A lien is a legal claim or right against property that serves as security for a debt or obligation, ensuring the creditor can recover what is owed. Understanding how liens work can protect your assets and clarify financial responsibilities in transactions. Explore the rest of the article to learn how liens impact property ownership and your financial decisions.

Table of Comparison

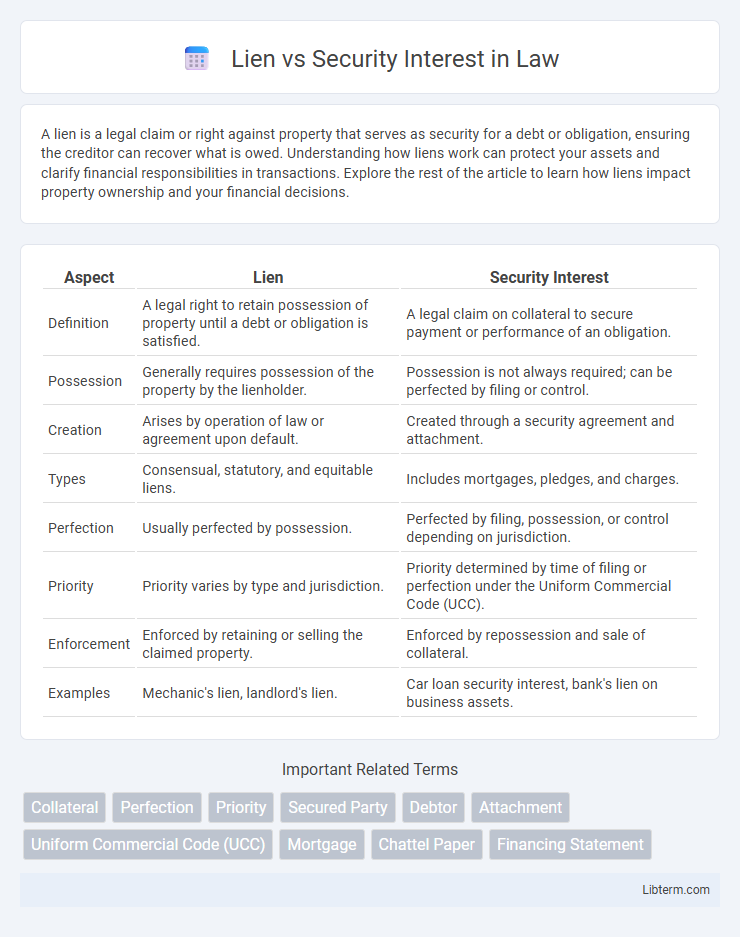

| Aspect | Lien | Security Interest |

|---|---|---|

| Definition | A legal right to retain possession of property until a debt or obligation is satisfied. | A legal claim on collateral to secure payment or performance of an obligation. |

| Possession | Generally requires possession of the property by the lienholder. | Possession is not always required; can be perfected by filing or control. |

| Creation | Arises by operation of law or agreement upon default. | Created through a security agreement and attachment. |

| Types | Consensual, statutory, and equitable liens. | Includes mortgages, pledges, and charges. |

| Perfection | Usually perfected by possession. | Perfected by filing, possession, or control depending on jurisdiction. |

| Priority | Priority varies by type and jurisdiction. | Priority determined by time of filing or perfection under the Uniform Commercial Code (UCC). |

| Enforcement | Enforced by retaining or selling the claimed property. | Enforced by repossession and sale of collateral. |

| Examples | Mechanic's lien, landlord's lien. | Car loan security interest, bank's lien on business assets. |

Understanding Liens: Definition and Purpose

A lien is a legal claim or right against assets that are typically used as collateral to satisfy a debt or obligation. It allows creditors to secure repayment by holding interest in the debtor's property until the underlying obligation is fulfilled. Understanding liens is crucial for comprehending how security interests function in protecting creditor rights and facilitating debt recovery.

What Is a Security Interest?

A security interest is a legal claim or right granted by a debtor to a creditor over the debtor's property, serving as collateral to secure repayment of a debt or performance of an obligation. This interest allows the creditor to repossess or take ownership of the collateral if the debtor defaults. Unlike a lien, which often arises automatically by law, a security interest is typically created through a contractual agreement, providing lenders with a prioritized claim against specific assets.

Key Differences Between Liens and Security Interests

Liens and security interests both provide creditors with legal claims on a debtor's property as collateral for a debt, but key differences exist in their formation and enforcement. A lien is typically a passive encumbrance automatically attached to property by operation of law or statute, such as a mechanic's lien, without the debtor's explicit agreement. Security interests require an explicit agreement and are often perfected through public filing or possession, granting the creditor prioritized rights after default.

Types of Liens Explained

Liens are legal claims or holds on assets to secure payment of a debt or obligation, varying by type such as tax liens, mechanic's liens, and judgment liens, each serving specific purposes and governed by distinct laws. Tax liens arise from unpaid taxes and enable the government to claim property, mechanic's liens protect contractors and suppliers by securing payment for work performed, and judgment liens result from court decisions to satisfy a monetary award. Understanding these lien types is crucial for borrowers and creditors to manage rights and remedies related to secured interests effectively.

Types of Security Interests

Security interests encompass various types, including consensual liens like mortgages and conditional sales contracts, statutory liens arising from laws such as tax liens, and judicial liens obtained through court judgments. Fixed security interests attach to specific assets like real estate or equipment, while floating security interests cover fluctuating assets such as inventory or accounts receivable. Understanding these distinctions is critical for businesses managing collateral and creditors enforcing claims.

Legal Framework Governing Liens

The legal framework governing liens is primarily established through statutory laws and judicial precedents that define the creation, enforcement, and priority of liens on personal or real property. Unlike general security interests, liens often arise by operation of law, such as mechanic's liens or tax liens, granting creditors a possessory or non-possessory claim until the underlying debt is satisfied. Understanding the jurisdiction-specific legislation, including the Uniform Commercial Code (UCC) in the United States, is essential for accurately distinguishing liens from security interests and determining their enforceability.

Legal Framework Governing Security Interests

The legal framework governing security interests primarily stems from the Uniform Commercial Code (UCC) Article 9 in the United States, which establishes standardized rules for creating, perfecting, and enforcing security interests in personal property. Liens, in contrast, arise from common law or statutory provisions, often tied to specific types of claims like mechanic's liens or tax liens, and generally require possession or full legal authority over collateral. Understanding the distinction between liens and security interests is crucial, as security interests provide a more flexible, transferable, and broadly recognized mechanism for securing obligations under commercial transactions.

Priority Rules: Lien Holders vs. Secured Parties

Priority rules dictate that lien holders typically have superior claims over secured parties when a lien is properly perfected and arises by operation of law, such as tax liens or mechanic's liens. Secured parties must perfect their security interests, often through filing a UCC-1 financing statement, to establish priority and can be subordinate to earlier liens if they fail to perfect timely. Courts generally prioritize liens based on the timing and method of perfection, with earlier perfected liens having precedence in competing claims against collateral.

Enforcement and Remedies: Liens vs. Security Interests

Enforcement of liens typically involves the right to retain possession of property until a debt is satisfied, often resulting in a possessory lien or a mechanic's lien that can lead to foreclosure or forced sale under statutory procedures. Security interests, governed by the Uniform Commercial Code (UCC) in the United States, allow creditors to repossess or sell collateral after a debtor's default, with strict compliance to notification and disposition rules ensuring the creditor acts commercially reasonably. Remedies for liens are often statutory and limited to specific circumstances, while security interests provide broader enforcement options including repossession, strict foreclosure, and judicial enforcement.

Choosing Between a Lien and a Security Interest

Choosing between a lien and a security interest depends on the specific legal rights and control desired over the collateral. A lien provides a claim or hold on property, often arising by operation of law, which secures payment or performance of an obligation without transferring possession. Security interests, governed by the Uniform Commercial Code (UCC), involve a consensual agreement granting the creditor a legal interest in personal property as collateral, requiring formal perfection steps like filing a financing statement for priority.

Lien Infographic

libterm.com

libterm.com