Separating common household waste into recyclables and non-recyclables reduces environmental impact and conserves natural resources. Proper separation ensures materials like paper, glass, and plastics can be efficiently processed and reused, minimizing landfill overflow. Explore the rest of this article to learn effective methods for organizing your waste separation system.

Table of Comparison

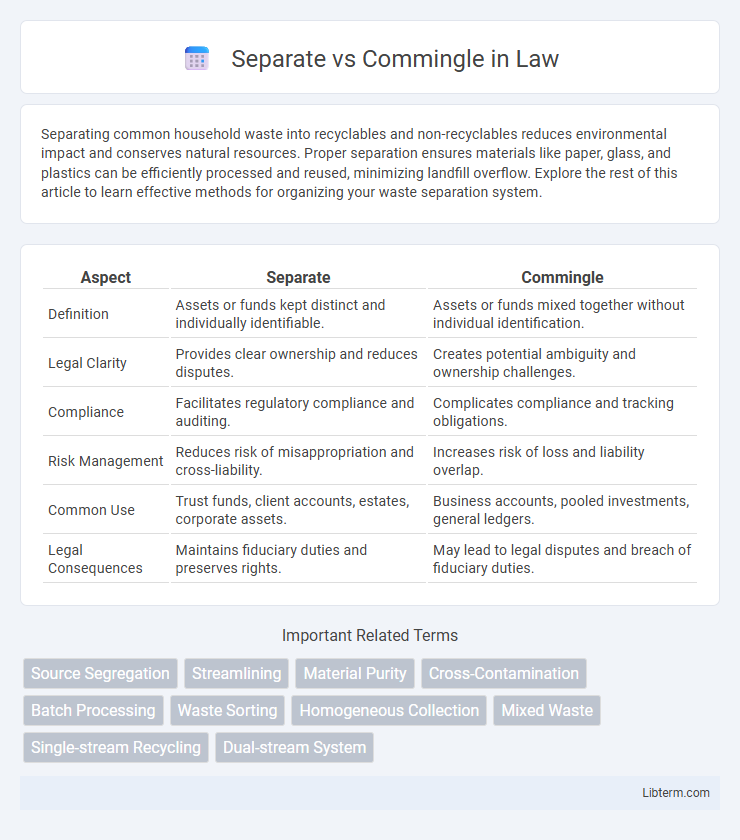

| Aspect | Separate | Commingle |

|---|---|---|

| Definition | Assets or funds kept distinct and individually identifiable. | Assets or funds mixed together without individual identification. |

| Legal Clarity | Provides clear ownership and reduces disputes. | Creates potential ambiguity and ownership challenges. |

| Compliance | Facilitates regulatory compliance and auditing. | Complicates compliance and tracking obligations. |

| Risk Management | Reduces risk of misappropriation and cross-liability. | Increases risk of loss and liability overlap. |

| Common Use | Trust funds, client accounts, estates, corporate assets. | Business accounts, pooled investments, general ledgers. |

| Legal Consequences | Maintains fiduciary duties and preserves rights. | May lead to legal disputes and breach of fiduciary duties. |

Understanding Separate vs Commingle: Key Definitions

Separate refers to the process of keeping different materials, such as recyclable waste or financial assets, distinct to maintain their individual properties and values. Commingle involves combining multiple materials or funds into a single batch, often to simplify processing or management but risking contamination or loss of specific characteristics. Understanding the key definitions of separate and commingle is essential for effective waste management, recycling programs, and financial asset administration to optimize resource recovery and value.

Historical Context: Evolution of Separation and Commingling

The historical evolution of separation and commingling in legal and financial contexts reflects shifts in regulatory frameworks and societal values toward asset protection and transparency. Early financial systems emphasized strict separation to prevent fraud and clarify ownership, while modern practices sometimes allow commingling to enhance operational efficiency, subject to stringent oversight. This progression highlights the balance between safeguarding individual interests and enabling flexible management of pooled resources.

Legal Implications of Separate vs Commingle

The legal implications of separate versus commingled funds primarily revolve around asset protection, fiduciary duties, and bankruptcy proceedings. Maintaining separate accounts ensures clearer ownership, reduces risk of misappropriation, and simplifies tracing assets in legal disputes, while commingling funds can create challenges in proving distinct ownership and may lead to legal liabilities such as breach of fiduciary duty or fraudulent conveyance claims. Courts often scrutinize commingled funds closely, especially in trusts, estates, and client accounts, making rigorous accounting and adherence to regulatory requirements essential to avoid sanctions or loss of legal standing.

Financial Impact of Separation vs Commingling Assets

Separating assets provides clearer financial tracking, reduces legal risks, and simplifies tax reporting, which can enhance financial transparency and protect individual or business finances. Commingling assets often leads to complications in accounting, potential tax penalties, and increased liability exposure due to the blending of funds, which can obscure true financial positions. Maintaining separate accounts also facilitates better financial decision-making and audit processes, ultimately impacting net worth and creditworthiness more favorably than commingling.

Separate vs Commingle in Business Operations

Separate business operations involve maintaining distinct accounts, resources, and management for different divisions or subsidiaries to ensure clear financial tracking and legal compliance. Commingle operations combine assets, revenues, and expenses across units, which can streamline processes but increase risks related to accounting accuracy and liability exposure. Effective decision-making in business operations requires assessing whether separation enhances control and transparency or if commingling promotes efficiency and resource sharing.

Tax Considerations: Separate or Commingle Funds

Separate funds maintain clear accounting records, simplifying tax reporting and reducing the risk of errors or audits by clearly distinguishing income and deductible expenses for each entity or purpose. Commingle funds may complicate tax compliance due to blending income streams and expenses, increasing the potential for misclassification and requiring meticulous documentation to support tax positions. Maintaining separate accounts enhances transparency and compliance with IRS regulations, particularly for businesses managing multiple projects or entities.

Risk Management: Benefits of Keeping Assets Separate

Maintaining separate assets enhances risk management by isolating liabilities and protecting individual wealth from potential creditor claims or business failures. Segregation of assets reduces the chance of cross-contamination, ensuring that financial difficulties in one area do not impact others. This separation also simplifies legal processes and strengthens protection strategies in estate planning and creditor negotiations.

When to Commingle: Situations That Justify Blending

Commingle blending is justified when working with small quantities of similar materials where individual identification is inefficient or impractical, such as small shipments of bulk commodities or raw materials in manufacturing. It optimizes inventory management and reduces handling costs when product characteristics remain consistent across sources. Industries like food processing and recycling often utilize commingling to streamline operations while maintaining regulatory compliance through proper documentation.

Best Practices for Managing Separate and Commingled Resources

Best practices for managing separate and commingled resources involve maintaining clear documentation and records to ensure proper identification and accountability of each asset. Implementing robust tracking systems and regular audits helps prevent misallocation and ensures compliance with regulatory requirements. Segregating resources physically or digitally while establishing standardized procedures enhances operational efficiency and mitigates risks associated with commingling.

Case Studies: Lessons Learned from Separate vs Commingle Approaches

Case studies reveal that separate waste management systems often achieve higher recycling rates due to reduced contamination and more efficient sorting processes. In contrast, commingled approaches can lower collection costs and increase participation but may face challenges in quality control and downstream processing efficiency. Key lessons emphasize the importance of local infrastructure, public awareness, and continuous monitoring to optimize either approach for sustainable waste management outcomes.

Separate Infographic

libterm.com

libterm.com