An external budget constraint limits the total amount of spending based on income and borrowing capacity outside of your current resources. Understanding this constraint is crucial for making informed financial decisions and optimizing resource allocation. Discover how mastering your external budget constraint can improve your financial planning in the rest of this article.

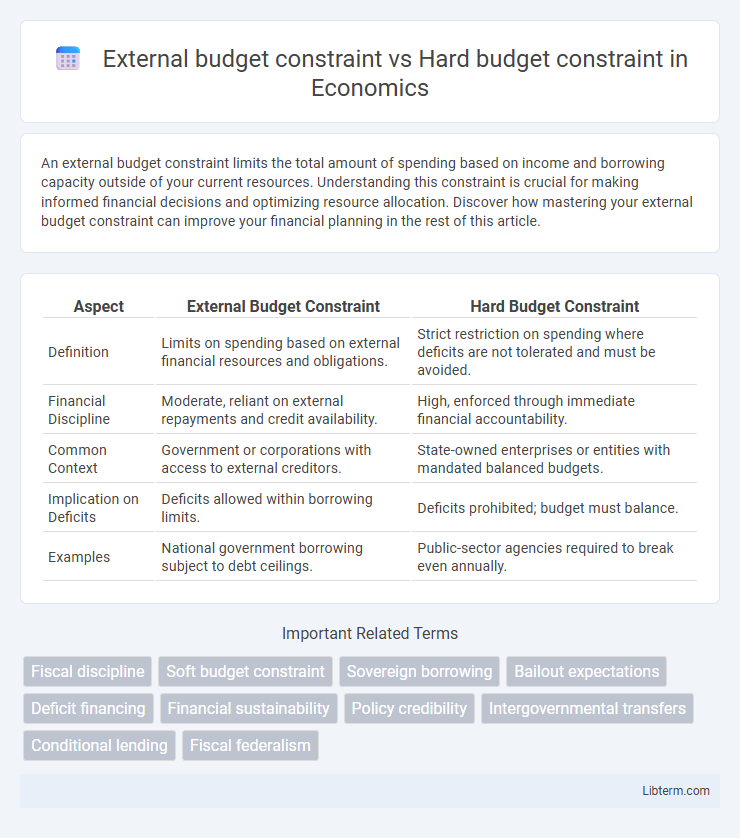

Table of Comparison

| Aspect | External Budget Constraint | Hard Budget Constraint |

|---|---|---|

| Definition | Limits on spending based on external financial resources and obligations. | Strict restriction on spending where deficits are not tolerated and must be avoided. |

| Financial Discipline | Moderate, reliant on external repayments and credit availability. | High, enforced through immediate financial accountability. |

| Common Context | Government or corporations with access to external creditors. | State-owned enterprises or entities with mandated balanced budgets. |

| Implication on Deficits | Deficits allowed within borrowing limits. | Deficits prohibited; budget must balance. |

| Examples | National government borrowing subject to debt ceilings. | Public-sector agencies required to break even annually. |

Introduction to Budget Constraints

External budget constraints refer to limitations imposed by external sources such as lenders or investors, restricting the amount an entity can spend based on available funding. Hard budget constraints strictly enforce these limits, often resulting in cessation of funding once the budget is exhausted, compelling entities to operate within predefined financial boundaries. Understanding the distinction between external and hard budget constraints is crucial for effective financial planning and resource allocation in organizations.

Defining External Budget Constraint

External budget constraint refers to the financial limit imposed by resources or funding available from outside sources, such as government grants, loans, or investor capital, which restricts an entity's spending based on externally provided funds. Unlike hard budget constraints that strictly enforce expenditure limits without flexibility, external budget constraints depend on conditions tied to external financing agreements and can vary according to external stakeholders' terms. Understanding external budget constraints is critical for organizations managing project financing, ensuring compliance with funding requirements while planning expenditures.

Understanding Hard Budget Constraint

Hard budget constraint refers to a strict financial limit where an entity, such as a firm or government agency, must operate within its available resources without expecting external bailouts or additional funding. Unlike an external budget constraint that considers potential external financial support or borrowing, a hard budget constraint enforces accountability and efficiency by compelling all expenses to be fully covered by actual revenues or allocated budgets. Understanding hard budget constraints is crucial for ensuring sustainable financial management and preventing moral hazard in economic institutions.

Key Differences Between External and Hard Budget Constraints

External budget constraints refer to limits imposed by outside sources such as creditors or market conditions, restricting an organization's ability to spend beyond available external funding. Hard budget constraints occur when an entity must strictly operate within its allocated budget without the possibility of external bailouts or additional financing, enforcing strict financial discipline. Key differences include the origin of the constraint--external constraints are imposed by external agents, while hard budget constraints are self-imposed or internally enforced--and the flexibility, as external constraints may allow for renegotiation, whereas hard constraints demand adherence without exceptions.

Importance in Economic Policy and Planning

External budget constraints limit government spending to available external resources like revenue and borrowing capacity, ensuring fiscal discipline and reducing the risk of excessive debt. Hard budget constraints enforce strict adherence to budget limits, preventing overspending and promoting efficient resource allocation in public finance management. Both constraints are critical for sustainable economic policy, controlling inflation, maintaining investor confidence, and enabling effective long-term economic planning.

Real-world Examples of External Budget Constraints

External budget constraints limit government or organizational spending through factors like access to international loans, fiscal rules set by supranational entities such as the European Union, or donor-imposed conditions in developing countries. For example, Greece's financial crisis highlighted external budget constraints imposed by the EU and International Monetary Fund, requiring stringent austerity measures tied to bailout packages. Similarly, low-income countries dependent on foreign aid face external constraints where donor funding dictates budget priorities, restricting autonomy in fiscal planning.

Effects of Hard Budget Constraints on Organizations

Hard budget constraints force organizations to balance expenses strictly within available resources, eliminating the possibility of deficit spending or external bailouts. This constraint increases financial discipline, driving efficiency, cost control, and innovation to optimize limited funds. Organizations under hard budget constraints often improve operational performance and prioritize sustainable growth to maintain solvency.

Implications for Government and Public Sector Entities

External budget constraints limit government and public sector entities by requiring external funding sources to balance expenditures, which can restrict fiscal flexibility and increase dependency on market conditions or donor support. Hard budget constraints enforce strict financial discipline by compelling these entities to cover all costs from their own revenues and prevent overspending, fostering efficiency but potentially limiting investment in public goods. The choice between these constraints significantly impacts fiscal autonomy, risk management, and the ability to respond to public needs and economic fluctuations.

Challenges and Limitations of Each Constraint

External budget constraints limit spending based on externally imposed financial resources, often causing inflexibility during unexpected expenses and hindering adaptive budget management. Hard budget constraints require strict adherence to predetermined limits, which can stifle innovation and lead to underinvestment in critical areas due to fear of budget overruns. Both constraints pose challenges in balancing fiscal discipline with the need for responsive and strategic financial decisions.

Conclusion: Choosing the Right Budget Constraint Model

Selecting the appropriate budget constraint model depends on the financial discipline and accountability required within an organization. External budget constraints emphasize reliance on outside funding sources, ensuring limits align with externally imposed financial boundaries. Hard budget constraints enforce strict internal control by disallowing deficits, fostering efficient resource allocation and minimizing financial risk.

External budget constraint Infographic

libterm.com

libterm.com