk of reduced transparency and market distortions. |

Introduction to Mutual Ownership and Cross-shareholding

Mutual ownership refers to a business structure where members or customers collectively own the company, sharing profits and decision-making authority, often seen in cooperatives and mutual insurance firms. Cross-shareholding occurs when two or more companies own shares in each other, creating a network of reciprocal equity interests that can strengthen alliances and stabilize ownership but may reduce market transparency. Both structures influence corporate governance and stakeholder relationships by aligning interests internally rather than relying solely on external shareholders.

Defining Mutual Ownership: Concepts and Examples

Mutual ownership refers to a structure where members or stakeholders collectively own and control a company or asset, often seen in cooperatives, mutual insurance firms, and credit unions, exemplified by entities like Nationwide Building Society in the UK. This model emphasizes shared benefits, democratic decision-making, and alignment of interests among members. Unlike cross-shareholding, which involves companies holding stakes in each other to strengthen alliances or deter hostile takeovers, mutual ownership prioritizes member-centric governance and equitable profit distribution.

What is Cross-shareholding? Key Characteristics

Cross-shareholding occurs when two or more companies own shares in each other, creating a network of reciprocal equity relationships. Key characteristics include mutual shareholding stakes that strengthen business ties, reduce takeover risks, and often stabilize stock prices by aligning corporate interests. This structure can lead to complex governance dynamics and potentially limit market competition by entrenching existing management.

Comparative Overview: Mutual Ownership vs Cross-shareholding

Mutual ownership involves two or more entities holding equity stakes in each other to create a balanced control structure, while cross-shareholding refers to a network of companies owning shares in each other, often forming complex interrelated ownership webs. Mutual ownership typically promotes mutual cooperation and aligned strategic goals between fewer parties, whereas cross-shareholding often aims at consolidating control, reducing hostile takeovers, and maintaining long-term partnerships across multiple enterprises. The comparative advantage of mutual ownership lies in clearer governance and profit-sharing arrangements, while cross-shareholding provides enhanced stability and influence within interconnected corporate groups.

Strategic Motivations Behind Each Structure

Mutual ownership structures are strategically motivated by enhancing collaborative control and aligning interests between entities to foster stability and long-term partnerships. Cross-shareholding aims to create defense mechanisms against hostile takeovers, reinforce inter-company alliances, and facilitate shared strategic decision-making. Both structures optimize resource allocation and market positioning but differ in their emphasis on control dynamics and strategic risk management.

Impact on Corporate Governance and Decision-making

Mutual ownership creates aligned interests among shareholders, promoting transparency and cooperative decision-making that strengthens corporate governance frameworks. Cross-shareholding often leads to complex ownership structures, increasing the risk of entrenchment, reducing accountability, and complicating board oversight. Both ownership types influence power dynamics, but mutual ownership generally supports clearer governance mechanisms compared to cross-shareholding's potential for conflicts and managerial protection.

Financial and Legal Implications

Mutual ownership structures often lead to concentrated control, impacting financial transparency and increasing the risk of conflicts of interest, while cross-shareholding can create complex interdependencies that complicate financial reporting and valuation. Legally, mutual ownership may face fewer regulatory barriers but risks antitrust concerns, whereas cross-shareholding arrangements often require careful compliance with securities laws to prevent market manipulation and ensure disclosure. Both structures can influence corporate governance stability, affecting investors' rights and the enforceability of fiduciary duties.

Risks and Benefits: A Comparative Analysis

Mutual ownership fosters shared control among stakeholders, enhancing collaboration but increasing risk of decision-making gridlock and reduced accountability. Cross-shareholding stabilizes corporate alliances by aligning interests between companies, yet it raises concerns over reduced market competition and potential conflicts of interest. Evaluating these structures requires assessing trade-offs between governance efficiency, strategic flexibility, and the impact on shareholder value.

Global Case Studies: Real-world Applications

Mutual ownership involves companies owning significant shares in each other to strengthen business alliances and stabilize management, as seen in Japanese keiretsu networks such as Mitsubishi and Sumitomo, which enhance long-term corporate cooperation. Cross-shareholding refers to reciprocal equity stakes, frequently used in South Korean chaebols like Samsung and Hyundai, to consolidate control and deter hostile takeovers while complicating governance transparency. European examples include Allianz and BMW's cross-shareholding, facilitating strategic partnerships and financial synergy, demonstrating diverse applications of these structures globally.

Future Trends in Ownership Structures

Mutual ownership, characterized by cooperative member control, is evolving with increasing digital integration and stakeholder inclusivity, while cross-shareholding, involving reciprocal equity stakes among corporations, faces regulatory scrutiny due to anti-competitive concerns. Future trends suggest a shift toward hybrid ownership models combining mutual benefits with strategic equity alliances to enhance corporate resilience and innovation. Blockchain technology and decentralized finance are expected to further transform ownership transparency and governance in both structures.

Mutual ownership Infographic

libterm.com

libterm.com