The Law of One Price states that identical goods should sell for the same price in different markets when there are no transportation costs or trade barriers. This principle ensures market efficiency by preventing arbitrage opportunities that could disrupt price equilibrium. Explore the rest of the article to understand how this law impacts global trade and pricing strategies.

Table of Comparison

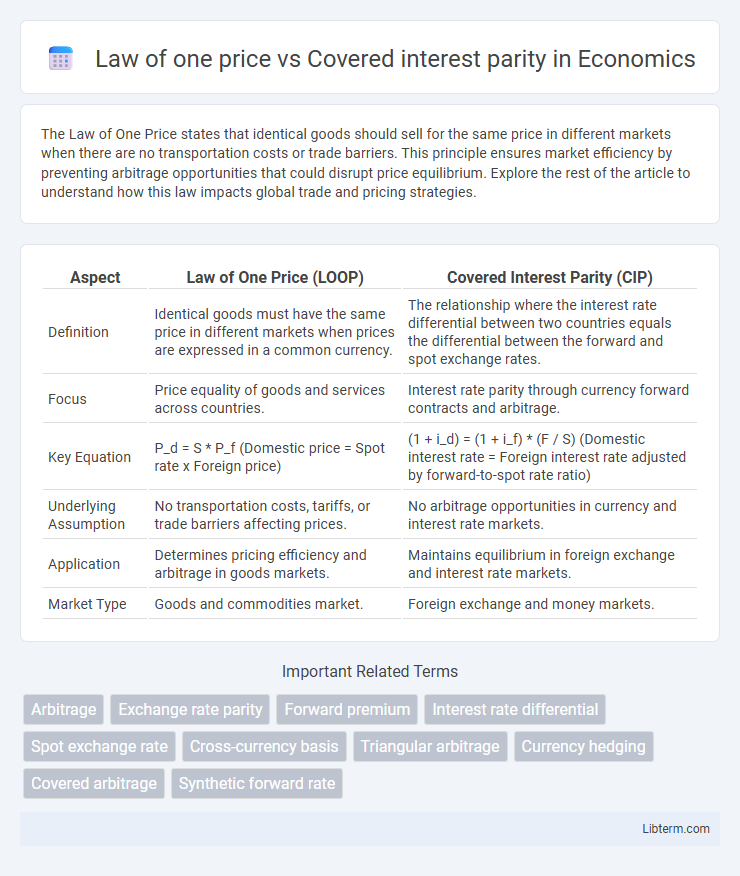

| Aspect | Law of One Price (LOOP) | Covered Interest Parity (CIP) |

|---|---|---|

| Definition | Identical goods must have the same price in different markets when prices are expressed in a common currency. | The relationship where the interest rate differential between two countries equals the differential between the forward and spot exchange rates. |

| Focus | Price equality of goods and services across countries. | Interest rate parity through currency forward contracts and arbitrage. |

| Key Equation | P_d = S * P_f (Domestic price = Spot rate x Foreign price) | (1 + i_d) = (1 + i_f) * (F / S) (Domestic interest rate = Foreign interest rate adjusted by forward-to-spot rate ratio) |

| Underlying Assumption | No transportation costs, tariffs, or trade barriers affecting prices. | No arbitrage opportunities in currency and interest rate markets. |

| Application | Determines pricing efficiency and arbitrage in goods markets. | Maintains equilibrium in foreign exchange and interest rate markets. |

| Market Type | Goods and commodities market. | Foreign exchange and money markets. |

Introduction to the Law of One Price and Covered Interest Parity

The Law of One Price states that identical goods should sell for the same price in different markets when prices are expressed in a common currency, assuming no transaction costs or trade barriers. Covered Interest Parity (CIP) extends this concept to financial markets by asserting that the returns on risk-free investments in different countries should be equal once adjusted for forward exchange rates, eliminating arbitrage opportunities. Both principles are foundational in international finance, ensuring price efficiency across goods and financial assets.

Fundamental Concepts: Price Convergence in Global Markets

The Law of One Price asserts that identical goods should sell for the same price across different markets when prices are expressed in a common currency, driven by arbitrage and the elimination of price discrepancies. Covered Interest Parity (CIP) extends this concept to financial markets, stating that the forward exchange rate should offset interest rate differentials between two countries, ensuring no arbitrage opportunities exist in currency and interest markets. Both principles rely fundamentally on price convergence mechanisms to harmonize valuations in global trade and finance, maintaining equilibrium across asset and goods markets.

Mechanism of the Law of One Price in International Trade

The Law of One Price ensures that identical goods sell for the same price across different markets when expressed in a common currency, preventing arbitrage opportunities in international trade. This mechanism relies on the assumption of frictionless markets, no transportation costs, and perfect information, leading to price convergence for tradable goods. While Covered Interest Parity focuses on interest rate differentials and forward exchange rates to eliminate arbitrage in financial markets, the Law of One Price governs price equalization in physical goods markets.

Covered Interest Parity: Definition and Core Principles

Covered Interest Parity (CIP) is a fundamental principle in international finance asserting that the difference in interest rates between two countries is equalized by the forward exchange rate premium or discount, eliminating arbitrage opportunities. This relationship ensures that investors achieve no riskless profit by exploiting interest rate differentials when the foreign exchange risk is hedged through forward contracts. CIP relies on the core principle that the spot exchange rate adjusted by the forward rate offsets interest rate discrepancies, maintaining equilibrium in global capital markets.

Key Differences between Law of One Price and Covered Interest Parity

The Law of One Price states that identical goods must sell for the same price in different markets when prices are expressed in a common currency, enforcing arbitrage in goods markets. Covered Interest Parity (CIP) ensures no arbitrage opportunities in the foreign exchange and money markets by linking interest rate differentials and forward exchange rates to spot exchange rates through covered positions. Unlike the Law of One Price which applies to goods, CIP pertains to financial instruments, integrating interest rates and forward contracts to maintain equilibrium in currency and interest rate markets.

Assumptions Underlying Each Financial Principle

The Law of One Price assumes no transportation costs, no tariffs or trade barriers, and perfect competition ensuring identical goods have the same price globally. Covered Interest Parity relies on assumptions of capital mobility, no transaction costs or taxes, and the ability to engage in arbitrage through forward contracts without credit risk. Both principles assume efficient markets but differ as the Law of One Price focuses on goods markets while Covered Interest Parity applies to financial markets and currency arbitrage.

Real-World Applications in Foreign Exchange Markets

The Law of One Price underpins the fundamental concept that identical goods should sell for the same price in different markets, serving as a basis for arbitrage opportunities in spot foreign exchange markets. Covered Interest Parity (CIP) extends this principle to financial assets, ensuring that the interest rate differential between two countries is offset by the forward exchange rate premium or discount, preventing arbitrage in interest-bearing instruments. Real-world deviations from CIP occur due to transaction costs, capital controls, and counterparty risks, affecting currency hedging strategies and international investment decisions in the foreign exchange markets.

Factors Leading to Deviations from Theoretical Equilibrium

Deviations from the Law of One Price arise due to transaction costs, tariffs, and differences in product quality or market segmentation, which prevent identical goods from trading at the same price across borders. In contrast, Covered Interest Parity (CIP) deviations occur because of capital controls, credit risk differentials, and market imperfections affecting forward exchange rates and interest rate arbitrage. Both frameworks assume frictionless markets, but real-world factors such as regulatory constraints, liquidity limitations, and information asymmetries lead to persistent discrepancies from theoretical equilibrium.

Implications for Traders, Investors, and Policymakers

Law of one price ensures arbitrage opportunities in goods markets are minimized, leading traders to seek price discrepancies across regions for profit. Covered interest parity (CIP) governs the relationship between interest rates and forward exchange rates, providing investors with a no-arbitrage condition in currency markets that stabilizes returns on cross-border investments. Policymakers rely on both principles to maintain efficient markets, guide monetary policy, and prevent misalignments in currency and asset prices that could disrupt international capital flows.

Conclusion: Interplay and Relevance in Modern Financial Systems

The Law of One Price establishes the foundation for price uniformity of identical goods across markets, while Covered Interest Parity (CIP) extends this concept to financial instruments by enforcing equilibrium in interest rates through forward exchange rates. Their interplay ensures arbitrage opportunities are minimized, promoting market efficiency and stability in modern financial systems. Understanding both principles is crucial for investors and policymakers to manage currency risk and maintain integrated global capital markets.

Law of one price Infographic

libterm.com

libterm.com