Tenancy by the Entirety is a form of joint property ownership available exclusively to married couples, providing protection against individual creditors and ensuring survivorship rights. This legal structure shields the property from claims against one spouse alone, offering a secure way to hold title in marital assets. Learn more about how Tenancy by the Entirety can safeguard Your property and what to consider in various states by reading the full article.

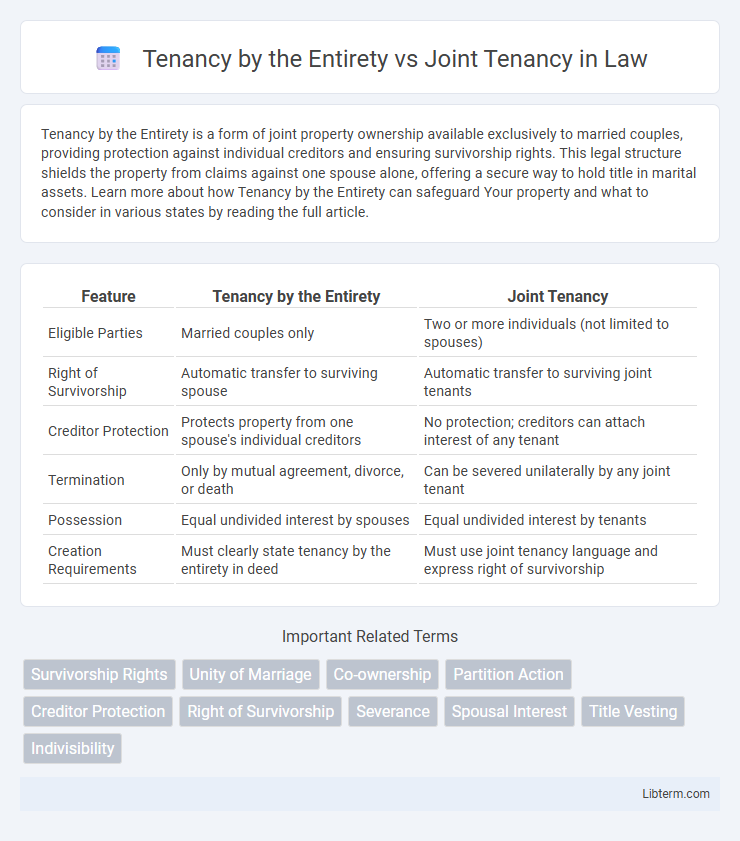

Table of Comparison

| Feature | Tenancy by the Entirety | Joint Tenancy |

|---|---|---|

| Eligible Parties | Married couples only | Two or more individuals (not limited to spouses) |

| Right of Survivorship | Automatic transfer to surviving spouse | Automatic transfer to surviving joint tenants |

| Creditor Protection | Protects property from one spouse's individual creditors | No protection; creditors can attach interest of any tenant |

| Termination | Only by mutual agreement, divorce, or death | Can be severed unilaterally by any joint tenant |

| Possession | Equal undivided interest by spouses | Equal undivided interest by tenants |

| Creation Requirements | Must clearly state tenancy by the entirety in deed | Must use joint tenancy language and express right of survivorship |

Understanding Tenancy by the Entirety

Tenancy by the Entirety is a form of property ownership available exclusively to married couples, offering survivorship rights and protection from individual creditors. Unlike Joint Tenancy, which can be held by any individuals and includes right of survivorship but no special creditor protections, Tenancy by the Entirety combines both spouses' interests as a single legal entity. This ownership structure ensures that neither spouse can sell or encumber the property without the other's consent, providing enhanced security.

Defining Joint Tenancy

Joint tenancy is a form of property ownership where two or more parties hold equal shares with the right of survivorship, ensuring that upon the death of one tenant, their interest automatically passes to the surviving tenants. This legal arrangement requires the four unities: time, title, interest, and possession, meaning all tenants acquire their interest simultaneously, through the same instrument, holding equal shares, and having equal rights to possess the entire property. Unlike tenancy by the entirety, joint tenancy does not provide protection against creditors of an individual tenant and can include co-owners who are not spouses.

Key Legal Differences

Tenancy by the Entirety is a form of ownership available only to married couples, providing right of survivorship and protecting the property from individual creditors of one spouse. Joint Tenancy also includes right of survivorship but can be held by any number of co-owners, and creditors of one joint tenant can potentially force a sale of the share. Unlike Joint Tenancy, Tenancy by the Entirety requires consent from both spouses for transfer or sale, offering stronger protection against unilateral actions.

Rights of Survivorship

Tenancy by the entirety grants automatic rights of survivorship exclusively to married couples, ensuring that upon the death of one spouse, full ownership transfers to the surviving spouse without probate. Joint tenancy with rights of survivorship allows multiple owners, regardless of marital status, to equally share property ownership with automatic transfer to surviving joint tenants upon one's death. Unlike joint tenancy, tenancy by the entirety offers protection from individual creditors of one spouse, reinforcing exclusive survivorship rights within married partnerships.

Creditor Protection Comparison

Tenancy by the Entirety offers superior creditor protection compared to Joint Tenancy, as it restricts creditors from attaching property individually owned by one spouse, safeguarding the home from individual debts. In Joint Tenancy, creditors can pursue a debtor's share, leading to potential forced sale or partition of the property. This distinction makes Tenancy by the Entirety a preferred estate planning tool for spouses seeking to protect their home from personal liabilities.

Eligibility and Ownership Requirements

Tenancy by the Entirety requires that the owners be legally married couples, offering each spouse equal and undivided interest with survivorship rights, which is not available to unmarried individuals. Joint Tenancy allows two or more individuals, married or not, to share equal ownership interests with rights of survivorship but does not require marital status. Eligibility for Tenancy by the Entirety is limited by state laws primarily to spouses, whereas Joint Tenancy is broadly accessible to any co-owners meeting the equal ownership and time of interest creation requirements.

Property Transfer and Termination

Tenancy by the Entirety ensures automatic transfer of property to the surviving spouse upon death, avoiding probate, and requires mutual consent from both spouses to terminate or transfer ownership. Joint Tenancy features a right of survivorship allowing property to pass directly to surviving joint tenants, and any joint tenant can unilaterally transfer their interest, potentially severing the joint tenancy. Understanding these distinctions is critical for estate planning and property rights management.

Tax Implications and Benefits

Tenancy by the Entirety offers significant tax advantages, including protection from creditors and automatic survivorship without triggering a taxable event, making it ideal for married couples seeking estate planning benefits. Joint Tenancy provides similar rights of survivorship, but can result in more complex tax consequences, such as potential gift tax implications when adding or removing tenants. Understanding the distinct tax treatments and liability protections of each ownership type is crucial for optimizing estate tax liabilities and asset transfer strategies.

Pros and Cons of Each Ownership Type

Tenancy by the Entirety offers strong creditor protection for married couples, ensuring that one spouse's debts do not impact the property, but it is restricted to legally married partners and may limit flexibility in ownership transfers. Joint Tenancy provides the right of survivorship, allowing seamless transfer of property upon a co-owner's death, but it exposes the property to creditors of any joint tenant and can lead to disputes due to shared ownership. Both ownership types eliminate probate for the surviving owner, but Tenancy by the Entirety is generally more secure for married couples, while Joint Tenancy is accessible to any co-owners regardless of marital status.

Choosing the Right Ownership Structure

Tenancy by the Entirety offers married couples protection from individual creditors and automatic survivorship rights, making it ideal for spouses seeking unified ownership and asset protection. Joint Tenancy provides equal ownership with survivorship rights but lacks the specific creditor protections found in Tenancy by the Entirety, suitable for non-married owners desiring shared control and simplified transfer upon death. Evaluating factors like marital status, creditor risk, and estate planning goals is crucial when selecting between these ownership structures for optimal asset management.

Tenancy by the Entirety Infographic

libterm.com

libterm.com