Brownian motion describes the random movement of particles suspended in a fluid, resulting from collisions with fast-moving molecules in the liquid or gas. This phenomenon is fundamental in fields like physics, chemistry, and finance for modeling random behaviors and diffusion processes. Explore the rest of the article to understand how Brownian motion influences various natural and applied sciences.

Table of Comparison

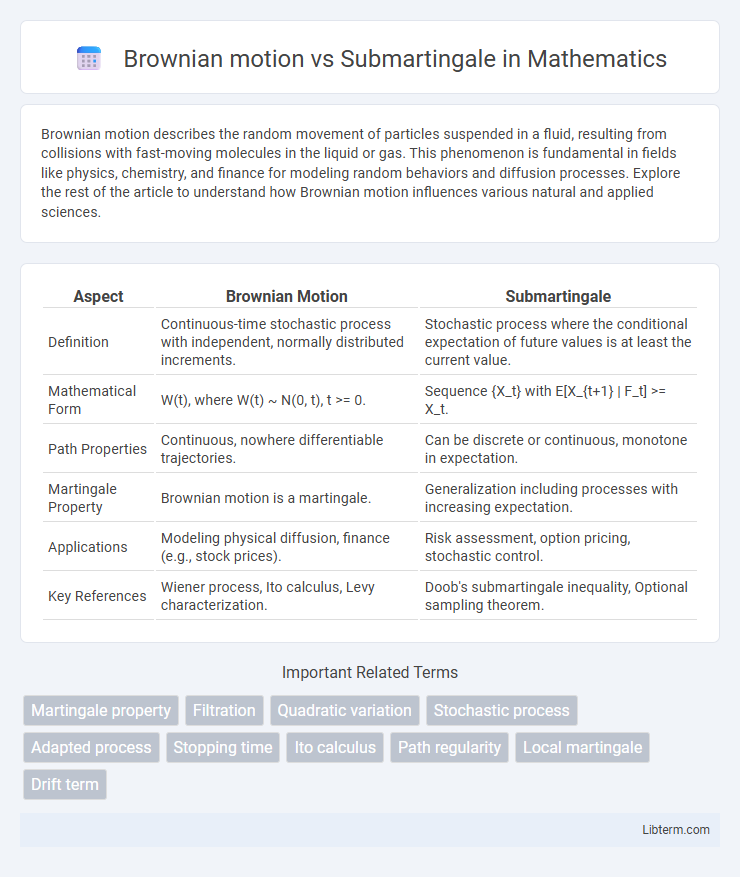

| Aspect | Brownian Motion | Submartingale |

|---|---|---|

| Definition | Continuous-time stochastic process with independent, normally distributed increments. | Stochastic process where the conditional expectation of future values is at least the current value. |

| Mathematical Form | W(t), where W(t) ~ N(0, t), t >= 0. | Sequence {X_t} with E[X_{t+1} | F_t] >= X_t. |

| Path Properties | Continuous, nowhere differentiable trajectories. | Can be discrete or continuous, monotone in expectation. |

| Martingale Property | Brownian motion is a martingale. | Generalization including processes with increasing expectation. |

| Applications | Modeling physical diffusion, finance (e.g., stock prices). | Risk assessment, option pricing, stochastic control. |

| Key References | Wiener process, Ito calculus, Levy characterization. | Doob's submartingale inequality, Optional sampling theorem. |

Introduction to Brownian Motion and Submartingales

Brownian motion is a continuous-time stochastic process characterized by independent, normally distributed increments with zero mean and variance proportional to time, widely used to model random phenomena in physics and finance. Submartingales are a class of stochastic processes that generalize martingales by allowing expected future values to be at least as large as the current value, capturing non-decreasing trends over time. Understanding these concepts is fundamental in stochastic calculus, with Brownian motion often serving as the driving process behind submartingales in modeling dynamic systems.

Fundamental Definitions and Concepts

Brownian motion is a continuous-time stochastic process characterized by independent, normally distributed increments with a mean of zero and continuous paths, commonly used to model random phenomena in physics and finance. A submartingale is a type of stochastic process that, with respect to a given filtration, has the property that its expected future value is at least as great as its current value, reflecting a tendency to increase or stay the same over time. While Brownian motion is a martingale with zero drift, a submartingale generalizes this concept by allowing positive drift or non-negative expected incremental growth, making it essential in studying optimal stopping problems and financial asset price models.

Historical Development and Mathematical Background

Brownian motion, first rigorously defined by Norbert Wiener in the 1920s, models continuous stochastic processes with Gaussian increments and stationary, independent increments. The concept of a submartingale emerged from the formalization of martingale theory in the 1930s and 1940s, primarily developed by Joseph Doob, extending the idea of expected values in stochastic processes that do not necessarily have zero drift. While Brownian motion is a fundamental example of a martingale with continuous paths, submartingales generalize this to include processes exhibiting nondecreasing expected values, thus broadening the mathematical framework for analyzing stochastic behavior in probability theory.

Properties of Brownian Motion

Brownian motion exhibits continuous paths, stationary and independent increments, and normally distributed changes with mean zero and variance proportional to elapsed time, distinguishing it from submartingales that require non-decreasing conditional expectations. It is a martingale due to its zero drift and satisfies strong Markov properties, which are foundational for stochastic calculus and diffusion processes. The Gaussian distribution of Brownian increments and its path continuity underlie its unique behavior compared to more general submartingales that may include drift or jumps.

Key Features of Submartingales

Submartingales are stochastic processes characterized by their property that the conditional expectation of future values given the past is at least equal to the current value, reflecting a non-decreasing trend in expectation. Unlike Brownian motion, which is a martingale with stationary independent increments, submartingales allow for upward drift, making them useful in financial modeling for modeling asset prices with expected growth. Key features include the optional stopping theorem applicability, preservation under positive scaling and addition, and adaptability to filtration, ensuring their flexibility in predicting non-decreasing stochastic behaviors.

Differences Between Brownian Motion and Submartingales

Brownian motion is a continuous-time stochastic process with independent, normally distributed increments and continuous paths, whereas a submartingale is a more general class of stochastic processes characterized by having conditional expected future values at least as large as the present value. Brownian motion is a martingale with zero drift, while submartingales may exhibit a nonnegative drift component, reflecting increasing trends or biases in their expected values. The key difference lies in Brownian motion's strict path continuity and Gaussian increments, contrasting with submartingales' allowance for jumps and broader conditional expectation growth properties.

Applications in Probability and Finance

Brownian motion serves as a fundamental model for continuous-time stochastic processes, extensively applied in option pricing and risk management through the Black-Scholes framework. Submartingales generalize Brownian motion by allowing non-decreasing expected values, critical for modeling asset price trends and formulating optimal stopping problems in financial mathematics. Both concepts underpin the theory of martingale measures and arbitrage-free pricing, essential for developing robust probabilistic models in quantitative finance.

Examples Illustrating Brownian Motion and Submartingale

Brownian motion is exemplified by the random and continuous path of a pollen particle suspended in water, modeled mathematically as a stochastic process with independent and normally distributed increments. A submartingale demonstration can be seen in the value of a fair game with a nonnegative drift, such as a stock price exhibiting an expected upward trend without predictable decreases. Unlike Brownian motion, which has zero drift and paths symmetric about zero, submartingales incorporate increasing conditional expectation, making them suitable for modeling asset prices with growth tendencies.

Mathematical Representation and Notation

Brownian motion \( (B_t)_{t \geq 0} \) is a continuous-time stochastic process characterized by independent, normally distributed increments with mean zero and variance \( t \), commonly represented as \( B_t \sim \mathcal{N}(0, t) \). A submartingale \( (X_t)_{t \geq 0} \) satisfies \( \mathbb{E}[X_t | \mathcal{F}_s] \geq X_s \) for \( 0 \leq s \leq t \), indicating a non-decreasing conditional expectation with respect to the filtration \( (\mathcal{F}_t) \). While Brownian motion is a martingale with zero drift, submartingales generalize this by allowing processes with non-negative drift, captured mathematically by the Doob decomposition \( X_t = M_t + A_t \) where \( M_t \) is a martingale and \( A_t \) is an increasing predictable process.

Conclusion: Comparing Stochastic Processes

Brownian motion is a continuous-time stochastic process with independent, normally distributed increments and continuous paths, serving as a fundamental model in finance and physics. Submartingales generalize martingales by allowing the conditional expectation to be greater than or equal to the current value, capturing a broader class of processes with non-decreasing trends in expectation. Comparing these stochastic processes highlights Brownian motion as a specific case with Gaussian properties, while submartingales encompass more general, potentially non-Gaussian dynamics useful for modeling diverse stochastic behaviors.

Brownian motion Infographic

libterm.com

libterm.com