Foreclosure occurs when a homeowner fails to make mortgage payments, leading the lender to seize and sell the property to recover the outstanding debt. This process significantly impacts your credit score and financial stability, making it crucial to understand the legal and financial implications involved. Explore the rest of the article to learn how to navigate foreclosure options and protect your home.

Table of Comparison

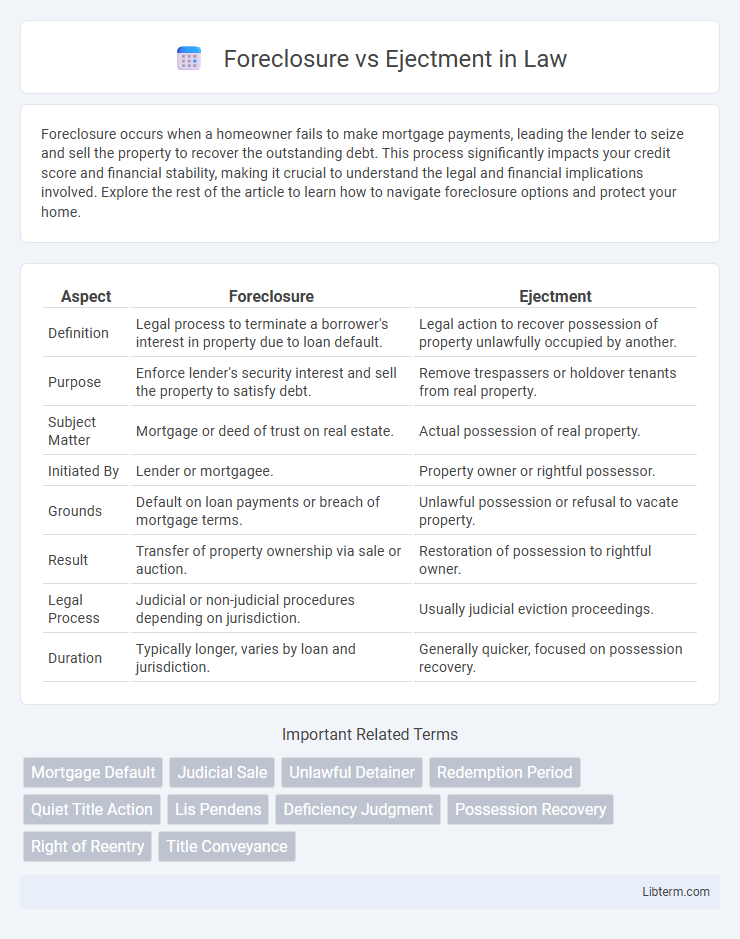

| Aspect | Foreclosure | Ejectment |

|---|---|---|

| Definition | Legal process to terminate a borrower's interest in property due to loan default. | Legal action to recover possession of property unlawfully occupied by another. |

| Purpose | Enforce lender's security interest and sell the property to satisfy debt. | Remove trespassers or holdover tenants from real property. |

| Subject Matter | Mortgage or deed of trust on real estate. | Actual possession of real property. |

| Initiated By | Lender or mortgagee. | Property owner or rightful possessor. |

| Grounds | Default on loan payments or breach of mortgage terms. | Unlawful possession or refusal to vacate property. |

| Result | Transfer of property ownership via sale or auction. | Restoration of possession to rightful owner. |

| Legal Process | Judicial or non-judicial procedures depending on jurisdiction. | Usually judicial eviction proceedings. |

| Duration | Typically longer, varies by loan and jurisdiction. | Generally quicker, focused on possession recovery. |

Understanding Foreclosure: Definition and Process

Foreclosure is a legal process through which a lender repossesses a property due to the borrower's failure to meet mortgage payment obligations, typically initiated after several missed payments. The process involves notifying the borrower, filing a public notice, and conducting a foreclosure sale to recover the outstanding loan balance. Understanding foreclosure requires recognizing key stages such as default, notice of default, foreclosure auction, and potential redemption period, which vary by jurisdiction and influence the borrower's rights.

What is Ejectment? Key Legal Concepts

Ejectment is a legal action used to recover possession of real property wrongfully occupied by another party, often following a breach of lease or illegal entry. Key legal concepts include proving rightful ownership or leasehold interest, establishing the defendant's wrongful possession, and demonstrating the plaintiff's right to immediate possession. Unlike foreclosure, which involves the forced sale of property to satisfy a debt, ejectment focuses solely on regaining control of the property without addressing underlying financial obligations.

Foreclosure vs Ejectment: Core Differences

Foreclosure involves a legal process where a lender seeks to recover the balance of a loan from a borrower who has defaulted, typically resulting in the sale of the property used as collateral. Ejectment is a legal action to remove a tenant or occupant unlawfully residing on a property without proper rights or permissions. The core difference lies in foreclosure addressing debt recovery through property seizure, while ejectment focuses on regaining possession of property from unauthorized occupants.

Legal Grounds for Foreclosure

Foreclosure is based on the legal grounds of defaulting on a mortgage or loan agreement, allowing the lender to claim the property as collateral. The foreclosure process requires the lender to prove the borrower's failure to fulfill payment obligations, often involving a notice of default and a statutory redemption period. Ejectment, in contrast, primarily addresses unlawful possession or tenancy issues rather than lien enforcement.

Legal Grounds for Ejectment

Legal grounds for ejectment primarily involve the wrongful possession or unlawful occupancy of property, where the rightful owner or tenant seeks to regain possession through a court order. Ejectment actions require proof of ownership or a valid lease agreement, along with evidence that the defendant is possessing the property without legal right. Unlike foreclosure, which deals with the enforcement of mortgage debts and involves lenders reclaiming secured property, ejectment specifically addresses disputes over possession rights.

Rights of Property Owners in Foreclosure

Property owners facing foreclosure retain rights to redeem the property by paying the owed debt within a statutory redemption period, depending on state law. They are entitled to notice before the foreclosure sale and may challenge the lender's compliance with procedural requirements to protect their ownership. Owners must understand that foreclosure results in the loss of title and possession, whereas ejectment involves legal action to remove unauthorized occupants without affecting ownership rights.

Rights of Occupants in Ejectment Cases

In ejectment cases, the rights of occupants are typically limited to lawful possession and prompt eviction if their occupancy lacks proper authorization. Unlike foreclosure where occupants may have equity rights or redemption periods, ejectment focuses on the rightful owner regaining possession from unlawful tenants or holdovers. Courts prioritize the property owner's title and clear evidence of unauthorized occupation to resolve these disputes efficiently.

Timeline and Procedures: Foreclosure vs Ejectment

Foreclosure typically involves a lengthy process starting with missed mortgage payments, followed by notifications, a public auction, and potential redemption periods that can span several months to over a year depending on jurisdiction. Ejectment is a faster legal action used to remove unlawful occupiers from property, often initiated with a complaint, summons, and court hearing, resolving within weeks to a few months. Understanding the differences in timeline and procedures is crucial for lenders and property owners seeking efficient resolution of property disputes.

Common Defenses Against Foreclosure and Ejectment

Common defenses against foreclosure include challenging the lender's failure to follow proper notice procedures, disputing the validity of the loan documents, and proving errors in the loan servicing, such as incorrect accounting or failure to apply payments. In ejectment cases, defenses often focus on proving lawful possession through lease agreements, disputing the landlord's claim of ownership or authority to evict, and demonstrating compliance with eviction notice requirements. Both foreclosure and ejectment defenses frequently require thorough examination of procedural compliance and property rights documentation.

Preventing Foreclosure and Ejectment: Proactive Strategies

Preventing foreclosure requires timely mortgage payments, open communication with lenders, and exploring loan modification options to avoid property loss. Ejectment prevention involves maintaining lease agreements, promptly addressing tenant disputes, and utilizing mediation to resolve conflicts without eviction. Understanding legal rights and seeking professional advice early are essential strategies to safeguard property ownership and tenancy.

Foreclosure Infographic

libterm.com

libterm.com