The working class forms the backbone of modern economies by driving industrial production and providing essential services across various sectors. Understanding the challenges and opportunities faced by your working-class community can reveal insights into income inequality, labor rights, and social mobility. Explore the rest of the article to learn how these factors shape everyday life and influence broader economic trends.

Table of Comparison

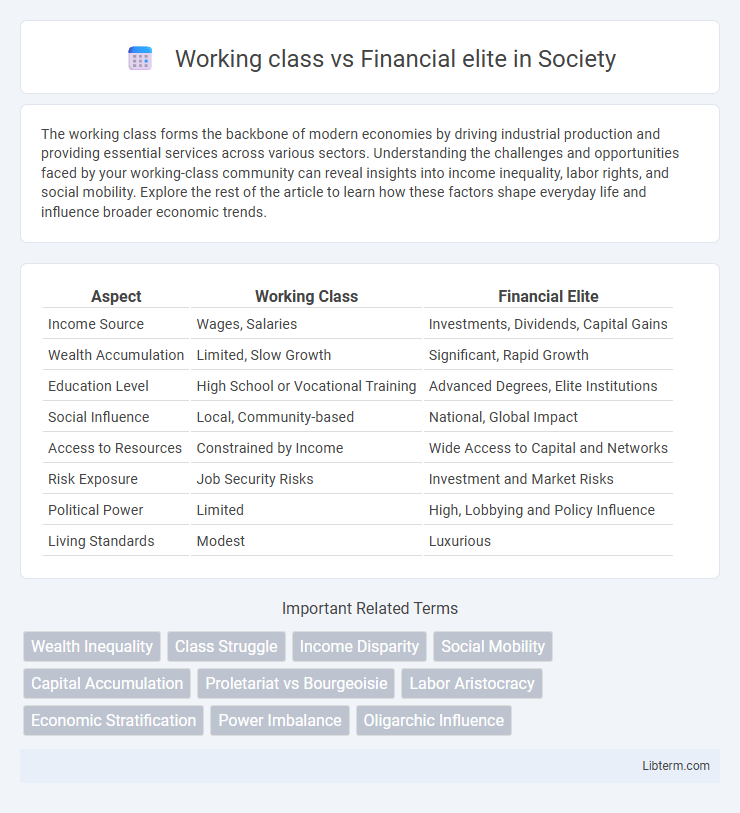

| Aspect | Working Class | Financial Elite |

|---|---|---|

| Income Source | Wages, Salaries | Investments, Dividends, Capital Gains |

| Wealth Accumulation | Limited, Slow Growth | Significant, Rapid Growth |

| Education Level | High School or Vocational Training | Advanced Degrees, Elite Institutions |

| Social Influence | Local, Community-based | National, Global Impact |

| Access to Resources | Constrained by Income | Wide Access to Capital and Networks |

| Risk Exposure | Job Security Risks | Investment and Market Risks |

| Political Power | Limited | High, Lobbying and Policy Influence |

| Living Standards | Modest | Luxurious |

Understanding the Working Class and Financial Elite

The working class primarily consists of individuals engaged in manual labor, skilled trades, and service-oriented jobs, often earning hourly wages tied to physical or routine tasks. The financial elite, in contrast, control substantial assets, investments, and capital, leveraging their wealth to influence markets and policy decisions. Understanding the distinct economic roles, income sources, and social influence of these groups reveals the structural dynamics shaping inequality and social mobility in modern economies.

Historical Roots of Class Divides

The historical roots of class divides between the working class and the financial elite trace back to the Industrial Revolution, which drastically shifted economic power towards capital owners and created a distinct laboring class. Feudal systems and colonial exploitation further entrenched economic hierarchies by concentrating wealth and political influence within a small elite, leaving the majority dependent on wage labor. The emergence of financial institutions and global capitalism in the 19th and 20th centuries amplified disparities, as wealth accumulation became increasingly linked to capital ownership rather than labor.

Income Inequality: Causes and Consequences

Income inequality between the working class and financial elite stems primarily from disparities in wages, capital ownership, and access to education and technology. The financial elite accumulate wealth through investments, stock ownership, and control of corporations, while the working class relies mostly on wages that have stagnated relative to productivity gains. This income gap fuels social stratification, limits social mobility, and exacerbates economic instability and political polarization.

Education and Economic Mobility

Educational access remains a critical factor influencing economic mobility, with the working class often facing barriers such as underfunded schools and limited higher education opportunities. The financial elite benefit from elite institutions, extensive networks, and legacy admissions that enhance their social capital and economic prospects. These disparities in education create a persistent cycle where economic mobility is hindered for the working class while the financial elite consolidate wealth and influence across generations.

Employment Opportunities and Job Security

Employment opportunities for the working class are often concentrated in sectors with limited wage growth and precarious job security, such as manufacturing, retail, and service industries. In contrast, the financial elite benefit from access to high-paying roles in finance, technology, and executive management, where job stability is bolstered by extensive professional networks and capital resources. Economic disparities between these groups are reinforced by differences in education, skills training, and market influence, affecting long-term career advancement and financial resilience.

Wealth Accumulation and Asset Ownership

The financial elite accumulate wealth primarily through diversified asset ownership, including stocks, real estate, and business equity, enabling significant capital growth and passive income streams. In contrast, the working class relies mainly on wages with limited asset accumulation, often facing barriers to investment opportunities and wealth-building tools. This disparity in asset ownership perpetuates economic inequality, as the financial elite leverage portfolio appreciation and financial instruments to expand their wealth exponentially.

Social Influence and Political Power

The financial elite exert significant social influence through wealth-driven networks, media ownership, and philanthropy, shaping public opinion and cultural norms to favor their interests. In contrast, the working class often lacks direct access to elite platforms, limiting their ability to influence social narratives and maintain a cohesive collective identity. Political power tends to be concentrated among financial elites who fund campaigns, lobby policymakers, and establish institutional frameworks that reinforce economic inequalities, whereas the working class faces systemic barriers to political representation and policy impact.

Lifestyles, Values, and Cultural Differences

The working class often prioritizes job security, community ties, and practical spending habits, while the financial elite tend to value wealth accumulation, luxury experiences, and exclusivity in social circles. Lifestyle differences manifest in housing choices, where the working class favors modest, functional homes and the financial elite invest in opulent properties and multiple residences. Cultural distinctions arise in education and entertainment preferences, with the working class engaging in accessible local events and the financial elite participating in elite institutions and global cultural affairs.

The Role of Government Policies

Government policies significantly shape the economic divide between the working class and the financial elite by determining tax structures, labor regulations, and social welfare programs. Progressive taxation and robust labor rights tend to support income redistribution and improve social mobility for the working class, while deregulation and tax incentives often concentrate wealth among the financial elite. Public investment in education, healthcare, and affordable housing further influences the balance of economic opportunity and security between these two groups.

Bridging the Gap: Solutions and Future Outlook

Bridging the gap between the working class and the financial elite requires targeted policies promoting equitable access to quality education, affordable healthcare, and fair wages. Investment in workforce development programs and expanded social safety nets can reduce income disparity and enhance economic mobility. Future outlooks emphasize inclusive growth through progressive taxation and corporate responsibility to foster a more balanced and sustainable economy.

Working class Infographic

libterm.com

libterm.com