The Appropriations Clause requires that government funds must be authorized by law before they can be spent, ensuring congressional control over federal expenditures. This constitutional provision prevents unauthorized use of public money and promotes fiscal accountability. Explore the rest of the article to understand how this clause impacts government budgeting and financial transparency.

Table of Comparison

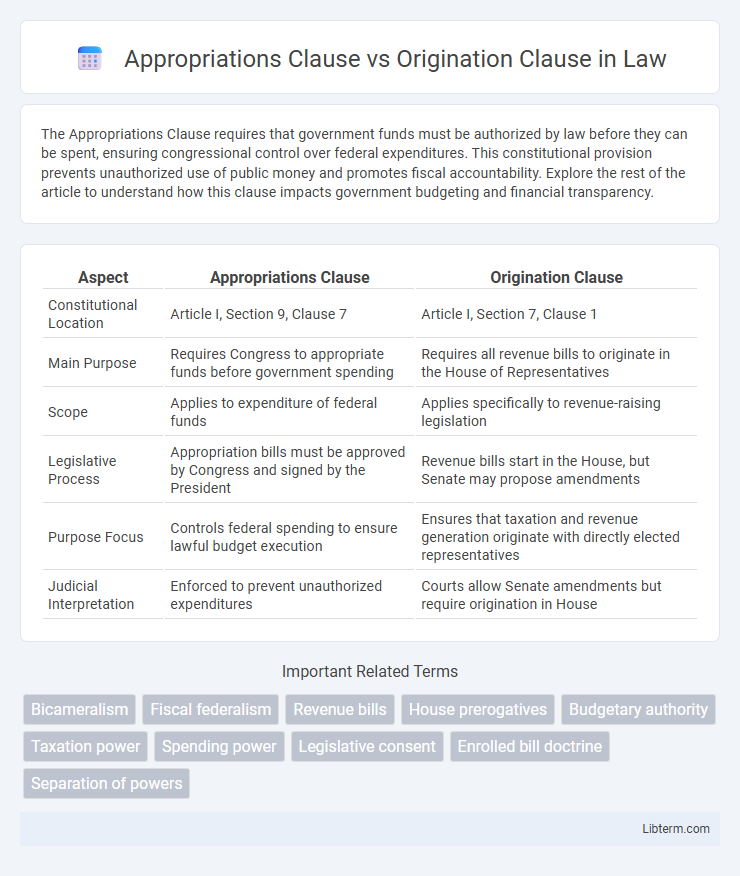

| Aspect | Appropriations Clause | Origination Clause |

|---|---|---|

| Constitutional Location | Article I, Section 9, Clause 7 | Article I, Section 7, Clause 1 |

| Main Purpose | Requires Congress to appropriate funds before government spending | Requires all revenue bills to originate in the House of Representatives |

| Scope | Applies to expenditure of federal funds | Applies specifically to revenue-raising legislation |

| Legislative Process | Appropriation bills must be approved by Congress and signed by the President | Revenue bills start in the House, but Senate may propose amendments |

| Purpose Focus | Controls federal spending to ensure lawful budget execution | Ensures that taxation and revenue generation originate with directly elected representatives |

| Judicial Interpretation | Enforced to prevent unauthorized expenditures | Courts allow Senate amendments but require origination in House |

Introduction to Constitutional Clauses

The Appropriations Clause, found in Article I, Section 9, Clause 7 of the U.S. Constitution, mandates that no money can be drawn from the Treasury except by appropriations made by law, ensuring congressional control over federal expenditures. The Origination Clause, located in Article I, Section 7, Clause 1, requires that all bills for raising revenue must originate in the House of Representatives, emphasizing the House's primary role in financial legislation. Both clauses collectively maintain a system of checks and balances by regulating how federal funds are proposed and authorized.

Defining the Appropriations Clause

The Appropriations Clause, found in Article I, Section 9, Clause 7 of the U.S. Constitution, mandates that no money can be withdrawn from the Treasury without an Act of Congress appropriating those funds. This clause ensures legislative control over federal expenditures by requiring specific approval for each appropriation. It establishes a fundamental check on executive spending, contrasting with the Origination Clause, which requires that all revenue-raising bills originate in the House of Representatives.

Understanding the Origination Clause

The Origination Clause mandates that all bills for raising revenue must originate in the House of Representatives, ensuring that the power to initiate taxation lies with the legislative body closest to the people. This provision serves as a fundamental check on fiscal legislation, limiting the Senate's role to amendment rather than origination. Understanding the Origination Clause clarifies the distinct procedural responsibilities in Congress, highlighting the House's primary role in financial matters and maintaining legislative balance.

Historical Background and Intent

The Appropriations Clause, rooted in Article I, Section 9, Clause 7 of the U.S. Constitution, was designed to ensure congressional control over government spending by requiring that no money be drawn from the Treasury without explicit legislation. The Origination Clause, found in Article I, Section 7, Clause 1, mandates that all bills for raising revenue must originate in the House of Representatives, reflecting the framers' intent to grant the people's directly elected representatives primary authority over taxation. Both clauses emerged from colonial experiences with executive overreach and aimed to establish a system of checks and balances to prevent unauthorized spending and taxation.

Key Differences Between the Clauses

The Appropriations Clause requires that no money be drawn from the Treasury except through appropriations made by law, ensuring Congress controls federal spending. The Origination Clause mandates that all bills for raising revenue must originate in the House of Representatives, securing the House's primary role in initiating tax legislation. Together, these clauses establish distinct but complementary roles in the federal budget and taxation processes.

Congressional Powers and Limitations

The Appropriations Clause grants Congress the exclusive power to control federal spending and allocate funds through legislation, ensuring government expenditures align with legislative priorities. In contrast, the Origination Clause requires that all revenue-raising bills originate in the House of Representatives, limiting the Senate's authority to initiate taxation measures. Together, these clauses delineate Congressional powers and impose procedural limitations to maintain a balance in fiscal policymaking and legislative authority.

Landmark Supreme Court Cases

The Appropriations Clause, found in Article I, Section 9, Clause 7 of the U.S. Constitution, mandates that no money can be drawn from the Treasury except through appropriations made by law, underscoring Congressional control over federal expenditures as reinforced in *United States v. MacCollom* (1979). The Origination Clause, located in Article I, Section 7, Clause 1, requires that all bills for raising revenue must originate in the House of Representatives, a principle affirmed in *Flint v. Stone Tracy Co.* (1911), which clarified the procedural requirements for revenue legislation. Landmark cases like *United States v. Lovett* (1946) illustrate the balance between these clauses, where the Supreme Court emphasized strict adherence to Congress's procedural powers to prevent unauthorized spending and maintain legislative intent.

Contemporary Debates and Issues

The Appropriations Clause, which requires Congress to allocate federal funds through legislation, frequently faces scrutiny in debates over executive branch spending authority and budgetary transparency. The Origination Clause mandates that all revenue-raising bills must originate in the House of Representatives, leading to contemporary disputes about legislative procedures and the use of "shell bills" to circumvent this requirement. Legal scholars and lawmakers continue to grapple with how these clauses impact separation of powers and fiscal accountability in modern congressional practices.

Practical Implications in Federal Budgeting

The Appropriations Clause requires that federal funds must be explicitly authorized by Congress before being spent, ensuring legislative control over budget execution. The Origination Clause mandates that all revenue-raising bills originate in the House of Representatives, emphasizing the chamber's primary role in federal taxation and fiscal policy. These clauses collectively shape the budgeting process by balancing revenue initiation and expenditure approval, enforcing a structured legislative framework for federal fiscal management.

Conclusion: Balancing Power in Fiscal Legislation

The Appropriations Clause grants Congress the power to control federal spending, ensuring funds are allocated through legislation, while the Origination Clause mandates that revenue-raising bills originate in the House of Representatives, reflecting the chamber's direct accountability to taxpayers. Together, these clauses establish a constitutional balance, empowering Congress to regulate the national budget while preserving the House's primacy in initiating fiscal policy. This dual framework safeguards democratic oversight and prevents unilateral control over federal revenues and expenditures.

Appropriations Clause Infographic

libterm.com

libterm.com