Real interest rate measures the return on investment after adjusting for inflation, reflecting the true cost of borrowing or the real yield on savings. Understanding how inflation impacts your purchasing power helps you make smarter financial decisions. Explore the rest of this article to learn how real interest rates affect your financial future.

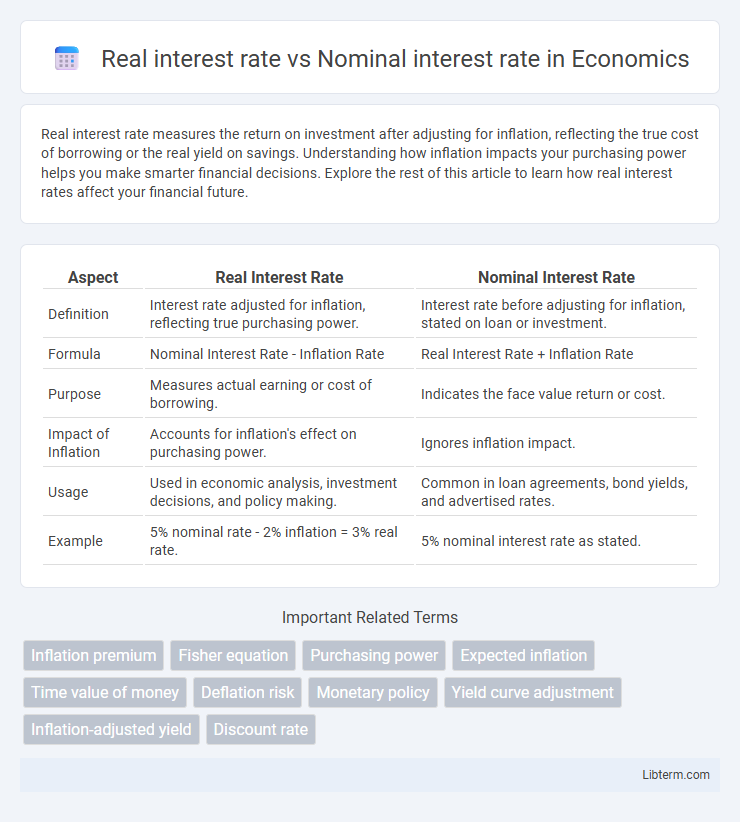

Table of Comparison

| Aspect | Real Interest Rate | Nominal Interest Rate |

|---|---|---|

| Definition | Interest rate adjusted for inflation, reflecting true purchasing power. | Interest rate before adjusting for inflation, stated on loan or investment. |

| Formula | Nominal Interest Rate - Inflation Rate | Real Interest Rate + Inflation Rate |

| Purpose | Measures actual earning or cost of borrowing. | Indicates the face value return or cost. |

| Impact of Inflation | Accounts for inflation's effect on purchasing power. | Ignores inflation impact. |

| Usage | Used in economic analysis, investment decisions, and policy making. | Common in loan agreements, bond yields, and advertised rates. |

| Example | 5% nominal rate - 2% inflation = 3% real rate. | 5% nominal interest rate as stated. |

Understanding Real vs Nominal Interest Rates

Real interest rate reflects the true cost of borrowing by adjusting nominal interest rates for inflation, providing a clearer measure of purchasing power changes over time. Nominal interest rate represents the stated rate on loans or investments without accounting for inflation, which can mislead investors about actual earnings or costs. Understanding the distinction helps individuals and businesses make informed financial decisions by considering inflation's impact on returns and expenses.

Definition of Nominal Interest Rate

Nominal interest rate refers to the percentage increase in money that the borrower pays to the lender without adjusting for inflation. It represents the stated or advertised rate on loans, savings accounts, or bonds, reflecting the overall return before considering changes in purchasing power. Unlike the real interest rate, the nominal rate does not account for inflation's impact on the value of money over time.

What Is Real Interest Rate?

The real interest rate represents the nominal interest rate adjusted for inflation, reflecting the true cost of borrowing and the actual yield on investments. It provides a more accurate measure of purchasing power changes over time compared to the nominal interest rate, which does not account for inflation. Understanding the real interest rate is essential for investors and borrowers seeking to evaluate the true profitability or expense of financial transactions.

Key Differences Between Real and Nominal Interest Rates

Real interest rates account for inflation, reflecting the true cost of borrowing or the true yield on an investment by adjusting the nominal interest rate for inflation. Nominal interest rates represent the stated rate without adjustment and may overstate the actual purchasing power of returns when inflation is high. The key difference lies in real rates providing a more accurate measure of financial gain or cost, making them critical for comparing investments and loans in an inflationary environment.

How Inflation Impacts Interest Rates

Inflation directly affects the relationship between real and nominal interest rates by eroding the purchasing power of money over time, causing nominal rates to rise as lenders demand compensation for this loss. The real interest rate, calculated by subtracting inflation from the nominal rate, provides a clearer measure of the true cost of borrowing and the real yield on investments. Central banks monitor inflation closely to adjust nominal interest rates, aiming to maintain positive real rates that encourage saving and investment while controlling economic growth.

Calculating Real Interest Rate

The real interest rate is calculated by subtracting the inflation rate from the nominal interest rate, reflecting the true cost of borrowing and the real yield to investors. For example, if the nominal interest rate is 6% and the inflation rate is 2%, the real interest rate equals 4%. This calculation helps investors and borrowers understand the purchasing power change of money over time and make informed financial decisions.

Importance of Real Interest Rate in Investments

The real interest rate, which accounts for inflation by subtracting the inflation rate from the nominal interest rate, is crucial for accurately assessing investment returns. It reflects the true purchasing power of earnings, enabling investors to make informed decisions and preserve wealth over time. Ignoring the real interest rate can lead to overestimating profitability and misjudging the actual growth of investment portfolios.

Effects on Borrowers and Lenders

Real interest rates reflect the true cost of borrowing by accounting for inflation, directly affecting borrowers' repayment burden and lenders' real returns. When real rates are high, borrowers face greater costs in inflation-adjusted terms, potentially reducing borrowing demand, while lenders gain higher purchasing power on loans repaid. Nominal interest rates, unadjusted for inflation, may mislead borrowers and lenders about the actual economic impact, resulting in either an unexpected loss or gain in real value depending on inflation fluctuations.

Real and Nominal Interest Rates in Economic Policy

Real interest rates measure the cost of borrowing adjusted for inflation, reflecting the true purchasing power of money over time, while nominal interest rates represent the stated rate without inflation adjustment. Economic policy decisions rely on real interest rates to gauge the actual burden on borrowers and the real return to lenders, influencing investment, consumption, and savings behavior. Central banks closely monitor nominal rates to implement monetary policy, but real rates provide a clearer signal for long-term economic growth and inflation control.

Practical Examples: Real vs Nominal Interest Rate in Action

A nominal interest rate of 5% on a savings account may seem attractive, but if inflation is 3%, the real interest rate, which accounts for inflation, is only 2%, reflecting the actual increase in purchasing power. For instance, a bond yielding a nominal rate of 7% during a 4% inflation period offers a real return of about 3%, demonstrating how inflation erodes nominal gains. Understanding the distinction helps investors make informed decisions by evaluating the true profitability of loans, investments, or savings by comparing nominal interest rates with the prevailing inflation rate.

Real interest rate Infographic

libterm.com

libterm.com