Dollarization refers to the process where a country adopts the US dollar as its official currency, either alongside or instead of its local currency. This economic strategy can stabilize inflation, attract foreign investment, and simplify international trade, but it may also limit a nation's monetary policy independence. Explore how dollarization could impact your country's economy and financial stability in the rest of this article.

Table of Comparison

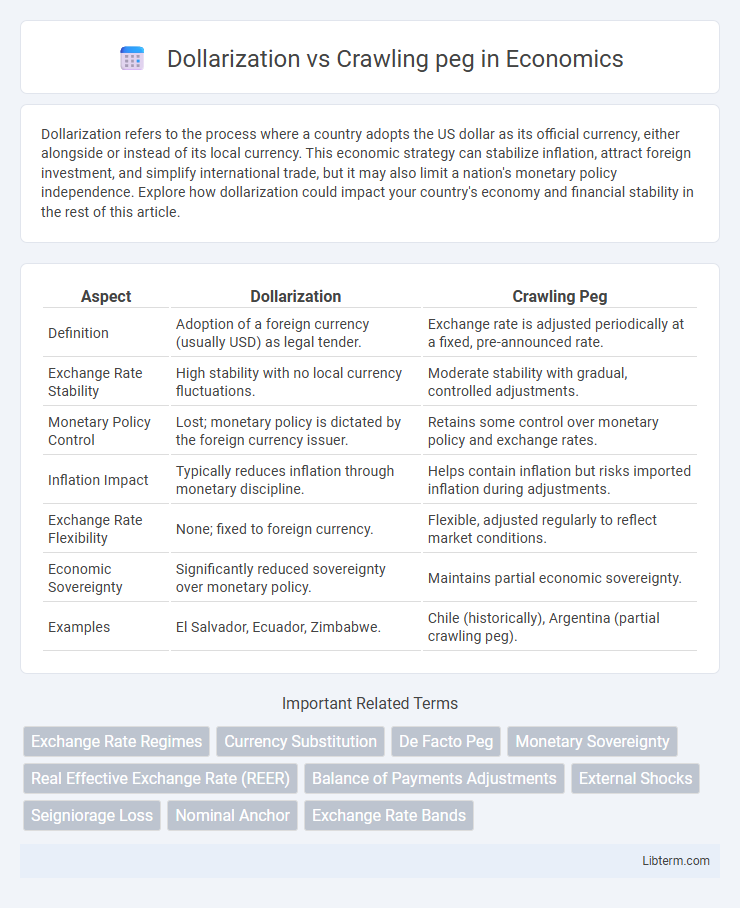

| Aspect | Dollarization | Crawling Peg |

|---|---|---|

| Definition | Adoption of a foreign currency (usually USD) as legal tender. | Exchange rate is adjusted periodically at a fixed, pre-announced rate. |

| Exchange Rate Stability | High stability with no local currency fluctuations. | Moderate stability with gradual, controlled adjustments. |

| Monetary Policy Control | Lost; monetary policy is dictated by the foreign currency issuer. | Retains some control over monetary policy and exchange rates. |

| Inflation Impact | Typically reduces inflation through monetary discipline. | Helps contain inflation but risks imported inflation during adjustments. |

| Exchange Rate Flexibility | None; fixed to foreign currency. | Flexible, adjusted regularly to reflect market conditions. |

| Economic Sovereignty | Significantly reduced sovereignty over monetary policy. | Maintains partial economic sovereignty. |

| Examples | El Salvador, Ecuador, Zimbabwe. | Chile (historically), Argentina (partial crawling peg). |

Introduction to Exchange Rate Regimes

Exchange rate regimes define how a country manages its currency relative to others, impacting economic stability and trade competitiveness. Dollarization involves adopting a foreign currency, usually the US dollar, to stabilize inflation and encourage investment. In contrast, a crawling peg allows gradual adjustments of the exchange rate, helping maintain export competitiveness while controlling inflation.

Defining Dollarization

Dollarization refers to a monetary system where a country adopts a foreign currency, typically the U.S. dollar, as its official legal tender, eliminating its own national currency in daily transactions and financial systems. This approach stabilizes the economy by reducing currency risk and inflation but sacrifices independent monetary policy control. In contrast, a crawling peg involves a domestic currency pegged to a foreign currency with gradual, preannounced adjustments to the exchange rate, allowing more flexibility while aiming to maintain stability.

Explaining the Crawling Peg System

The crawling peg system is an exchange rate regime where a country's currency is adjusted periodically at a fixed, pre-announced rate or in response to specific indicators like inflation differentials. This mechanism allows gradual depreciation or appreciation, helping to maintain exchange rate stability while accommodating economic fundamentals and external shocks. Compared to dollarization, which eliminates exchange rate volatility by adopting a foreign currency, crawling peg offers more policy flexibility and monetary sovereignty.

Key Differences Between Dollarization and Crawling Peg

Dollarization involves a country adopting a foreign currency, usually the US dollar, as its official medium of exchange, eliminating its own currency and monetary policy control. A crawling peg is a flexible exchange rate system where a domestic currency is periodically adjusted at a predetermined rate against a foreign currency, allowing gradual devaluation or appreciation. Key differences include loss of independent monetary policy under dollarization versus retained policy flexibility with a crawling peg, and full currency substitution versus managed exchange rate adjustments.

Economic Stability: Which System Performs Better?

Dollarization often provides stronger economic stability by eliminating currency risk and reducing inflation through the adoption of a stable foreign currency like the US dollar. Crawling peg systems offer gradual exchange rate adjustments that help maintain competitiveness while controlling inflation, but they remain vulnerable to speculative attacks and policy inconsistencies. Empirical evidence suggests dollarization tends to deliver greater inflation control and exchange rate stability, enhancing investor confidence and long-term economic stability.

Impact on Monetary Policy and Sovereignty

Dollarization limits a country's monetary policy flexibility by adopting a foreign currency, effectively outsourcing control over interest rates and money supply to the issuing nation, which can constrain responses to local economic shocks. Crawling peg regimes allow gradual adjustments in exchange rates, offering a balance between fixed and flexible currencies, thereby preserving some monetary policy autonomy while maintaining exchange rate stability. Sovereignty under dollarization is significantly reduced as the nation cannot issue its own currency or set independent monetary policies, whereas a crawling peg maintains national control over monetary instruments, albeit with constraints imposed by commitment to exchange rate adjustments.

Inflation Control: Dollarization vs Crawling Peg

Dollarization stabilizes inflation by adopting a stable foreign currency, typically the US dollar, which eliminates exchange rate risk and curbs hyperinflation. In contrast, a crawling peg allows gradual adjustments to the exchange rate, providing flexibility to respond to inflationary pressures while maintaining external competitiveness. Inflation control under dollarization tends to be more rigid and predictable, whereas the crawling peg offers a balanced approach by blending stability with adaptive monetary policy.

Real-World Examples and Case Studies

Dollarization, implemented in Ecuador since 2000, stabilized inflation and restored investor confidence by adopting the US dollar as legal tender, eliminating currency risk but sacrificing independent monetary policy. Argentina's crawling peg system between the 1990s and early 2000s attempted gradual devaluation adjustments to control inflation and maintain export competitiveness, but failed amid capital flight and speculative attacks, leading to currency crisis and default. Comparative analysis reveals dollarization offers macroeconomic stability at the cost of flexibility, while crawling peg provides adaptive exchange rates with exposure to market volatility and speculative risks.

Pros and Cons of Each Regime

Dollarization stabilizes the economy by eliminating currency risk and inflation volatility, attracting foreign investment, but it sacrifices monetary policy autonomy and seigniorage revenue. Crawling peg allows gradual adjustments of the exchange rate to maintain competitiveness and control inflation, yet it requires constant intervention and risks speculative attacks if mismanaged. Dollarization suits countries with weak institutions, while crawling peg is effective for economies with moderate inflation and sufficiently credible central banks.

Conclusion: Choosing the Right Path for Economic Growth

Dollarization offers currency stability and inflation control by adopting a strong foreign currency, often the US dollar, making it ideal for countries facing persistent inflation and exchange rate volatility. Crawling peg allows gradual adjustments of the exchange rate to maintain export competitiveness and respond flexibly to economic conditions, benefiting economies with moderate inflation and evolving external balances. The choice between dollarization and crawling peg depends on the country's inflation history, monetary policy autonomy, and economic structure, with dollarization prioritizing stability and crawling peg emphasizing controlled flexibility for sustainable growth.

Dollarization Infographic

libterm.com

libterm.com