Means-tested welfare programs allocate benefits based on an individual's income and financial resources, ensuring assistance reaches those who need it most. These programs often cover essential needs such as housing, healthcare, and food security, directly supporting vulnerable populations. Explore the rest of the article to understand how means-tested welfare impacts your community and the broader social safety net.

Table of Comparison

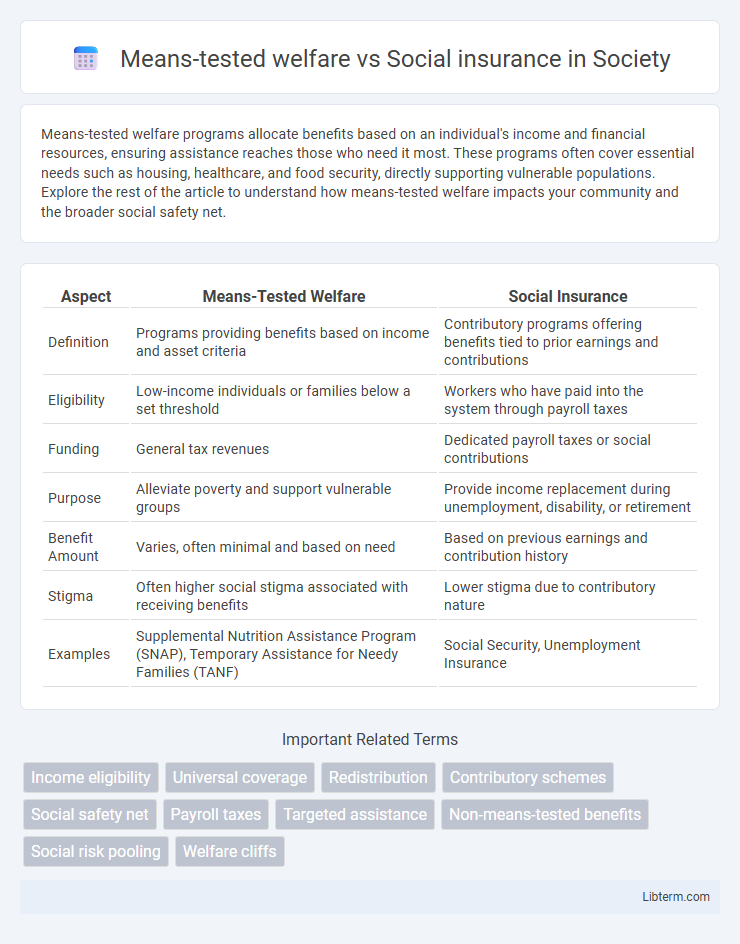

| Aspect | Means-Tested Welfare | Social Insurance |

|---|---|---|

| Definition | Programs providing benefits based on income and asset criteria | Contributory programs offering benefits tied to prior earnings and contributions |

| Eligibility | Low-income individuals or families below a set threshold | Workers who have paid into the system through payroll taxes |

| Funding | General tax revenues | Dedicated payroll taxes or social contributions |

| Purpose | Alleviate poverty and support vulnerable groups | Provide income replacement during unemployment, disability, or retirement |

| Benefit Amount | Varies, often minimal and based on need | Based on previous earnings and contribution history |

| Stigma | Often higher social stigma associated with receiving benefits | Lower stigma due to contributory nature |

| Examples | Supplemental Nutrition Assistance Program (SNAP), Temporary Assistance for Needy Families (TANF) | Social Security, Unemployment Insurance |

Introduction to Means-Tested Welfare and Social Insurance

Means-tested welfare programs provide financial assistance to individuals or families based on their income and assets falling below a specific threshold, targeting low-income populations to reduce poverty and support basic needs. Social insurance systems, such as Social Security or unemployment benefits, operate on contributory principles where eligibility and benefits depend on prior work history and contributions to the insurance fund. Both welfare types aim to enhance economic security, but means-tested welfare focuses on need-based eligibility while social insurance prioritizes risk pooling and earned entitlements.

Defining Means-Tested Welfare Programs

Means-tested welfare programs provide financial assistance to individuals and families based on their income and asset levels, ensuring support reaches those with the greatest economic need. These programs often include food stamps, Medicaid, and housing subsidies, targeting vulnerable populations below specific income thresholds. Unlike social insurance, which offers benefits based on prior contributions, means-tested welfare is designed to alleviate poverty by addressing immediate economic disparities through eligibility criteria.

What is Social Insurance?

Social insurance is a government program designed to provide financial support to individuals based on prior contributions through payroll taxes, covering risks such as unemployment, disability, and retirement. Unlike means-tested welfare, social insurance benefits are not dependent on current income or assets but on eligibility criteria related to work history and contributions. Examples include Social Security in the United States and unemployment insurance programs worldwide.

Key Differences Between Means-Tested Welfare and Social Insurance

Means-tested welfare programs provide financial assistance based on household income and assets, ensuring support reaches individuals and families below a specified poverty threshold. Social insurance involves contributory schemes where individuals pay premiums or taxes during employment, qualifying for benefits such as unemployment, disability, or retirement regardless of current income. The primary difference lies in eligibility criteria--means-tested welfare targets low-income populations through income verification, while social insurance offers universal or work-history-based coverage without strict income testing.

Eligibility Criteria: Means-Tested vs Social Insurance

Means-tested welfare programs determine eligibility based on income and asset limits, targeting low-income individuals or families who fall below a specific financial threshold. Social insurance programs require participants to meet work history or contribution requirements, such as paying payroll taxes, ensuring benefits are provided to those who have contributed over time. Eligibility for means-tested welfare is assessed through current financial need, while social insurance eligibility relies on prior participation and earnings records.

Funding Mechanisms and Cost Distribution

Means-tested welfare programs are primarily funded through general tax revenues, targeting resources to individuals with low income or assets, thus concentrating costs on the broader taxpayer base. Social insurance schemes rely on dedicated payroll taxes or contributions from employers and employees, distributing costs proportionally among current workers and beneficiaries based on earnings history. The distinct funding mechanisms result in divergent cost distribution, with means-tested welfare emphasizing redistribution and social insurance fostering a contributory risk-sharing model.

Advantages of Means-Tested Welfare

Means-tested welfare programs target financial aid to low-income individuals and families, ensuring resources are allocated to those most in need, which enhances economic equity and reduces poverty rates effectively. These programs often require proof of income or assets, improving the efficiency of government spending by limiting benefits to eligible recipients instead of broad population coverage. By concentrating support, means-tested welfare can address specific disparities and urgent social issues more directly than broader social insurance schemes.

Strengths and Limitations of Social Insurance

Social insurance programs, such as Social Security and unemployment insurance, offer broad-based coverage funded by payroll taxes, ensuring financial protection against specific risks like retirement, disability, or job loss. Their strength lies in promoting social solidarity and providing stable, predictable benefits to contributors, reducing dependency on government charity. However, limitations include exclusion of informal or low-wage workers, potential under-coverage for marginalized groups, and rigid eligibility criteria that may not address all individual needs effectively.

Societal Impacts and Public Perceptions

Means-tested welfare programs target assistance to low-income individuals, often reducing poverty but sometimes stigmatizing recipients and creating public debates about fairness. Social insurance schemes, funded by contributions from workers and employers, foster a sense of collective responsibility and receive broader public support due to perceived earned entitlement. Societal impacts vary as means-tested welfare can generate dependency concerns, while social insurance promotes social cohesion and long-term economic security.

Future Trends in Social Protection Systems

Means-tested welfare programs will increasingly target resources to vulnerable populations by leveraging advanced data analytics for precise eligibility assessments, enhancing efficiency and reducing fraud. Social insurance schemes are projected to expand coverage and incorporate flexible contribution models to address demographic shifts such as aging populations and changing labor market patterns. Integration of digital platforms and real-time monitoring is expected to improve responsiveness and adaptability of social protection systems, balancing fiscal sustainability with inclusive support.

Means-tested welfare Infographic

libterm.com

libterm.com