Fraud detection leverages advanced algorithms and machine learning models to identify unusual patterns and prevent financial losses. Continuous monitoring of transactions ensures that suspicious activities are flagged in real time, protecting both businesses and consumers. Explore the rest of the article to understand how you can enhance your fraud detection strategies effectively.

Table of Comparison

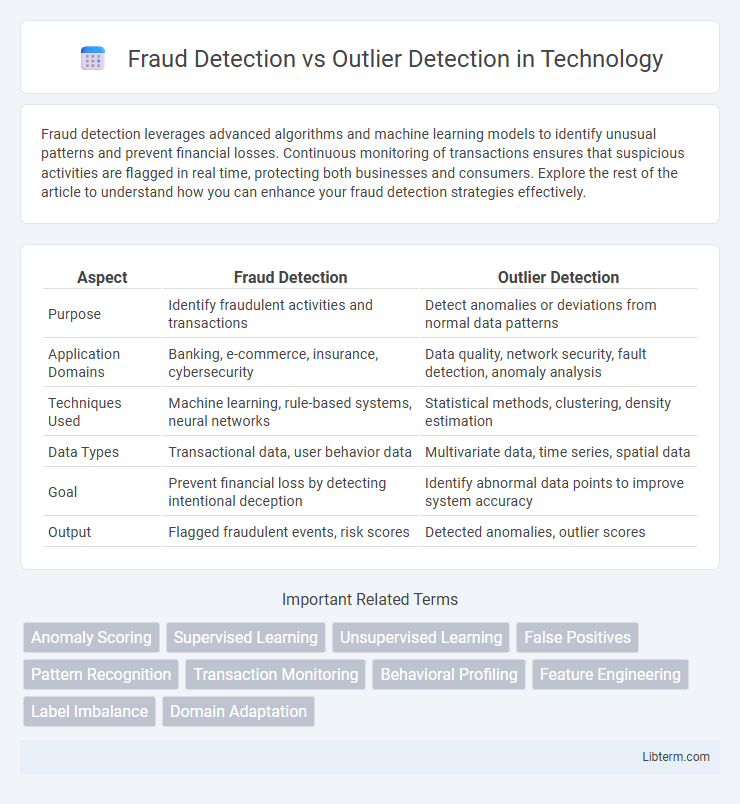

| Aspect | Fraud Detection | Outlier Detection |

|---|---|---|

| Purpose | Identify fraudulent activities and transactions | Detect anomalies or deviations from normal data patterns |

| Application Domains | Banking, e-commerce, insurance, cybersecurity | Data quality, network security, fault detection, anomaly analysis |

| Techniques Used | Machine learning, rule-based systems, neural networks | Statistical methods, clustering, density estimation |

| Data Types | Transactional data, user behavior data | Multivariate data, time series, spatial data |

| Goal | Prevent financial loss by detecting intentional deception | Identify abnormal data points to improve system accuracy |

| Output | Flagged fraudulent events, risk scores | Detected anomalies, outlier scores |

Introduction to Fraud Detection vs Outlier Detection

Fraud detection involves identifying deceptive activities, often using supervised learning techniques that rely on labeled historical fraud data to recognize patterns indicative of fraudulent behavior. Outlier detection focuses on finding anomalous data points that deviate significantly from the norm without necessarily being fraudulent, typically employing unsupervised methods such as clustering or statistical analysis. While both techniques aim to identify unusual patterns, fraud detection is specifically tailored to uncover malicious acts, whereas outlier detection highlights any deviations, including errors or rare events.

Defining Fraud Detection

Fraud detection involves identifying deceptive activities or transactions that aim to gain unauthorized benefits, often using advanced machine learning algorithms to analyze patterns and anomalies in large datasets. Unlike general outlier detection, which flags unusual data points regardless of intent, fraud detection specifically targets malicious behavior by incorporating domain-specific knowledge and behavioral analysis. Effective fraud detection systems combine real-time monitoring, risk scoring, and predictive analytics to minimize financial losses and protect against cyber threats.

Understanding Outlier Detection

Outlier detection identifies data points that significantly deviate from the norm, serving as a critical tool in anomaly identification. This technique uses statistical models, machine learning algorithms, and clustering methods to recognize unusual patterns within large datasets. Understanding outlier detection enhances fraud detection systems by filtering noise and pinpointing suspicious transactions more accurately.

Key Differences Between Fraud Detection and Outlier Detection

Fraud detection specifically targets identifying deceptive activities that violate established rules or patterns within financial transactions, whereas outlier detection focuses on finding data points that deviate significantly from the norm without necessarily implying malicious intent. Fraud detection algorithms often incorporate domain knowledge and supervised learning models trained on labeled fraudulent examples, while outlier detection commonly uses unsupervised methods like clustering or statistical techniques to highlight anomalies. The key difference lies in fraud detection's goal to prevent financial loss and secure systems by recognizing known fraudulent behavior, contrasted with outlier detection's broader application in identifying unusual or rare events that may require further investigation.

Techniques Used in Fraud Detection

Fraud detection employs advanced techniques like machine learning algorithms, including supervised learning models such as decision trees, random forests, and neural networks, which analyze historical transaction data to identify suspicious patterns. Rule-based systems and anomaly detection frameworks complement these methods by flagging behavior that deviates from established norms, leveraging statistical analysis and clustering techniques. Integration of real-time data processing and natural language processing further enhances the accuracy and speed of detecting fraudulent activities across diverse financial ecosystems.

Methods for Identifying Outliers

Fraud detection techniques often incorporate supervised learning models trained on labeled datasets, enabling precise identification of fraudulent patterns, while outlier detection primarily relies on unsupervised methods such as clustering, density estimation, and statistical analysis to identify anomalies without predefined labels. Common algorithms for outlier detection include k-means clustering, DBSCAN, isolation forests, and Local Outlier Factor (LOF), which assess data points based on their deviation from expected behavior. Effective fraud detection integrates outlier detection methods with domain-specific features and behavioral analytics to enhance accuracy and reduce false positives.

Use Cases: Fraud Detection in Real-World Scenarios

Fraud detection systems analyze transaction patterns, user behavior, and historical data to identify suspicious activities, primarily in banking, e-commerce, and insurance industries. These systems employ machine learning algorithms to detect anomalies indicative of credit card fraud, identity theft, or insurance claim fraud. Unlike generic outlier detection, fraud detection integrates domain-specific rules and real-time alerts to prevent financial losses and secure sensitive information.

Applications of Outlier Detection Across Industries

Outlier detection is widely applied across industries such as finance for identifying unusual transaction patterns, healthcare for detecting rare diseases or anomalies in medical imaging, and manufacturing for quality control by spotting defective products. In cybersecurity, outlier detection helps recognize unusual network activity indicative of potential threats, while in retail, it identifies atypical customer behavior to refine marketing strategies. These applications leverage statistical and machine learning techniques to enhance decision-making and operational efficiency by highlighting deviations that may indicate errors, fraud, or emerging trends.

Challenges in Fraud Detection and Outlier Detection

Challenges in fraud detection include handling evolving fraud patterns, imbalanced datasets with scarce fraudulent examples, and the high cost of false positives that can disrupt legitimate transactions. Outlier detection faces difficulties in distinguishing between rare but normal variations and true anomalies, managing high-dimensional data, and adapting to dynamically changing data distributions. Both domains require robust algorithms that balance sensitivity and specificity to maintain accuracy and reduce operational risks.

Choosing the Right Approach for Anomaly Analysis

Fraud detection targets specific deceptive behaviors using supervised learning models trained on labeled fraud cases, while outlier detection identifies unusual data points without prior labels through unsupervised techniques. Selecting the right approach depends on data availability, problem context, and the nature of anomalies--fraud detection excels when historical fraud patterns exist, whereas outlier detection suits unknown or emerging anomalies. Combining domain expertise with algorithmic performance metrics improves precision and reduces false positives in anomaly analysis.

Fraud Detection Infographic

libterm.com

libterm.com