The hearth tax was a historic property tax levied on the number of hearths or fireplaces within a dwelling, primarily in England during the 17th century, acting as an indicator of household wealth and size. This tax influenced architectural designs, as some homeowners concealed or reduced visible hearths to avoid higher assessments. Explore the remainder of this article to uncover how the hearth tax shaped society, economy, and historical records.

Table of Comparison

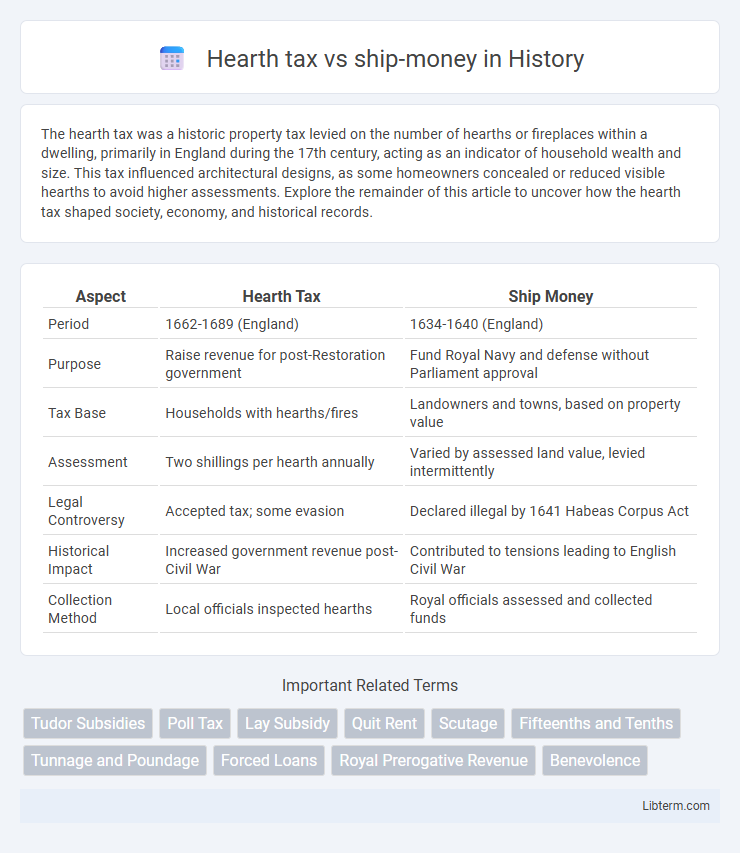

| Aspect | Hearth Tax | Ship Money |

|---|---|---|

| Period | 1662-1689 (England) | 1634-1640 (England) |

| Purpose | Raise revenue for post-Restoration government | Fund Royal Navy and defense without Parliament approval |

| Tax Base | Households with hearths/fires | Landowners and towns, based on property value |

| Assessment | Two shillings per hearth annually | Varied by assessed land value, levied intermittently |

| Legal Controversy | Accepted tax; some evasion | Declared illegal by 1641 Habeas Corpus Act |

| Historical Impact | Increased government revenue post-Civil War | Contributed to tensions leading to English Civil War |

| Collection Method | Local officials inspected hearths | Royal officials assessed and collected funds |

Introduction to Hearth Tax and Ship-Money

Hearth Tax, introduced in 1662 in England, was a property tax levied based on the number of hearths or fireplaces within a dwelling, serving as a direct method to assess wealth for taxation purposes. Ship-Money, imposed by King Charles I in the 1630s and 1640s, was a levy on coastal towns and inland counties intended to fund the navy without Parliamentary consent, sparking significant legal and political controversy. Both fiscal measures reflect key historical tensions involving taxation authority and economic burden in 17th-century England.

Historical Context of Hearth Tax

The Hearth Tax, implemented in 1662 during the reign of Charles II, served as a property tax targeting households based on the number of hearths or fireplaces. It reflected the Restoration government's need to raise revenue after the English Civil War and was seen as a method to fund royal expenses without broad parliamentary consent. Unlike ship-money, a tax historically levied on coastal counties for naval defense primarily under Charles I, the Hearth Tax expanded fiscal reach across all England, symbolizing shifting state control over taxation.

Origins and Implementation of Ship-Money

Ship-money originated as a medieval tax imposed on coastal towns to fund naval defense but was expanded by King Charles I in the 1630s to include inland counties, bypassing Parliament's consent. Unlike the hearth tax, which was a property tax based on the number of hearths in a household, ship-money was levied as a direct fiscal measure to raise funds for the Royal Navy. Its controversial implementation sparked widespread resistance and contributed to the tensions leading up to the English Civil War.

Key Differences Between Hearth Tax and Ship-Money

Hearth tax, imposed in 17th-century England, targeted household fireplaces as a means to generate revenue based on the number of hearths in a dwelling, reflecting wealth and property size. Ship-money, levied primarily during the reign of Charles I, was a tax on coastal counties intended to fund the Royal Navy, often extended inland, sparking significant legal and political controversy over its validity without parliamentary consent. The key differences lie in their assessment bases--domestic property versus maritime defense--and their differing historical roles in the evolving conflict between monarchy and Parliament.

Economic Impact on Households

Hearth tax and ship-money imposed substantial burdens on households, constraining disposable income and exacerbating economic inequality in 17th-century England. Hearth tax levied charges based on the number of hearths in a home, disproportionately affecting larger families and wealthier households with multiple fireplaces, while ship-money targeted coastal and inland properties to fund naval defense, often collected arbitrarily, increasing uncertainty and financial strain for common citizens. Both taxes disrupted local economies by reducing spending power and fueling resistance among households already vulnerable to economic pressures.

Public Reactions and Resistance

The Hearth tax faced widespread public resistance due to its intrusive nature and the burden it placed on ordinary households, leading to frequent evasion and protests. In contrast, ship-money provoked significant legal and political backlash, especially from the gentry who viewed it as an illegal extension of royal taxation without parliamentary consent. Both taxes influenced early modern English attitudes toward authority, highlighting growing tensions over fiscal policy and governance.

Legal and Political Controversies

The Hearth Tax, imposed in 1662, faced legal challenges due to its invasive assessment methods and perceived unfair burden on poorer households, igniting widespread political opposition that questioned royal authority. Ship Money, levied by King Charles I without parliamentary consent between 1634 and 1640, provoked significant legal disputes culminating in the landmark case of John Hampden, which challenged the legality of non-parliamentary taxation and intensified tensions leading to the English Civil War. Both taxes exemplified contested royal prerogative, sparking debates over the limits of monarchical power and parliamentary rights in 17th-century England.

Tax Collection Methods and Enforcement

Hearth tax was collected through household surveys where officials counted hearths or fireplaces, with local officers responsible for door-to-door assessments, making enforcement highly localized and reliant on community compliance. Ship-money employed a writ system demanding fixed payments from counties and towns, enforced by royal officials who could seize goods or imprison defaulters, reflecting a centralized and more coercive tax collection approach. Both methods faced resistance, but ship-money's enforcement was more politically contentious due to its use outside wartime without parliamentary consent.

Legacy and Long-term Effects

Hearth tax and ship-money both fueled widespread resistance that contributed to the erosion of royal authority before the English Civil War. The legacy of hearth tax was its association with intrusive government surveillance and fiscal oppression, fostering deep public mistrust toward the crown's taxation methods. Ship-money's long-term effects included setting legal precedents against arbitrary taxation, reinforcing parliamentary power over royal prerogative and influencing constitutional developments in England.

Comparative Analysis: Hearth Tax vs Ship-Money

Hearth tax and ship-money were both forms of taxation imposed in 17th-century England, but they differed significantly in purpose and implementation. Hearth tax, introduced in 1662, targeted domestic households by levying a fixed amount per hearth or fire used for heating, serving as a direct and visible tax on property. In contrast, ship-money was an unpopular levy imposed on coastal counties to fund naval defense without parliamentary consent, highlighting tensions over royal authority and taxation legitimacy.

Hearth tax Infographic

libterm.com

libterm.com