Normalization enhances database efficiency by organizing data to reduce redundancy and improve data integrity. It involves decomposing tables into smaller, related ones to streamline queries and updates. Explore the rest of the article to understand how normalization can optimize your database performance.

Table of Comparison

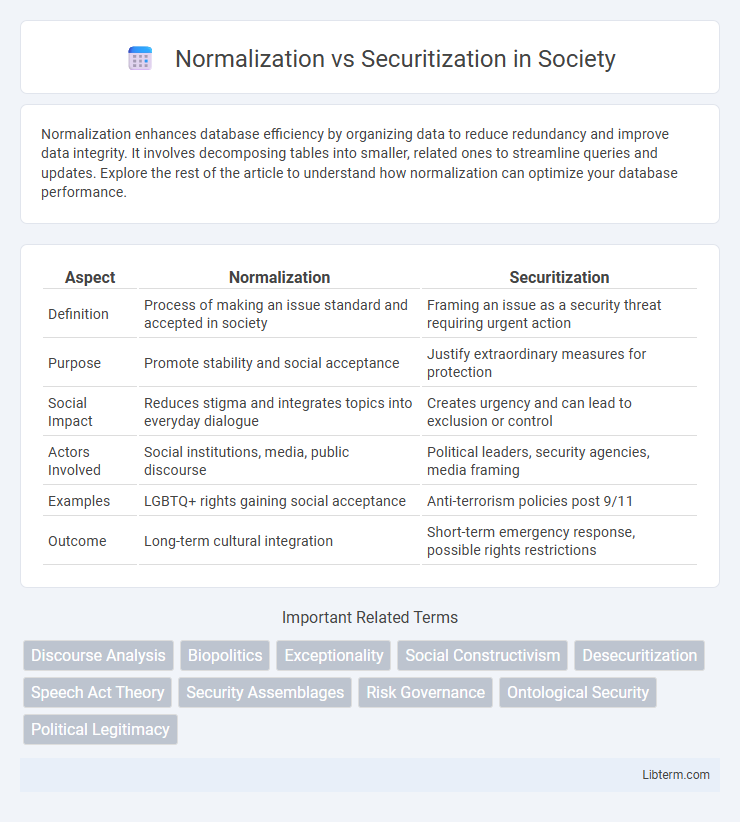

| Aspect | Normalization | Securitization |

|---|---|---|

| Definition | Process of making an issue standard and accepted in society | Framing an issue as a security threat requiring urgent action |

| Purpose | Promote stability and social acceptance | Justify extraordinary measures for protection |

| Social Impact | Reduces stigma and integrates topics into everyday dialogue | Creates urgency and can lead to exclusion or control |

| Actors Involved | Social institutions, media, public discourse | Political leaders, security agencies, media framing |

| Examples | LGBTQ+ rights gaining social acceptance | Anti-terrorism policies post 9/11 |

| Outcome | Long-term cultural integration | Short-term emergency response, possible rights restrictions |

Understanding Normalization and Securitization: Definitions

Normalization refers to the process of organizing data to reduce redundancy and improve database efficiency by structuring tables according to specific rules or normal forms. Securitization is a financial practice where illiquid assets are pooled together and converted into marketable securities, allowing for risk distribution and liquidity enhancement. Understanding normalization and securitization involves recognizing their core purposes: normalization optimizes data integrity and storage, while securitization transforms assets into tradeable financial instruments.

Historical Context and Evolution

Normalization originated during the 1970s as a database design methodology aimed at reducing data redundancy and improving integrity by organizing data into related tables through functional dependencies. Securitization emerged in the 1980s within the financial industry as a process of pooling various types of debt instruments, such as mortgages and loans, and transforming them into marketable securities to enhance liquidity and risk management. The evolution of normalization and securitization reflects their distinct purposes: normalization's foundation in relational database theory by Edgar F. Codd, contrasted with securitization's roots in financial innovation responding to capital market demands.

Key Differences Between Normalization and Securitization

Normalization involves restructuring data to minimize redundancy and improve data integrity, primarily in database management systems. Securitization is a financial process that pools various types of debt and repackages them into securities sold to investors, shifting credit risk away from the originator. The key differences lie in their domains--normalization pertains to data organization, while securitization deals with financial asset management and risk distribution.

Theoretical Foundations and Frameworks

Normalization is grounded in sociological and political theory frameworks that explain how radical ideas become mainstream through gradual acceptance and institutional adaptation, emphasizing discursive practices and power relations. Securitization theory, rooted in the Copenhagen School, focuses on the process by which state actors frame issues as existential threats, justifying extraordinary measures beyond ordinary political procedures. Both frameworks explore the social construction of reality but differ in their mechanisms: normalization deals with integration and routinization, while securitization centers on crisis framing and urgent security responses.

Applications in Policy and Governance

Normalization in policy emphasizes embedding practices that stabilize governance frameworks, ensuring consistent regulatory environments and institutional trust. Securitization involves framing issues as security threats, enabling extraordinary measures and resource allocation to address crises or perceived dangers in public policy. Governments apply normalization to maintain long-term policy coherence, while securitization is used in counterterrorism, migration, and emergency response to justify intensified political and legal actions.

Impacts on Society and Social Perception

Normalization shapes social perceptions by embedding certain behaviors or ideas as standard, reducing stigma and fostering acceptance within communities. Securitization frames issues as threats, leading to heightened vigilance, exclusion, or control measures that can marginalize groups and heighten social tensions. The societal impact of normalization promotes integration and stability, whereas securitization often triggers fear, polarization, and challenges to civil liberties.

Security Studies: Role in Shaping Discourse

Normalization in security studies involves integrating security practices into everyday political and social processes, shaping public perception by making certain threats appear routine and manageable. Securitization theory emphasizes how political actors construct issues as existential threats, justifying extraordinary measures and shifting discourse towards emergency politics. Both concepts critically influence how security agendas are framed, legitimizing specific policies and altering the boundaries between normal governance and crisis response.

Case Studies: Real-World Examples

Normalization in data management is exemplified by the case study of Amazon's inventory system, where structured schemas reduce redundancy and improve query efficiency, enhancing operational scalability. Conversely, securitization in finance is illustrated by the 2008 mortgage crisis, where mortgage-backed securities (MBS) bundled loans to distribute risk, but also introduced systemic vulnerabilities due to lack of transparency and asset quality deterioration. These real-world examples highlight how normalization optimizes data integrity and performance, while securitization transforms asset liquidity and risk distribution, each with distinct implications across industries.

Challenges and Criticisms

Normalization faces challenges such as oversimplification of complex social issues and the risk of reinforcing existing inequalities by promoting conformity. Securitization is criticized for its tendency to prioritize security measures over individual rights, often leading to increased surveillance and potential human rights violations. Both concepts struggle with balancing effectiveness while avoiding unintended negative societal impacts, highlighting the need for nuanced policy approaches.

Future Trends and Implications

Future trends in normalization emphasize enhanced interoperability and streamlined data integration across diverse systems, fostering more efficient information exchange and processing. Securitization is evolving with advanced blockchain technologies and smart contracts, improving transparency and reducing risks in asset-backed securities markets. These developments imply a shift toward more automated, secure, and scalable financial infrastructures, driving innovation in risk management and regulatory compliance.

Normalization Infographic

libterm.com

libterm.com