Macroprudential policy focuses on safeguarding the financial system by monitoring and addressing systemic risks that could destabilize the economy. It involves regulatory measures designed to limit excessive credit growth, leverage, and interconnectedness among financial institutions. Explore the rest of this article to understand how macroprudential policy can protect your financial stability.

Table of Comparison

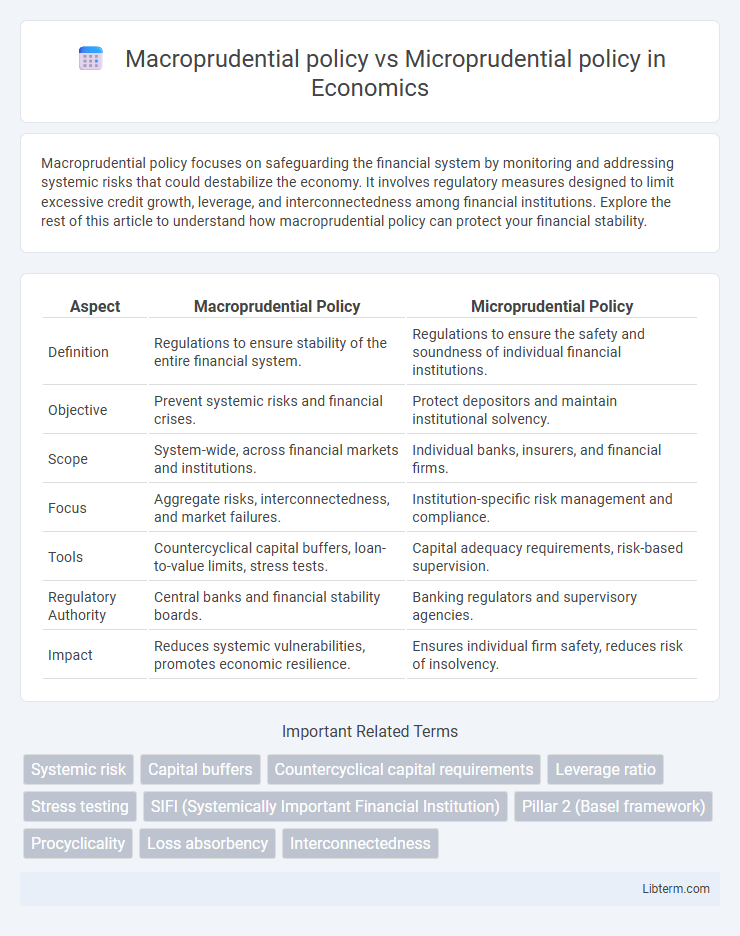

| Aspect | Macroprudential Policy | Microprudential Policy |

|---|---|---|

| Definition | Regulations to ensure stability of the entire financial system. | Regulations to ensure the safety and soundness of individual financial institutions. |

| Objective | Prevent systemic risks and financial crises. | Protect depositors and maintain institutional solvency. |

| Scope | System-wide, across financial markets and institutions. | Individual banks, insurers, and financial firms. |

| Focus | Aggregate risks, interconnectedness, and market failures. | Institution-specific risk management and compliance. |

| Tools | Countercyclical capital buffers, loan-to-value limits, stress tests. | Capital adequacy requirements, risk-based supervision. |

| Regulatory Authority | Central banks and financial stability boards. | Banking regulators and supervisory agencies. |

| Impact | Reduces systemic vulnerabilities, promotes economic resilience. | Ensures individual firm safety, reduces risk of insolvency. |

Introduction to Prudential Policies

Prudential policies encompass macroprudential and microprudential approaches that safeguard financial stability by targeting different levels of the financial system. Macroprudential policy focuses on systemic risks affecting the entire financial sector, aiming to prevent widespread crises through tools like capital buffers and stress testing. In contrast, microprudential policy concentrates on the health of individual financial institutions, ensuring their resilience and compliance with regulatory standards to protect depositors and maintain market confidence.

Defining Macroprudential Policy

Macroprudential policy focuses on the stability of the entire financial system by identifying and mitigating systemic risks that can lead to widespread financial crises. It uses tools such as countercyclical capital buffers, stress testing, and loan-to-value limits to address vulnerabilities stemming from interconnected financial institutions and procyclical market behaviors. In contrast, microprudential policy targets the soundness of individual financial institutions by ensuring they manage risks effectively and maintain adequate capital and liquidity.

Defining Microprudential Policy

Microprudential policy focuses on the stability and soundness of individual financial institutions by regulating capital adequacy, risk management, and governance practices to prevent failures that could impact depositors and creditors. It involves supervisory measures such as stress testing, capital requirements, and liquidity standards tailored to each bank or financial entity. This policy complements macroprudential efforts by mitigating risks at the micro-level to enhance overall financial system resilience.

Core Objectives: Macroprudential vs Microprudential

Macroprudential policy targets the stability of the entire financial system by addressing systemic risks, such as interconnectedness and market-wide shocks, to prevent widespread crises. Microprudential policy focuses on the soundness of individual financial institutions, ensuring their solvency and risk management to protect depositors and maintain confidence. Core objectives of macroprudential policy include reducing systemic vulnerabilities, while microprudential policy aims to safeguard individual banks' resilience and compliance with regulatory standards.

Key Tools and Instruments

Macroprudential policy utilizes tools such as countercyclical capital buffers, sectoral capital requirements, and systemic risk surcharges to address risks that threaten the stability of the entire financial system. Microprudential policy focuses on individual financial institutions by employing instruments like capital adequacy ratios, liquidity requirements, and supervisory stress tests to ensure their soundness and resilience. These policies collectively aim to mitigate systemic risk while safeguarding the solvency of banks and other financial entities.

Scope and Coverage Differences

Macroprudential policy targets the stability of the entire financial system by addressing systemic risks and interconnected vulnerabilities across institutions and markets, whereas microprudential policy concentrates on the soundness and resilience of individual financial institutions to protect depositors and maintain confidence. The scope of macroprudential measures includes broad-based tools such as countercyclical capital buffers and leverage ratios to mitigate systemic crises, while microprudential regulations involve institution-specific requirements like capital adequacy and risk management standards. Coverage in macroprudential policy spans diverse sectors including banking, insurance, and shadow banking, whereas microprudential supervision is primarily confined to regulated banking entities or financial firms.

Risk Assessment Approaches

Macroprudential policy employs systemic risk assessment approaches, analyzing interconnected financial institutions and market-wide vulnerabilities to prevent widespread financial instability. Microprudential policy focuses on individual financial entities, using risk-based capital adequacy and stress testing to ensure institution-specific resilience. Both approaches integrate quantitative models and qualitative evaluations but differ in scale and scope of risk identification and mitigation.

Implementation Challenges

Macroprudential policy faces implementation challenges such as identifying systemic risks and setting appropriate countercyclical capital buffers to prevent financial crises without stifling economic growth. Microprudential policy struggles with pinpointing individual institution vulnerabilities and enforcing compliance through stress testing and capital adequacy requirements. Both policies require robust data collection, real-time monitoring, and coordination between regulatory bodies to effectively mitigate risks across the financial system.

Case Studies and Real-world Applications

Macroprudential policy targets systemic risks to the financial system, exemplified by the European Central Bank's Countercyclical Capital Buffer implementation after the 2008 crisis to prevent credit booms. Microprudential policy focuses on individual institutions' safety, demonstrated by the U.S. Federal Reserve's stress tests for banks like JPMorgan Chase to assess resilience under adverse conditions. Real-world applications reveal that combining these policies, as seen in the Basel III framework, enhances overall financial stability by addressing both system-wide vulnerabilities and institution-specific risks.

Future Trends in Prudential Regulation

Future trends in prudential regulation emphasize the integration of macroprudential and microprudential policies to enhance financial system resilience. Advances in data analytics and real-time monitoring enable regulators to identify systemic risks while maintaining the soundness of individual institutions. Regulatory frameworks are evolving to address emerging risks from fintech innovation, climate change, and interconnected global markets.

Macroprudential policy Infographic

libterm.com

libterm.com