A corporate conglomerate consists of diverse businesses operating under a single parent company, spanning multiple industries to reduce risk and enhance growth opportunities. These entities leverage shared resources and management to achieve economies of scale and competitive advantages in various markets. Explore the rest of the article to understand how corporate conglomerates impact your investment strategies and business landscapes.

Table of Comparison

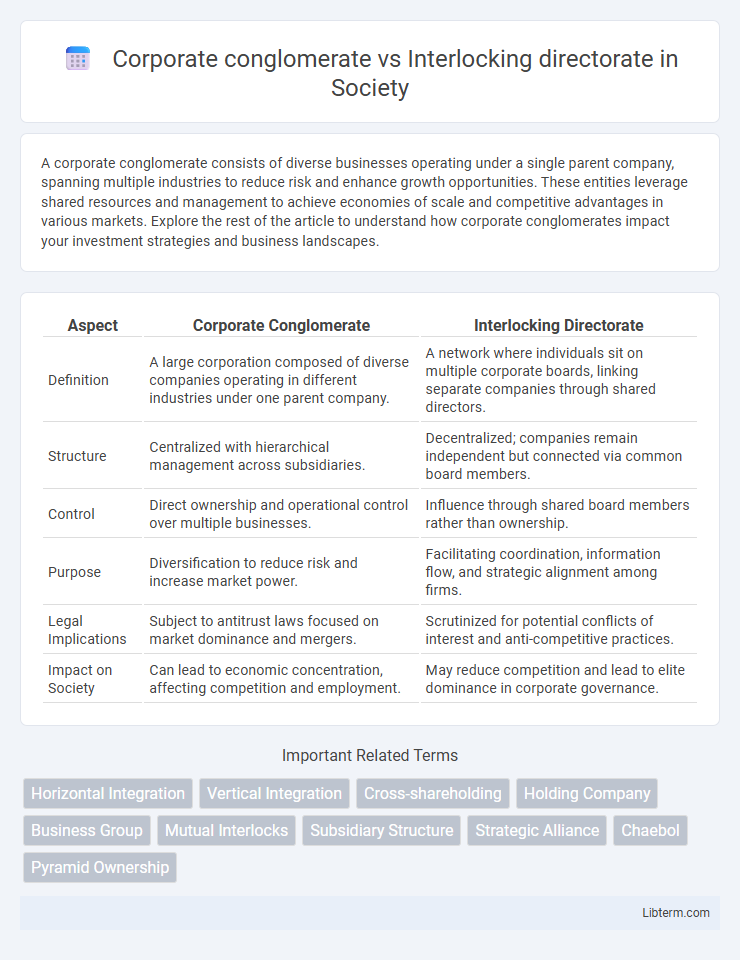

| Aspect | Corporate Conglomerate | Interlocking Directorate |

|---|---|---|

| Definition | A large corporation composed of diverse companies operating in different industries under one parent company. | A network where individuals sit on multiple corporate boards, linking separate companies through shared directors. |

| Structure | Centralized with hierarchical management across subsidiaries. | Decentralized; companies remain independent but connected via common board members. |

| Control | Direct ownership and operational control over multiple businesses. | Influence through shared board members rather than ownership. |

| Purpose | Diversification to reduce risk and increase market power. | Facilitating coordination, information flow, and strategic alignment among firms. |

| Legal Implications | Subject to antitrust laws focused on market dominance and mergers. | Scrutinized for potential conflicts of interest and anti-competitive practices. |

| Impact on Society | Can lead to economic concentration, affecting competition and employment. | May reduce competition and lead to elite dominance in corporate governance. |

Introduction to Corporate Conglomerates

Corporate conglomerates consist of multiple diverse businesses operating under a single corporate group, aiming to diversify risk and maximize profit through acquisitions in various industries. These conglomerates leverage economies of scale and cross-industry synergies to enhance competitive advantage and financial stability. Unlike interlocking directorates, which involve shared board members between separate companies, conglomerates are unified entities with centralized management overseeing diverse operations.

Understanding Interlocking Directorates

Interlocking directorates occur when a member of the board of directors of one corporation sits on the board of another, creating a network of overlapping directorships that influence corporate governance. This practice can facilitate coordination and information sharing between companies but may also raise concerns about conflicts of interest and reduced competition. Understanding interlocking directorates is essential for analyzing corporate control structures and their impact on market dynamics.

Key Characteristics of Corporate Conglomerates

Corporate conglomerates are large business entities comprising multiple diversified companies operating across various industries, often characterized by centralized management and financial control. They aim to reduce risk through portfolio diversification and leverage economies of scale in operations and capital allocation. Unlike interlocking directorates, which involve shared board members across separate firms without ownership integration, conglomerates maintain direct ownership and consolidate financial reporting.

Defining Features of Interlocking Directorates

Interlocking directorates occur when a member of a company's board of directors simultaneously serves on the board of another company, creating a network of interconnected firms that share governance and strategic influence. This structure facilitates information sharing, coordinated decision-making, and potential collusion between corporations, distinguishing it from a corporate conglomerate, which is a single company owning multiple unrelated businesses under one central management. Key defining features of interlocking directorates include overlapping board memberships, strategic alliances formed through shared directors, and regulatory scrutiny due to concerns over reduced competition and conflicts of interest.

Differences in Structure and Organization

Corporate conglomerates consist of multiple diversified businesses under a single parent company, each operating independently but unified by centralized ownership and financial control. Interlocking directorates involve individuals serving on the boards of directors of multiple, often unrelated, companies, creating informal networks through shared governance rather than direct corporate integration. The primary structural difference lies in conglomerates' legal and financial consolidation versus interlocking directorates' reliance on shared board membership to influence multiple organizations without direct corporate ownership.

Strategic Goals: Conglomerates vs. Interlocks

Corporate conglomerates pursue strategic goals centered on diversification to reduce risk and capitalize on multiple industry sectors, aiming for financial stability and market power expansion. Interlocking directorates focus on strategic alignment and coordination between firms, facilitating information flow and collaborative decision-making to influence industry standards and competitive strategies. Conglomerates leverage internal resource allocation while interlocks enhance inter-firm connectivity and governance to achieve long-term competitive advantage.

Impact on Market Competition

Corporate conglomerates reduce market competition by consolidating diverse businesses under one entity, enabling resource sharing and market power concentration. Interlocking directorates affect competition by facilitating strategic alliances or tacit collusion among firms through shared board members, potentially reducing competitive pressures. Both mechanisms influence market dynamics, but conglomerates centralize control, while interlocking directorates create informal networks impacting competitive behavior.

Regulatory Challenges and Legal Implications

Corporate conglomerates face regulatory challenges due to their vast market influence, raising antitrust concerns and requiring scrutiny under laws like the Sherman Act to prevent monopolistic practices. Interlocking directorates, where board members serve on multiple companies, lead to conflicts of interest and potential violations of Section 8 of the Clayton Act, which restricts such overlaps to maintain competitive fairness. Both structures compel regulatory agencies like the Federal Trade Commission (FTC) and the Department of Justice (DOJ) to enforce compliance and navigate complex legal implications surrounding market competition and corporate governance.

Influence on Corporate Governance

Corporate conglomerates consolidate diverse business entities under a single corporate group, centralizing decision-making and potentially streamlining governance processes by unifying strategic objectives across subsidiaries. Interlocking directorates involve overlapping board memberships between separate corporations, facilitating informal networks of influence that can affect competitive dynamics and corporate policies. While conglomerates enhance internal governance coherence, interlocking directorates pose challenges for regulatory oversight due to potential conflicts of interest and diluted accountability in shareholder representation.

Future Trends: Conglomerates and Interlocking Directorates

Corporate conglomerates are likely to evolve through strategic diversification driven by emerging technologies and global market expansion, enhancing synergies among varied business units. Interlocking directorates will increasingly leverage digital governance tools and data analytics to optimize board performance and accelerate decision-making processes. Future trends indicate a convergence where conglomerates utilize interlocking directorates to foster cross-industry collaboration and innovation, boosting competitive advantage.

Corporate conglomerate Infographic

libterm.com

libterm.com