Systemic risk refers to the potential collapse of an entire financial system or market due to the failure of a single entity or group of entities, causing widespread instability. This type of risk can trigger severe economic disruptions, affecting banks, investors, and the broader economy. Dive into the rest of the article to understand how systemic risk impacts your financial security and what measures can mitigate its effects.

Table of Comparison

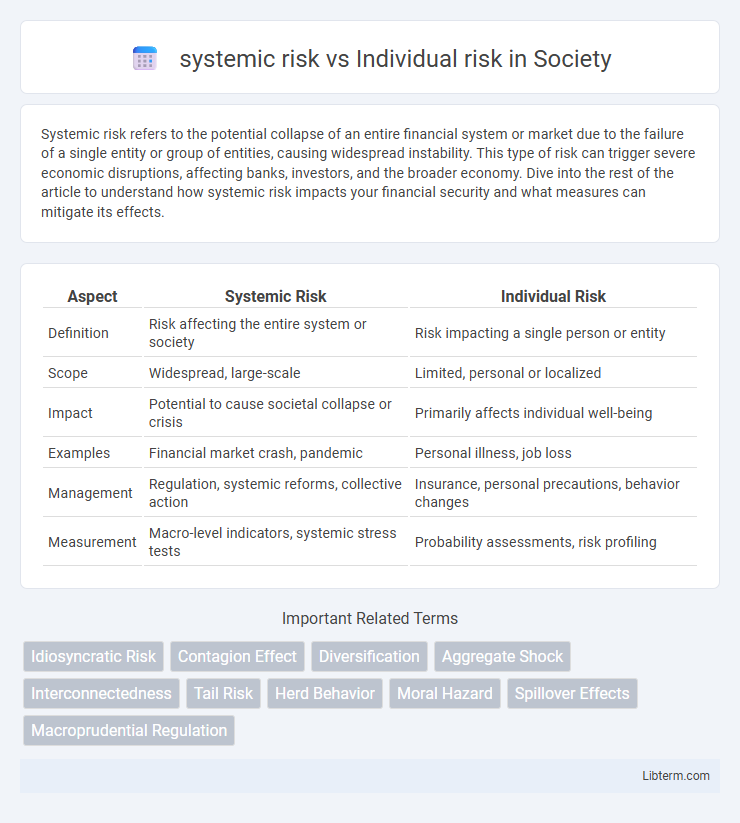

| Aspect | Systemic Risk | Individual Risk |

|---|---|---|

| Definition | Risk affecting the entire system or society | Risk impacting a single person or entity |

| Scope | Widespread, large-scale | Limited, personal or localized |

| Impact | Potential to cause societal collapse or crisis | Primarily affects individual well-being |

| Examples | Financial market crash, pandemic | Personal illness, job loss |

| Management | Regulation, systemic reforms, collective action | Insurance, personal precautions, behavior changes |

| Measurement | Macro-level indicators, systemic stress tests | Probability assessments, risk profiling |

Understanding Systemic Risk: A Comprehensive Overview

Systemic risk refers to the potential collapse of an entire financial system or market, driven by the interconnectedness and interdependencies among institutions, which contrasts with individual risk that affects a single entity. It encompasses risks arising from widespread economic factors, contagion effects, and the failure of key institutions, amplifying the impact across the financial ecosystem. Understanding systemic risk requires analyzing network vulnerabilities, market correlations, and regulatory frameworks designed to mitigate cascading failures.

Defining Individual Risk in Modern Contexts

Individual risk in modern contexts refers to the probability and impact of adverse events affecting a single person or entity, measured through factors like health, financial stability, and behavioral patterns. It contrasts with systemic risk, which involves widespread disruptions impacting entire systems or populations, such as financial markets or public health infrastructures. Advances in data analytics and personalized technology have enhanced the assessment and management of individual risk by enabling tailored interventions and real-time monitoring.

Key Differences Between Systemic and Individual Risk

Systemic risk refers to the possibility of collapse of an entire financial system or market due to interconnections and contagion effects, affecting multiple institutions simultaneously, whereas individual risk pertains to the potential loss faced by a single entity or investment. Systemic risk impacts broader economic stability and often triggers widespread financial crises, while individual risk is limited to idiosyncratic factors specific to one organization, such as management failure or operational errors. Understanding these key differences is crucial for risk management strategies, as systemic risk requires regulatory oversight and systemic safeguards, whereas individual risk is managed through diversification and internal controls.

Common Sources of Systemic Risk

Common sources of systemic risk include interconnected financial institutions, market-wide failures, and macroeconomic shocks that collectively threaten the stability of the entire financial system. These risks differ from individual risk, which affects single entities without necessarily impacting the broader market. Understanding systemic risk involves analyzing factors such as liquidity shortages, concentration of exposures, and contagion effects that amplify disruptions across the financial network.

Factors Influencing Individual Risk Exposure

Individual risk exposure is influenced by factors such as personal behavior, health status, and financial stability, which directly affect one's vulnerability to specific hazards. Variables like lifestyle choices, occupational hazards, and access to preventive measures play critical roles in determining the magnitude of personal risk. Unlike systemic risk, which impacts entire systems or markets, individual risk is shaped by unique, localized conditions and personal decision-making processes.

Impact of Systemic Risk on Financial Markets

Systemic risk in financial markets refers to the potential collapse of an entire financial system or market, triggered by the failure of a single entity or group of entities, leading to widespread economic disruption. Unlike individual risk, which affects specific institutions or assets, systemic risk can cause cascading failures, liquidity shortages, and severe declines in market confidence, drastically impacting investment portfolios, credit availability, and global economic stability. Key events such as the 2008 financial crisis illustrate how systemic risk amplifies market volatility and necessitates robust regulatory frameworks to safeguard financial stability.

Strategies for Managing Individual Risk

Effective strategies for managing individual risk include diversification, insurance, and regular risk assessments tailored to personal circumstances. Diversification minimizes exposure to any single asset or sector, reducing potential losses, while insurance safeguards against unforeseen events such as health issues, property damage, or liability claims. Conducting periodic risk evaluations helps identify emerging threats and adjust financial plans accordingly, ensuring resilience against individual uncertainties.

Regulatory Approaches to Systemic Risk Mitigation

Regulatory approaches to systemic risk mitigation prioritize macroprudential policies designed to address threats to the entire financial system, such as capital buffers, stress testing, and the designation of systemically important financial institutions (SIFIs). These regulations differ from individual risk management, which targets risks faced by single entities through microprudential measures like credit risk assessment and internal controls. Effective systemic risk regulation requires coordination among central banks, financial authorities, and international bodies to ensure stability and prevent contagion across interconnected markets.

Case Studies: Systemic Risk vs. Individual Risk Events

Case studies reveal how systemic risk events, such as the 2008 financial crisis triggered by the collapse of Lehman Brothers, cause widespread market disruptions affecting entire economies compared to individual risk incidents limited to single entities like the bankruptcy of Enron. Systemic risks propagate through interconnected financial institutions, leading to cascading failures, whereas individual risks impact only isolated companies or sectors. Understanding these distinctions aids financial regulators in designing policies to mitigate large-scale economic consequences stemming from systemic events.

Future Trends in Risk Assessment and Management

Future trends in risk assessment emphasize the integration of systemic risk analysis alongside traditional individual risk models, leveraging big data and advanced analytics to capture interconnected vulnerabilities across financial systems. Enhanced machine learning algorithms enable predictive insights into cascading failures, improving the management of systemic threats that individual risk assessments might overlook. Emphasizing real-time monitoring and scenario simulations, organizations are adopting dynamic frameworks to better anticipate and mitigate both systemic and individual risks in increasingly complex environments.

systemic risk Infographic

libterm.com

libterm.com