Reimbursement alimony is a legal remedy designed to compensate a spouse who has financially supported the other during marriage, usually covering expenses like education or career advancement. This form of alimony ensures equitable distribution of acquired benefits when the marriage ends, reflecting your contribution to the other's increased earning capacity. Explore the full article to understand how reimbursement alimony might affect your divorce settlement and financial future.

Table of Comparison

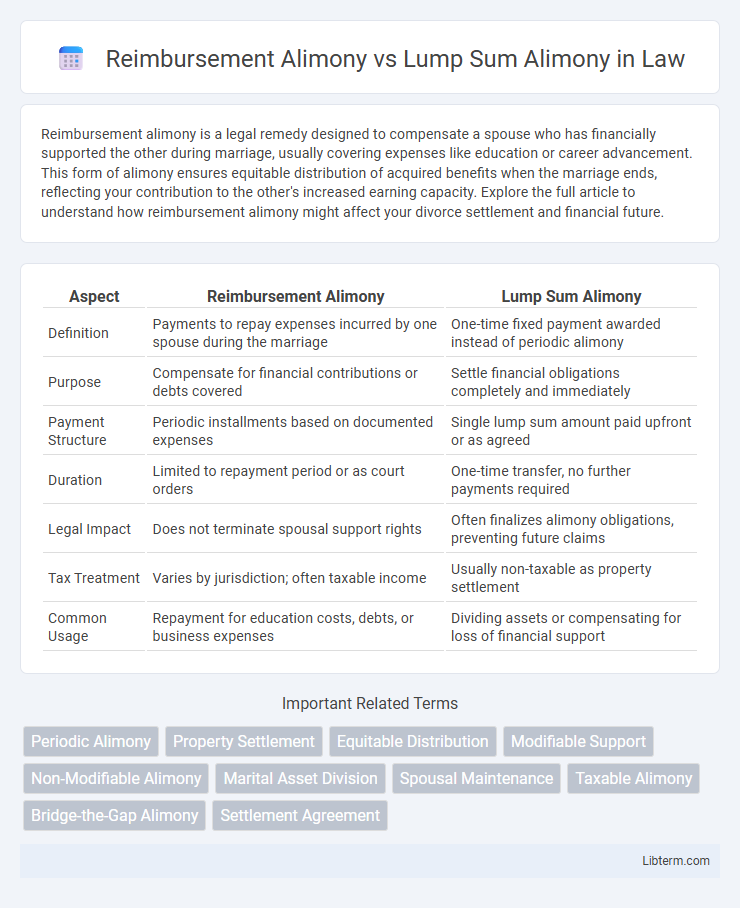

| Aspect | Reimbursement Alimony | Lump Sum Alimony |

|---|---|---|

| Definition | Payments to repay expenses incurred by one spouse during the marriage | One-time fixed payment awarded instead of periodic alimony |

| Purpose | Compensate for financial contributions or debts covered | Settle financial obligations completely and immediately |

| Payment Structure | Periodic installments based on documented expenses | Single lump sum amount paid upfront or as agreed |

| Duration | Limited to repayment period or as court orders | One-time transfer, no further payments required |

| Legal Impact | Does not terminate spousal support rights | Often finalizes alimony obligations, preventing future claims |

| Tax Treatment | Varies by jurisdiction; often taxable income | Usually non-taxable as property settlement |

| Common Usage | Repayment for education costs, debts, or business expenses | Dividing assets or compensating for loss of financial support |

Understanding Alimony: An Overview

Reimbursement alimony involves one spouse repaying the other for financial contributions made during the marriage, such as education or career support, aiming to balance the economic disparity post-divorce. Lump sum alimony is a fixed, one-time payment that fully resolves spousal support obligations without ongoing payments or modifications. Understanding these alimony types is crucial for navigating divorce settlements and ensuring fair financial arrangements based on individual circumstances and state laws.

What Is Reimbursement Alimony?

Reimbursement alimony is a type of spousal support awarded to compensate one spouse for financial contributions or expenses incurred during the marriage, such as funding the other spouse's education or supporting the household. Unlike lump sum alimony, which is a fixed, one-time payment, reimbursement alimony aims to repay specific investments rather than provide ongoing support. This form of alimony ensures equitable compensation, reflecting the monetary sacrifices made for the benefit of the marital partnership.

What Is Lump Sum Alimony?

Lump sum alimony is a fixed amount of money awarded to a former spouse, payable in one comprehensive payment or installments, rather than ongoing periodic payments. This type of alimony is often used to settle financial obligations such as property division or debt reimbursement, providing a clear, final monetary resolution. Unlike reimbursement alimony, which reimburses specific expenses, lump sum alimony represents a predetermined sum agreed upon or ordered by the court.

Key Differences Between Reimbursement and Lump Sum Alimony

Reimbursement alimony requires one spouse to repay the other for specific expenses like education or medical costs, with payments typically made over time and subject to modification based on financial changes. Lump sum alimony is a fixed amount paid either as a single payment or in installments, intended as final financial support without future adjustments. Reimbursement alimony is considered a debt and enforceable as a money judgment, whereas lump sum alimony is a property right, often treated as a settled transfer that cannot be modified after payment.

Legal Criteria for Awarding Each Type of Alimony

Reimbursement alimony is awarded when one spouse has financially supported the other's education or career advancement, requiring clear evidence of expenses and an expectation of shared contribution. Lump sum alimony is granted based on a fixed, predetermined amount, often used when future obligations are uncertain or when a clean financial break is preferable, emphasizing the parties' needs and ability to pay. Courts assess factors like duration of marriage, contribution to marital assets, and financial disparity to determine the appropriate alimony type.

Advantages of Reimbursement Alimony

Reimbursement alimony offers financial fairness by compensating a spouse who contributed to the other's education or career advancement, ensuring equitable distribution of benefits gained during the marriage. It provides clear, quantifiable repayment obligations, reducing ambiguity and potential disputes in alimony calculations. Unlike lump sum alimony, reimbursement alimony adjusts to actual expenditures, promoting accountability and preventing overpayment or underpayment scenarios.

Benefits of Lump Sum Alimony

Lump sum alimony provides the benefit of a fixed, one-time payment that offers financial certainty and eliminates ongoing dependency on the payor spouse. This form of alimony is easier to enforce and reduces the risk of future disputes or modifications. Lump sum alimony also protects the recipient against changes in the payor's financial situation, ensuring immediate and guaranteed access to funds.

Financial Implications: Tax and Payment Considerations

Reimbursement alimony involves periodic payments to compensate a spouse for financial contributions like education or property investment, often treated as taxable income for the recipient and deductible for the payer, impacting tax liabilities significantly. Lump sum alimony requires a one-time payment of a fixed amount, which is generally non-taxable for the recipient and not deductible for the payer, offering more predictable financial planning. Choosing between reimbursements or lump sums depends on cash flow preferences, tax consequences, and long-term financial security for both parties.

Choosing the Right Alimony Type for Your Situation

Reimbursement alimony reimburses a spouse for financial contributions made during the marriage, such as education or home improvements, while lump sum alimony provides a fixed, one-time payment regardless of future circumstances. Choosing the right alimony type depends on factors like the duration of the marriage, financial needs, and the ability to enforce payments. Consulting a family law expert ensures a tailored alimony arrangement that protects long-term financial interests and minimizes future conflicts.

Frequently Asked Questions About Reimbursement vs Lump Sum Alimony

Reimbursement alimony requires one spouse to repay the other for specific expenses such as education or career advancement, directly tied to tangible financial contributions. Lump sum alimony is a fixed, one-time payment that resolves support obligations without ongoing installments, often used to settle claims in a clean break arrangement. Key distinctions include the method of payment, enforceability as a judgment, and tax implications, which frequently appear in FAQs concerning divorce settlements.

Reimbursement Alimony Infographic

libterm.com

libterm.com