Arbitrage exploits price differences of the same asset across different markets to secure risk-free profits. Traders capitalize on these inefficiencies by simultaneously buying low in one market and selling high in another, ensuring gains without exposure to market fluctuations. Discover how mastering arbitrage can enhance your trading strategy by reading the full article.

Table of Comparison

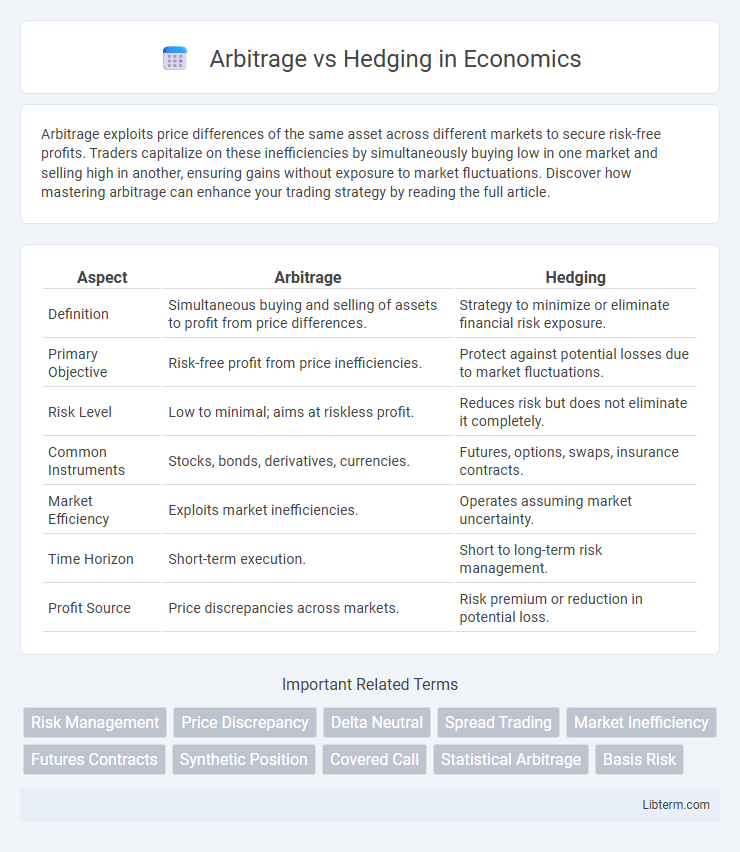

| Aspect | Arbitrage | Hedging |

|---|---|---|

| Definition | Simultaneous buying and selling of assets to profit from price differences. | Strategy to minimize or eliminate financial risk exposure. |

| Primary Objective | Risk-free profit from price inefficiencies. | Protect against potential losses due to market fluctuations. |

| Risk Level | Low to minimal; aims at riskless profit. | Reduces risk but does not eliminate it completely. |

| Common Instruments | Stocks, bonds, derivatives, currencies. | Futures, options, swaps, insurance contracts. |

| Market Efficiency | Exploits market inefficiencies. | Operates assuming market uncertainty. |

| Time Horizon | Short-term execution. | Short to long-term risk management. |

| Profit Source | Price discrepancies across markets. | Risk premium or reduction in potential loss. |

Understanding Arbitrage: Core Concepts

Arbitrage involves simultaneously buying and selling an asset in different markets to exploit price discrepancies, ensuring risk-free profit. Core concepts include the law of one price, market efficiency, and the elimination of price differentials through quick trades. Successful arbitrage requires high-speed execution, market liquidity, and minimal transaction costs to capitalize on fleeting arbitrage opportunities.

What Is Hedging? An Overview

Hedging is a risk management strategy used by investors and businesses to protect against potential losses from price fluctuations in assets, currencies, or commodities. It involves taking an offsetting position in a related security or derivative to minimize exposure to adverse market movements. Common hedging instruments include options, futures contracts, and swaps, which help stabilize financial outcomes and reduce uncertainty.

Key Differences Between Arbitrage and Hedging

Arbitrage involves simultaneously buying and selling assets in different markets to exploit price discrepancies for risk-free profit, while hedging focuses on reducing or managing potential losses from existing investments by taking offsetting positions. Arbitrage is generally riskless, aiming for guaranteed gains, whereas hedging accepts some risk to limit potential downside exposure. Arbitrage strategies prioritize price inefficiencies, while hedging strategies prioritize risk mitigation and portfolio protection.

Common Strategies in Arbitrage

Common strategies in arbitrage include spatial arbitrage, where traders exploit price differences of the same asset across different markets, and statistical arbitrage, which relies on quantitative models to identify price inefficiencies. Triangular arbitrage leverages discrepancies in currency exchange rates within the forex market to secure risk-free profits. Convertible arbitrage targets mispricings between a convertible security and its underlying stock, combining long and short positions to capitalize on price corrections.

Popular Hedging Techniques

Popular hedging techniques include futures contracts, options, and forward contracts, which businesses use to manage exposure to price volatility in commodities, currencies, and interest rates. Hedging involves taking an offsetting position to reduce risk, unlike arbitrage, which exploits price discrepancies across markets for profit without risk exposure. Effective hedging strategies often incorporate diversification and dynamic adjustments to maintain optimal risk management in fluctuating markets.

Risk Profiles: Arbitrage vs Hedging

Arbitrage involves exploiting price discrepancies across markets to earn risk-free profits, resulting in a typically low-risk profile due to simultaneous buying and selling. Hedging aims to reduce potential losses from adverse price movements by taking offsetting positions, creating a risk profile that minimizes exposure but does not eliminate risk entirely. While arbitrage focuses on risk-neutral strategies seeking guaranteed returns, hedging prioritizes risk management and loss mitigation in uncertain markets.

Real-World Examples of Arbitrage

Arbitrage involves exploiting price differences of identical or similar assets across different markets to earn risk-free profits, as seen in currency arbitrage where traders capitalize on exchange rate discrepancies between forex platforms. Hedging, in contrast, aims to reduce potential losses by taking offsetting positions, such as using futures contracts to protect against commodity price fluctuations. Prominent real-world arbitrage examples include convertible bond arbitrage, where investors profit from price inefficiencies between convertible bonds and underlying stocks, and statistical arbitrage strategies leveraged by hedge funds to exploit short-term price anomalies in equities.

Practical Applications of Hedging

Hedging plays a critical role in risk management by allowing investors and businesses to protect against adverse price movements in assets, commodities, or currencies through instruments like futures, options, and swaps. Practical applications of hedging include airlines locking fuel prices with futures contracts to stabilize operational costs and exporters using currency forwards to safeguard profit margins against exchange rate fluctuations. This strategic approach effectively minimizes potential financial losses and enhances budget predictability in volatile markets.

Pros and Cons: Arbitrage Compared to Hedging

Arbitrage exploits price discrepancies across markets to secure risk-free profits but requires rapid execution and substantial capital, making it vulnerable to market inefficiencies and transaction costs. Hedging minimizes financial risk by using derivatives or other instruments to offset potential losses, but it can reduce potential gains and often involves ongoing costs and complexity. While arbitrage aims for immediate gains without risk, hedging focuses on risk management and long-term stability, offering contrasting benefits depending on investment goals.

Choosing the Right Approach: Arbitrage or Hedging?

Choosing between arbitrage and hedging depends on your risk tolerance and market objectives. Arbitrage exploits price discrepancies across markets for risk-free profits, suitable for traders seeking immediate gains without exposure to market fluctuations. Hedging involves taking positions to offset potential losses in assets, ideal for investors aiming to minimize risk and protect long-term portfolios against price volatility.

Arbitrage Infographic

libterm.com

libterm.com