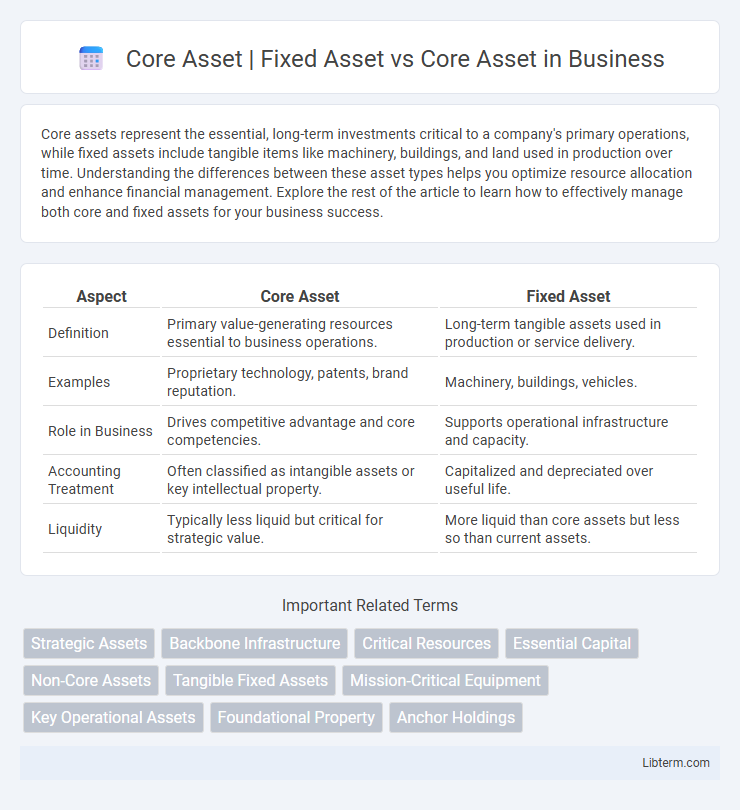

Core assets represent the essential, long-term investments critical to a company's primary operations, while fixed assets include tangible items like machinery, buildings, and land used in production over time. Understanding the differences between these asset types helps you optimize resource allocation and enhance financial management. Explore the rest of the article to learn how to effectively manage both core and fixed assets for your business success.

Table of Comparison

| Aspect | Core Asset | Fixed Asset |

|---|---|---|

| Definition | Primary value-generating resources essential to business operations. | Long-term tangible assets used in production or service delivery. |

| Examples | Proprietary technology, patents, brand reputation. | Machinery, buildings, vehicles. |

| Role in Business | Drives competitive advantage and core competencies. | Supports operational infrastructure and capacity. |

| Accounting Treatment | Often classified as intangible assets or key intellectual property. | Capitalized and depreciated over useful life. |

| Liquidity | Typically less liquid but critical for strategic value. | More liquid than core assets but less so than current assets. |

Introduction to Core Assets

Core assets represent essential, high-value resources fundamental to a company's operations and long-term competitiveness, often including intellectual property, key technologies, and critical infrastructure. Unlike fixed assets, which are tangible and depreciable physical items such as machinery and buildings, core assets encompass both tangible and intangible elements that drive strategic advantage and innovation. Understanding core assets is vital for effective asset management and maximizing organizational value beyond traditional fixed asset accounting.

Defining Fixed Assets

Fixed assets are tangible long-term resources used in business operations, such as machinery, buildings, and land, crucial for producing goods or services. Core assets represent essential fixed assets that provide the foundational value and operational capacity driving a company's primary business activities. Defining fixed assets involves recognizing these non-current assets, recorded on the balance sheet, which depreciate over time but are vital for sustained revenue generation.

Core Assets vs Fixed Assets: Key Differences

Core assets represent essential resources critical to a company's primary operations, often including intellectual property, patents, and software, while fixed assets are tangible, long-term physical items like buildings, machinery, and equipment. Unlike fixed assets that appear on the balance sheet and depreciate over time, core assets may not always be physical or capitalized but provide ongoing strategic value and competitive advantage. The key difference lies in core assets driving fundamental business value and growth, whereas fixed assets primarily support operational infrastructure.

The Strategic Importance of Core Assets

Core assets represent essential resources that provide sustained competitive advantage and long-term value creation, distinguishing them from fixed assets, which primarily serve operational functions and are valued based on depreciation. The strategic importance of core assets lies in their ability to drive innovation, facilitate market differentiation, and support scalable growth through unique capabilities or intellectual property. Companies leveraging core assets effectively enhance shareholder value by transforming these strategic resources into sustainable revenue streams and durable market positioning.

Role of Fixed Assets in Business Operations

Fixed assets, including buildings, machinery, and equipment, serve as essential components for core asset management by providing the necessary infrastructure to sustain daily business operations. These tangible assets support production capacity, enhance operational efficiency, and facilitate long-term value creation within companies. Effective management of fixed assets is crucial for maintaining asset performance, optimizing depreciation costs, and ensuring continuous business functionality.

Examples of Core Assets and Fixed Assets

Core assets include essential resources like brand reputation, proprietary technology, and intellectual property that drive long-term competitive advantage. Fixed assets consist of tangible items such as machinery, buildings, vehicles, and land used in the production process or business operations. Examples of core assets are patents and trademarks, while fixed assets include office equipment and factory infrastructure.

How to Identify a Core Asset

A core asset is a fundamental resource that drives a company's competitive advantage and long-term value, distinguished from fixed assets that primarily serve operational functions like machinery or buildings. To identify a core asset, assess its strategic importance, ability to generate sustainable profits, and alignment with the company's core competencies and mission. Key indicators include unique intellectual property, proprietary technology, or brand reputation that significantly influence market positioning.

Accounting Treatments: Core Asset vs Fixed Asset

Core assets represent essential assets critical to a company's core operations, while fixed assets encompass all long-term tangible assets used in business activities. Accounting treatments for fixed assets involve capitalization, depreciation over useful life, and impairment assessments, whereas core assets may receive specialized valuation approaches due to their strategic importance and potential for higher depreciation scrutiny. The distinction impacts financial reporting, asset management, and tax considerations, with core assets often requiring detailed disclosures and tailored impairment testing compared to general fixed assets.

Impact on Financial Performance

Core assets primarily contribute to a company's long-term value and revenue generation, while fixed assets represent physical property, plant, and equipment recorded on the balance sheet. The distinction impacts financial performance by influencing depreciation methods, asset turnover ratios, and return on assets, which affect profitability and investment decisions. Core assets drive strategic growth and competitive advantage, whereas fixed assets mainly affect operational efficiency and capital expenditures.

Best Practices for Managing Core and Fixed Assets

Effective management of core assets and fixed assets involves accurate asset identification, regular maintenance schedules, and comprehensive lifecycle tracking to maximize operational efficiency and asset longevity. Implementing integrated asset management systems ensures real-time monitoring, preventive maintenance, and compliance with financial reporting standards such as GAAP and IFRS. Best practices also include standardized asset tagging, periodic audits, and alignment of asset utilization with organizational strategic goals to optimize return on investment and reduce downtime.

Core Asset | Fixed Asset Infographic

libterm.com

libterm.com